Equities for the Long Run

Stan Druckenmiller was on CNBC this week ragging on the Fed & Biden + discussing views on AI, Argentina and China. Quality weekend read (Full Transcript).

What I would do is just say nothing and do Fed chair used to do. When you need to raise rates, raise ‘em. When you need to cut ‘em, cut ’em. Don’t go on “60 Minutes”. You’re not a rockstar, okay? You’re the Fed chairman. You’re supposed to be running monetary policy for the good of the country, not to be going on “60 Minutes”.

So there’s a land grab going on now in the answer machine business. It’s obviously a big task to take on Google, but if you think about it, Google has $300 billion in sales. If Perplexity even goes to $2 billion in sales, it’ll be a huge winner. Frankly, I’d say 90 -- 95 percent of my searchers now I use Perplexity, probably the best thing I could do for the viewers today, unless they’re listening to all my other stuff. Try this thing out, you’ll love it.

Here’s a clip from the interview.

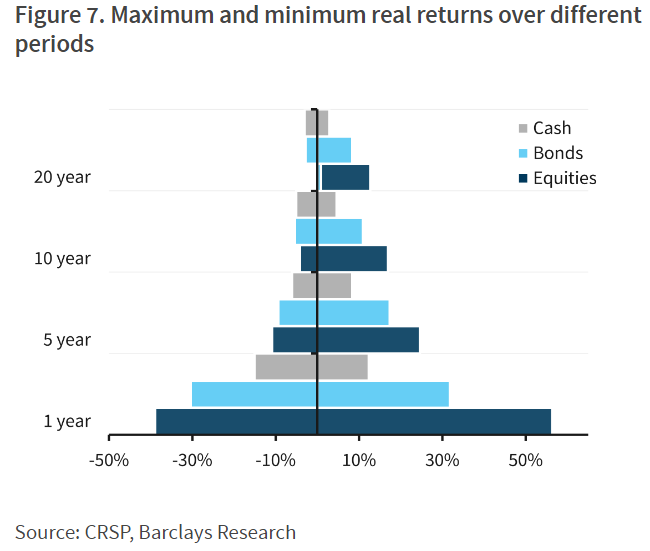

Chart below shows the total range of returns for different asset classes in the US since the Barclays data starts in 1925. In the short-term, equities can suffer serious losses; the greatest on record have been worse for equities. But over no 20-year period since 1925, have equities in the US failed to beat inflation. That cannot be said of any other asset class. It’s worth noting that we are looking at an empire that has flourished over the past 100 years.

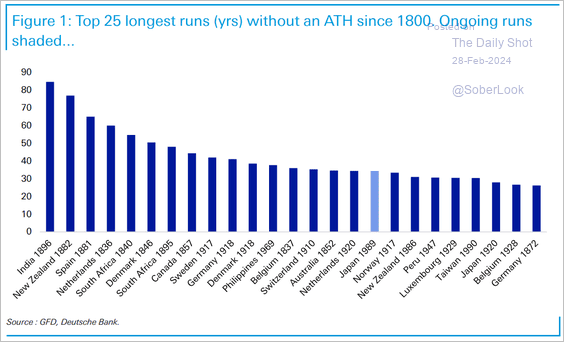

There are other developed markets that experienced multiple decade long periods where all time highs were not reclaimed.

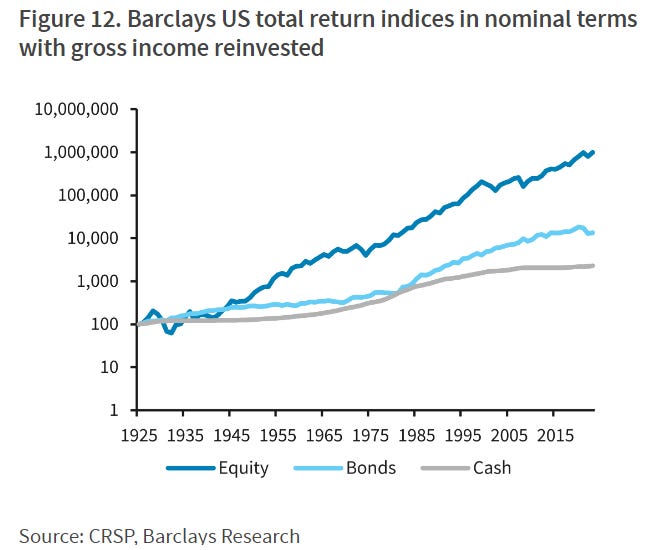

In the US, equities have been king over the long run.

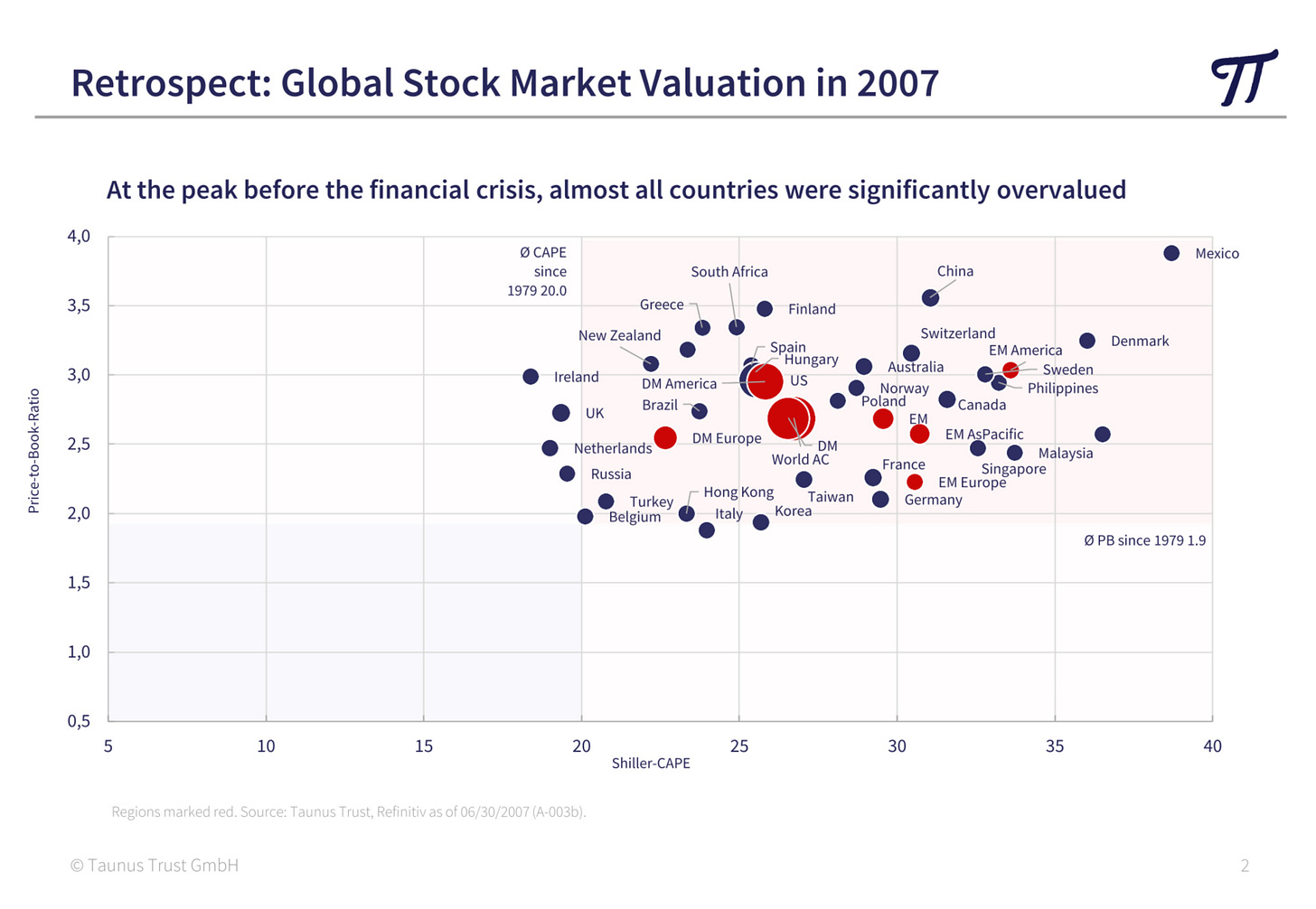

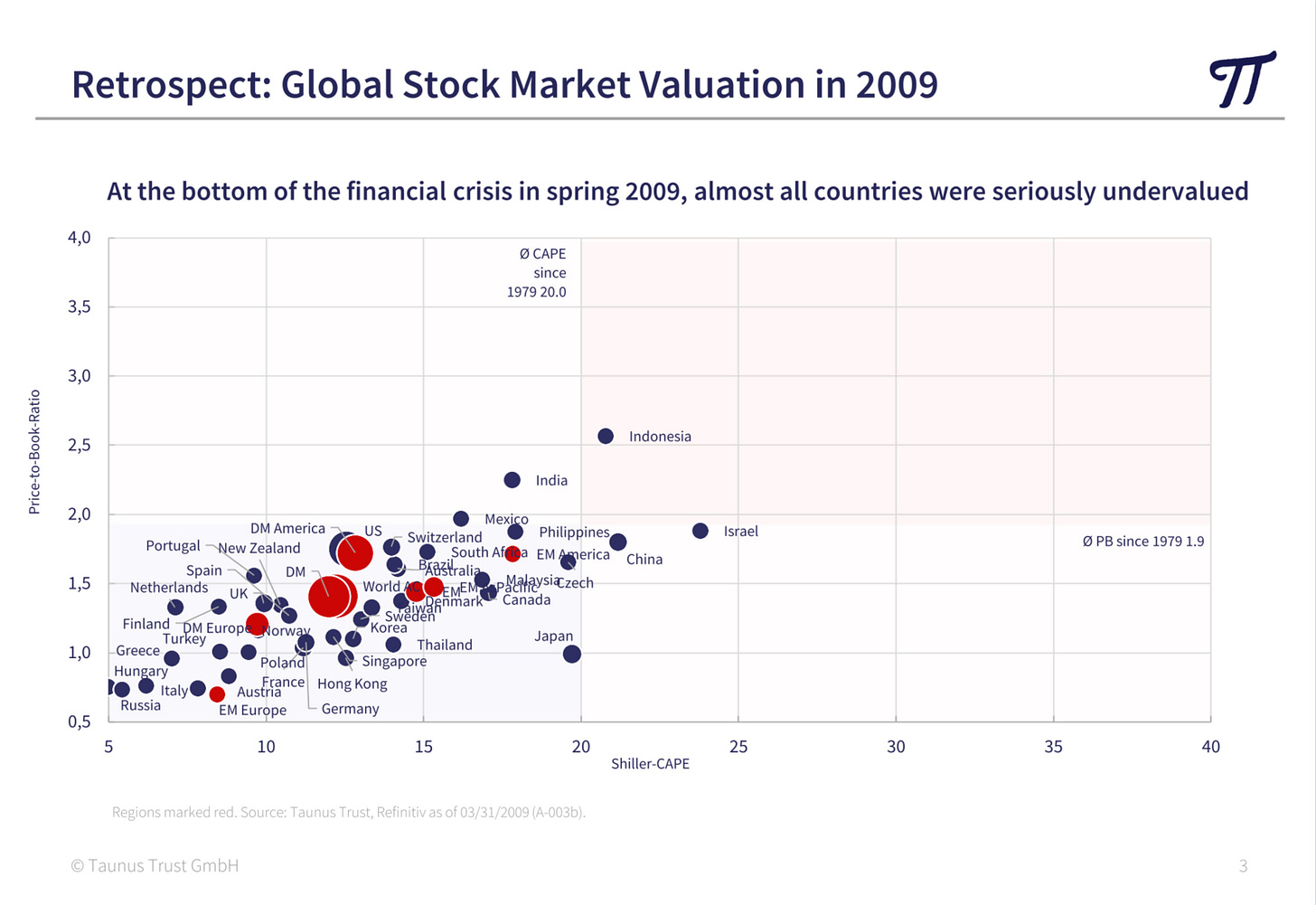

A pitfall of buy and hold strategies has been entry points at extreme valuations. Buying at higher valuations tends to reduce the margin of safety and exposes you to larger drawdowns if multiples contract. How have global valuations evolved over time? Below is price to book and Shiller CAPE of different global markets on the eve of the Global Financial Crisis.

The crisis caused most geographies to cheapen significantly.

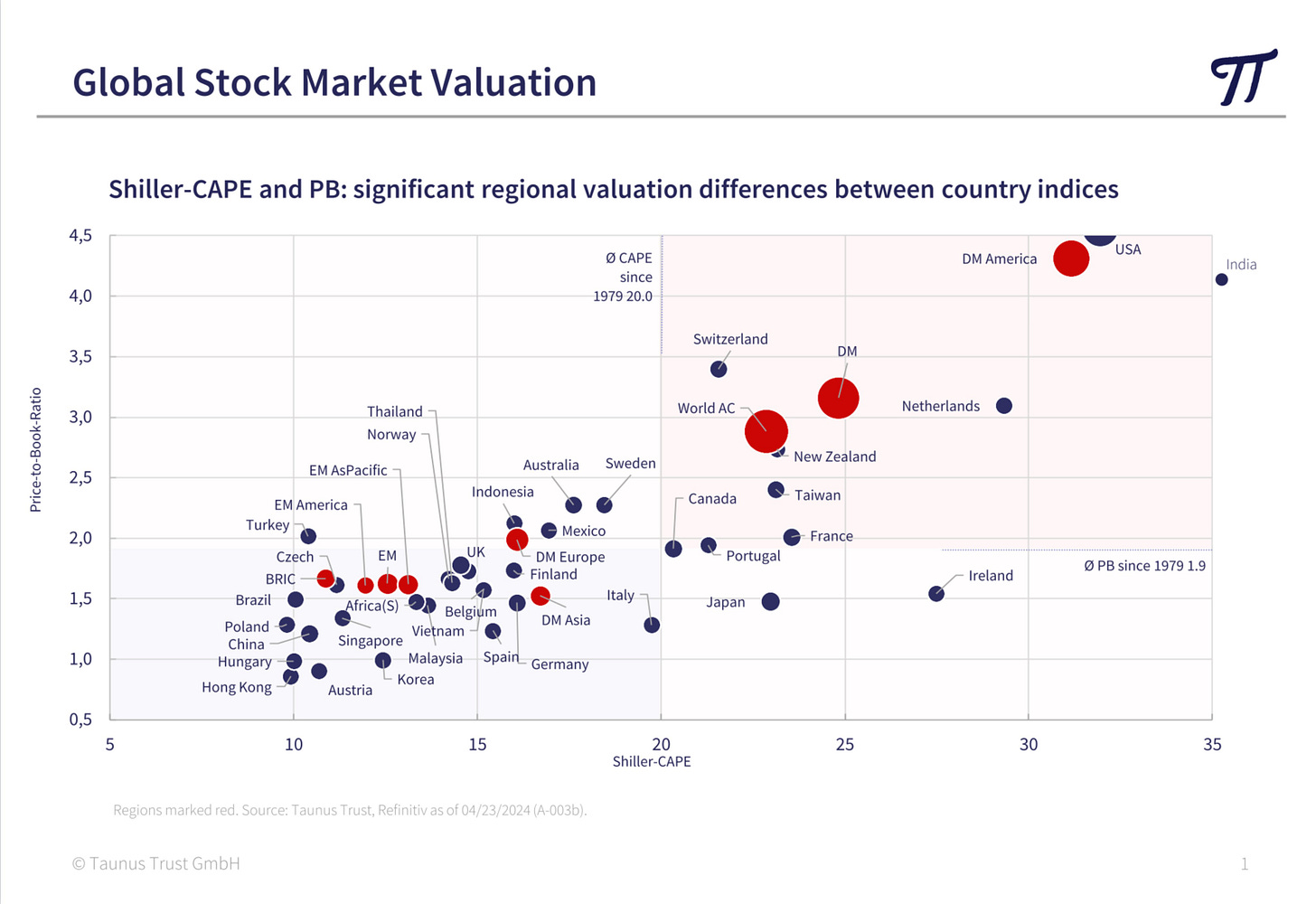

Today, many geographies look fairly reasonably valued, other than the US and India, whom are off the charts. Priced to perfection.

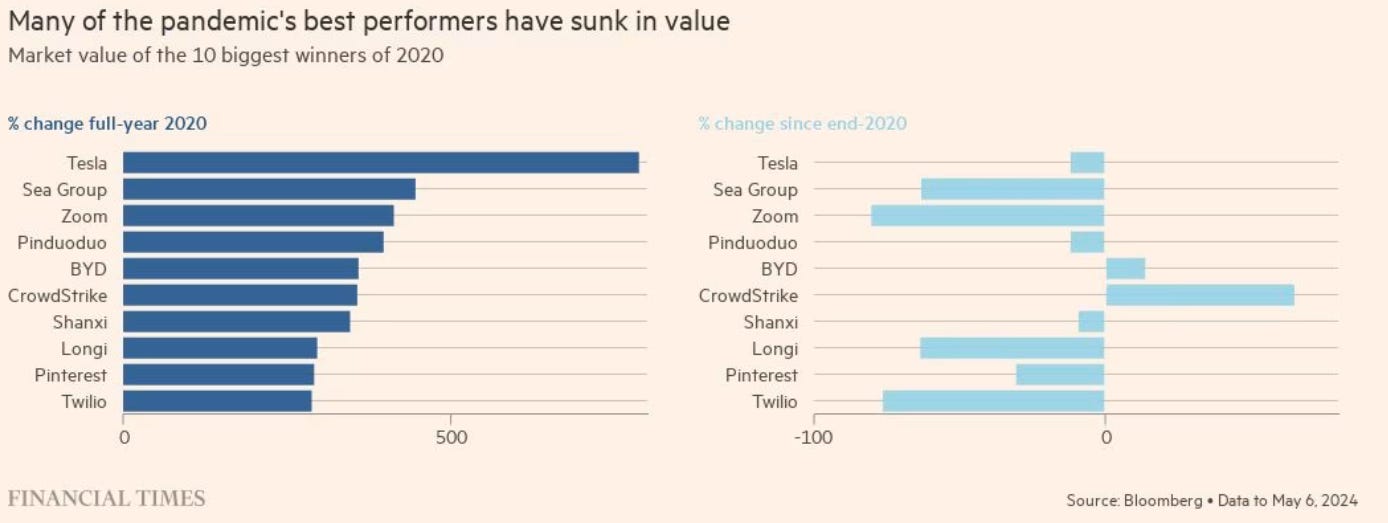

A recent example of chasing high valuations is demonstrated by the performance of the biggest Covid winners post 2020. Only CrowdStrike and BYD have positive performance post 2020.

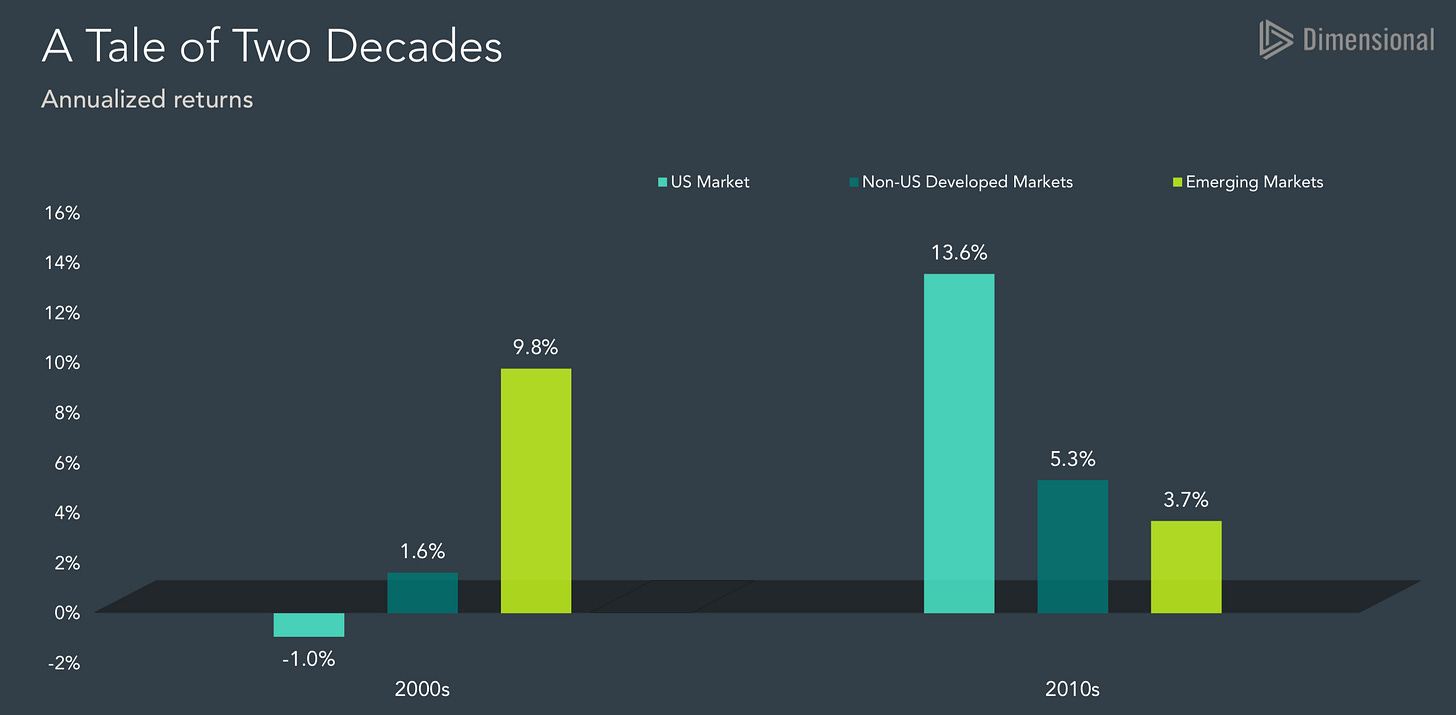

In a world where US exceptionalism is the consensus view, it is funny how quickly investors forget that international and emerging markets outperformed in the 2000s.

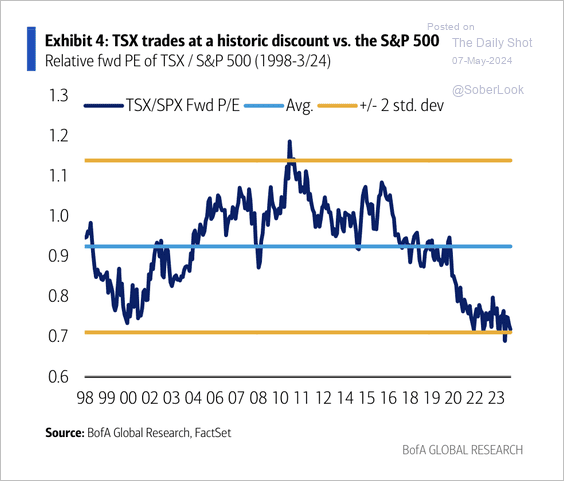

The TSX is trading at a historic discount to the S&P 500. It doesn’t mean it is a great investment, investing on relative valuations can be a trap. I will say that sentiment towards the demise of Canada does seem to be at extremes.

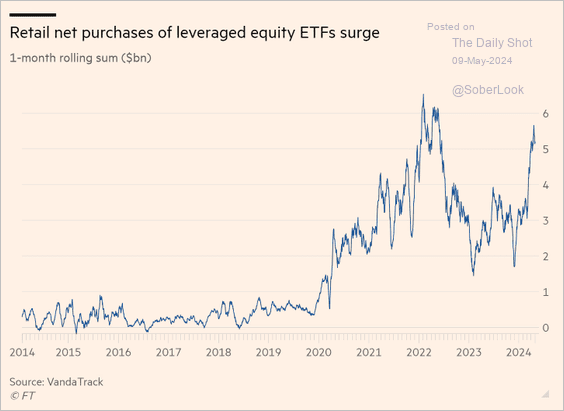

Retail is coming back to markets. Purchases of leveraged ETFs are back to Covid bubble highs.

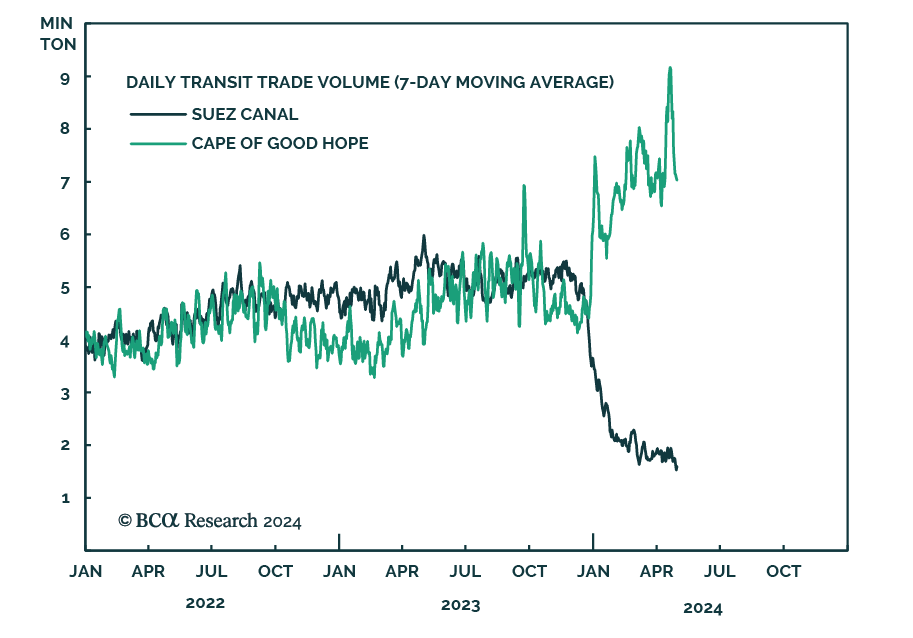

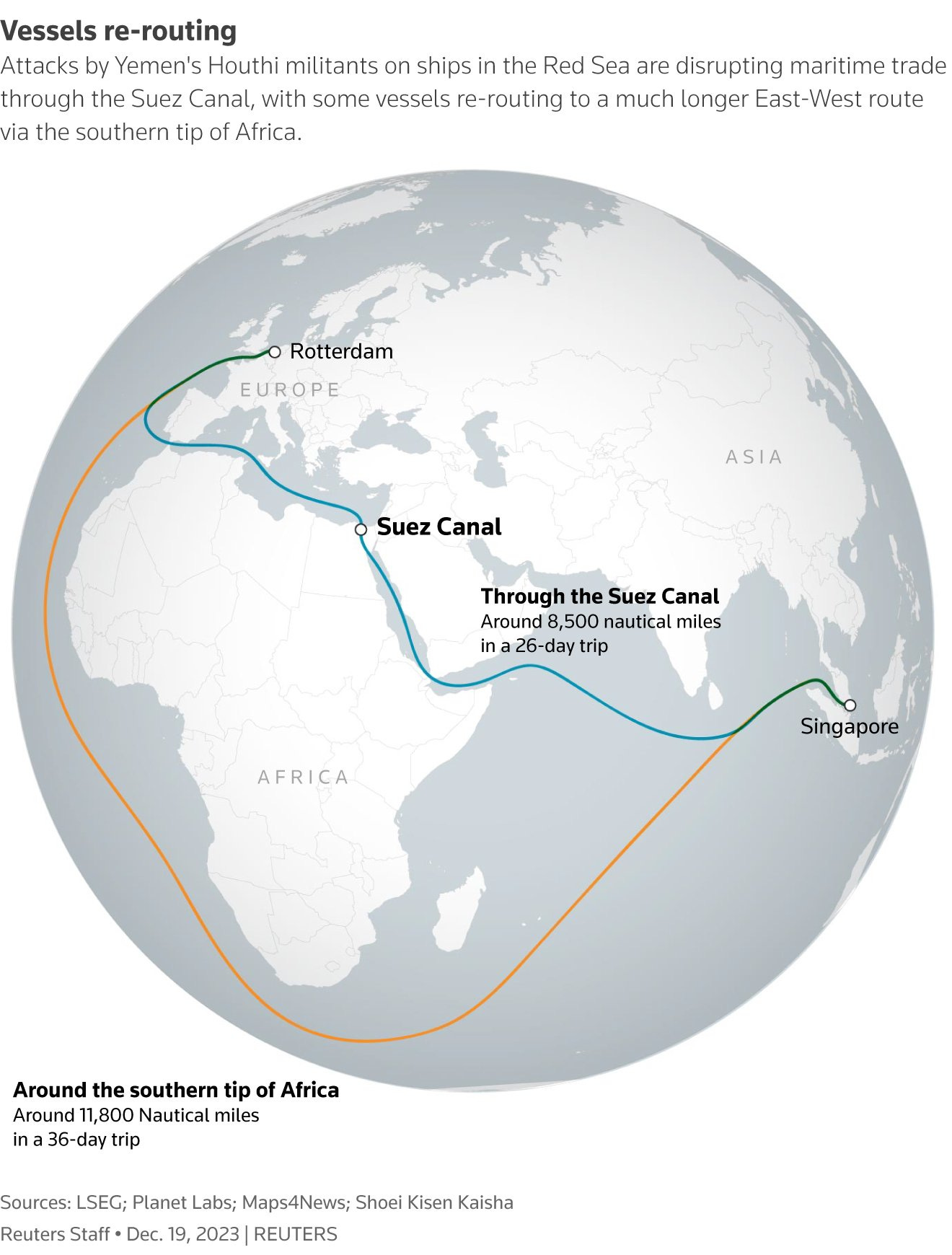

Despite the lack of headlines, shipping companies continue to avoid the Suez Canal.

The Red Sea blockage is set to cut up to 20% of shipping capacity between Asia and Europe in Q2.

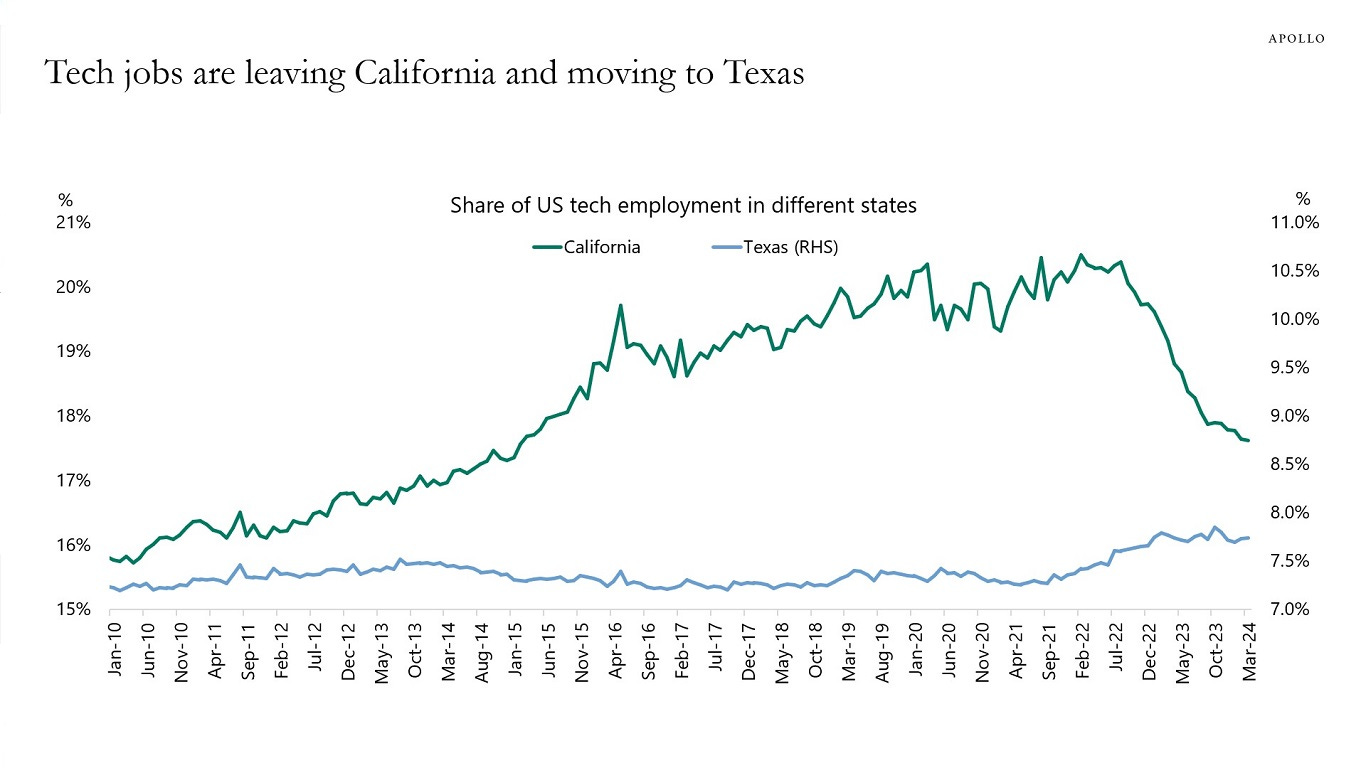

Tech jobs continue to leave California.

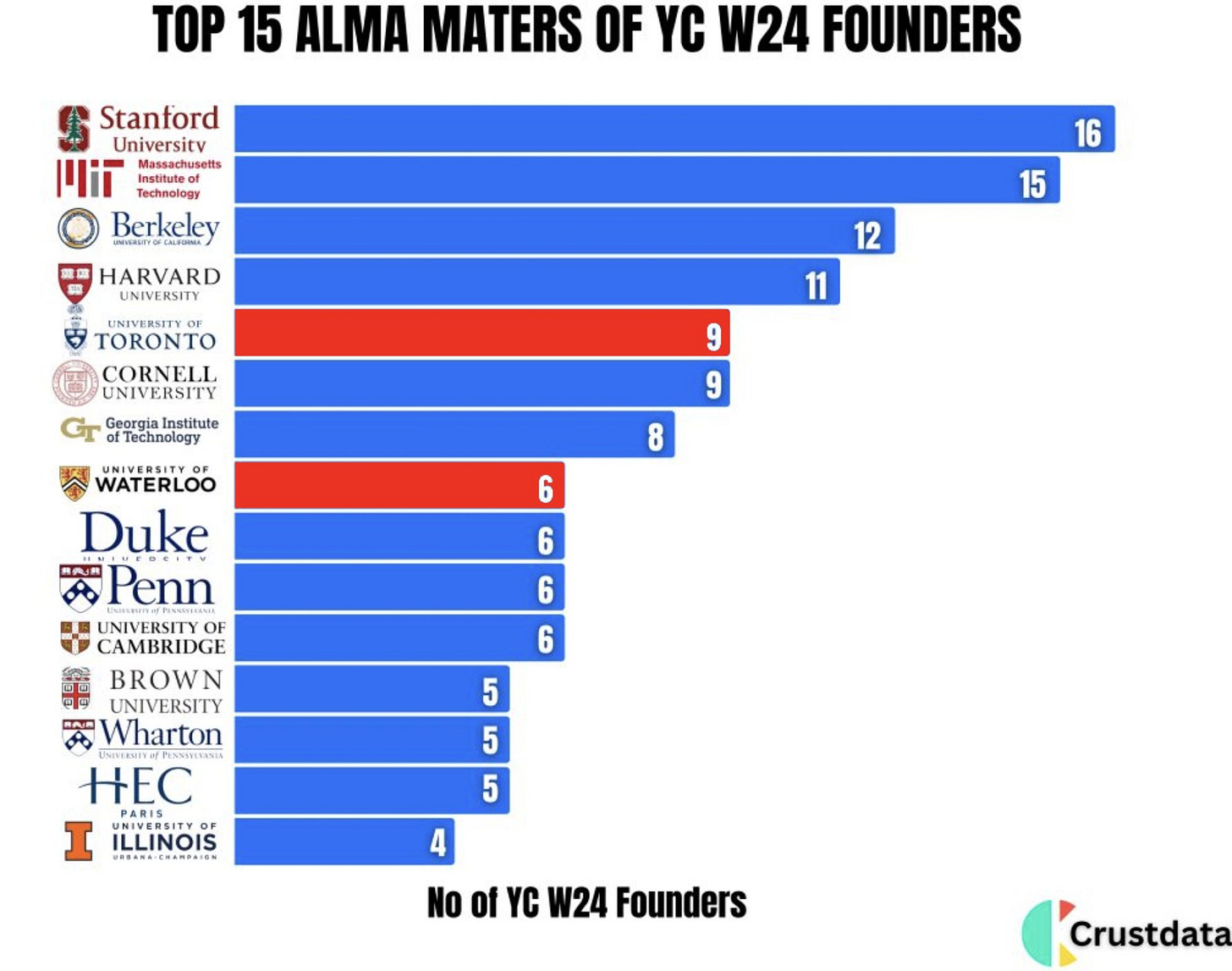

Canadian universities are punching above their weight as launching pads into the prestigious YCombinator program out of Silicon Valley. Now, Canada needs to figure out how to convince these entrepreneurs to build their companies in Canada. An increasingly difficult task when these companies are virtual and very mobile. States will compete for these individuals if California continues to fumble.

Interesting inside look into the buyout of Burger King and Tim Hortons from my former overlords. The comment around 3G identifying the Burger King brand was much bigger than the value of the business itself, stood out to me.