Euphoria

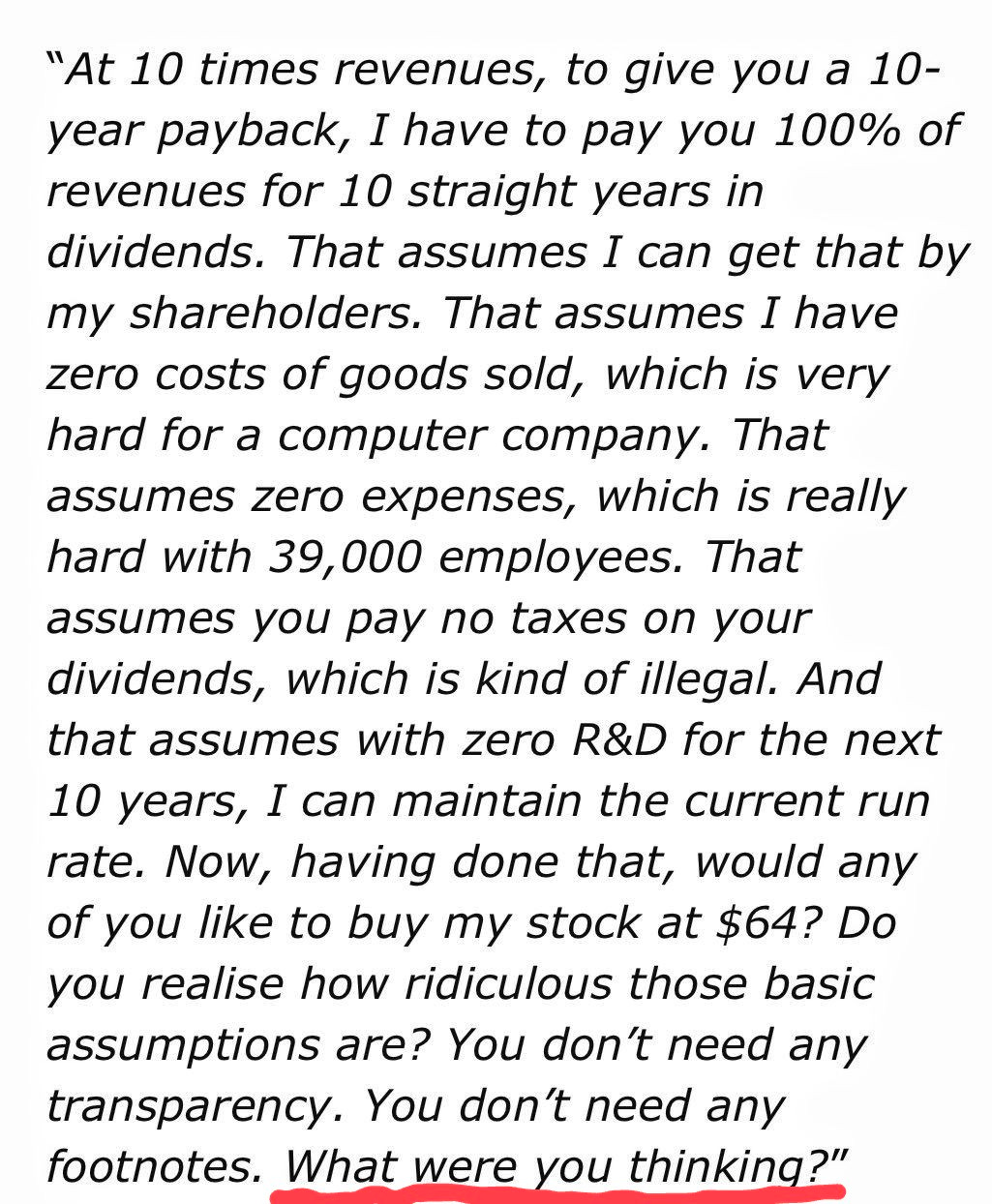

Chair of Rockefeller International wrote an FT column titled, The mother of all bubbles.

Signs of euphoria aren’t hard to find. Flows into levered single name ETFs have recently skyrocketed.

Meme stocks have also been on the rise since late November.

Have investors already forgotten some of the lessons learned as recently as 2022?

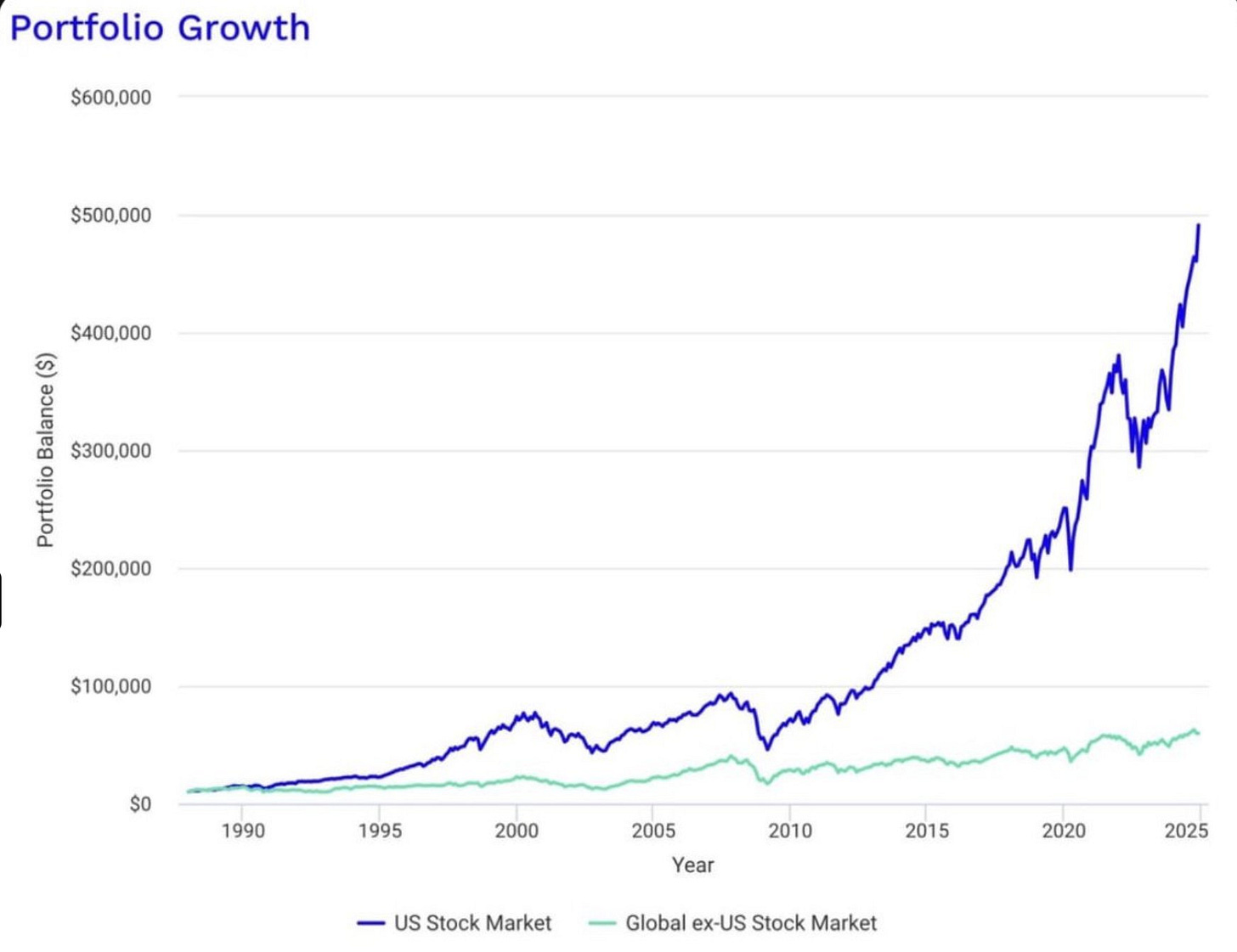

Investors are convinced that US markets are the one market worth investing in. To be fair, non US investors have had a very different experience compared to S&P 500 investors.

All but effectively 2 years since the global financial crisis has the S&P 500 outperformed the MSCI World. Investors banking on mean reversion are exhausted.

The market underestimated how much stronger US earnings growth was going to be.

Markets have gotten increasingly complacent. Animal spirits are evident, the cost of hedging a portfolio with 1-month SPX options is at its lowest in three decades, aside from two brief periods. A 1-month 100% strike put costs 95 basis points, meaning you break even if SPX declines by 50 points in the next month, according to GS.

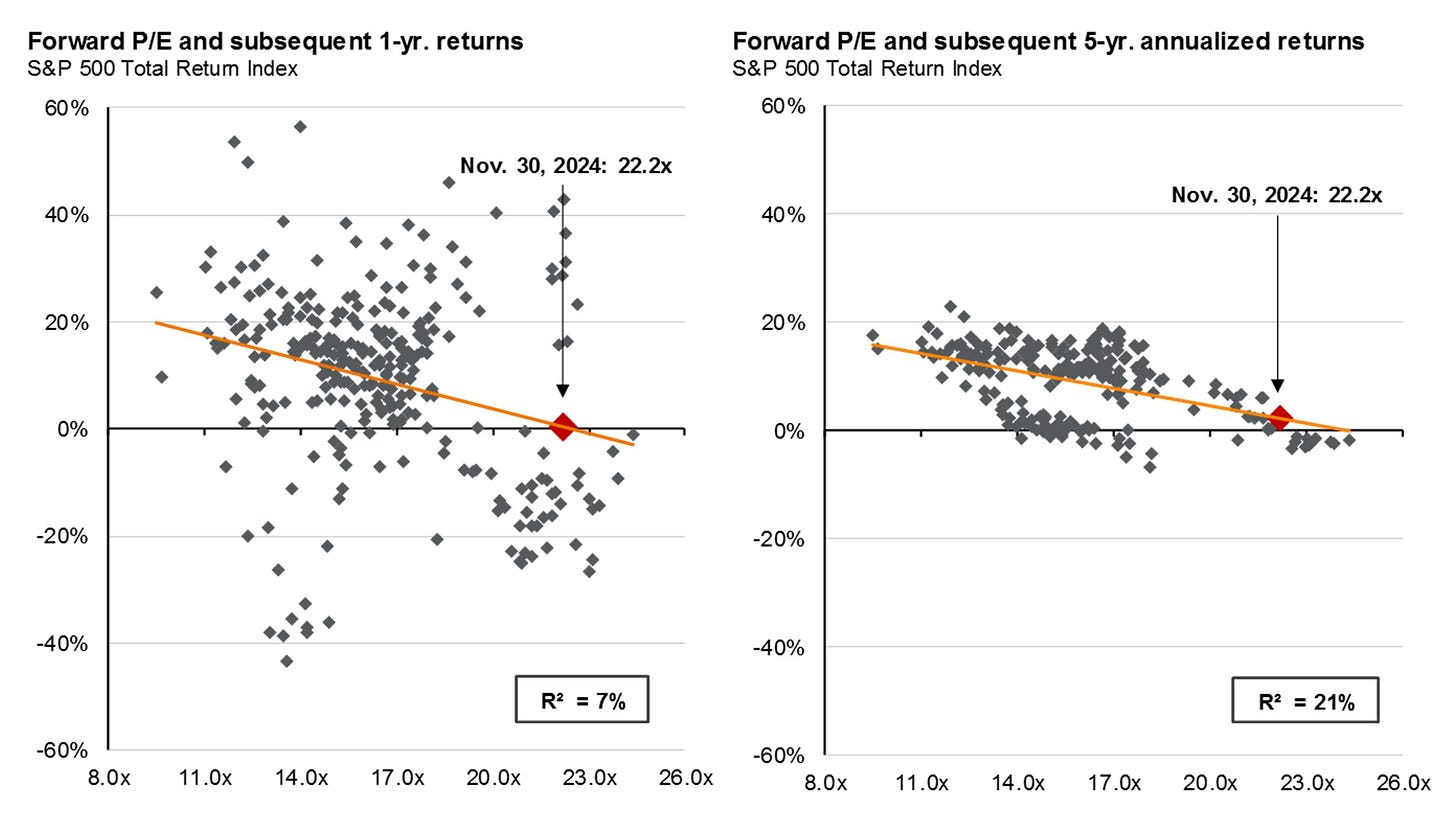

Valuations are now stretched. The good news has been priced in.

Valuation based index investing hasn’t worked well over the past years but data shows as multiples approach extremes, forward returns are muted.

One of the major drivers of market strength prior to the Red sweep was expectations around AI.

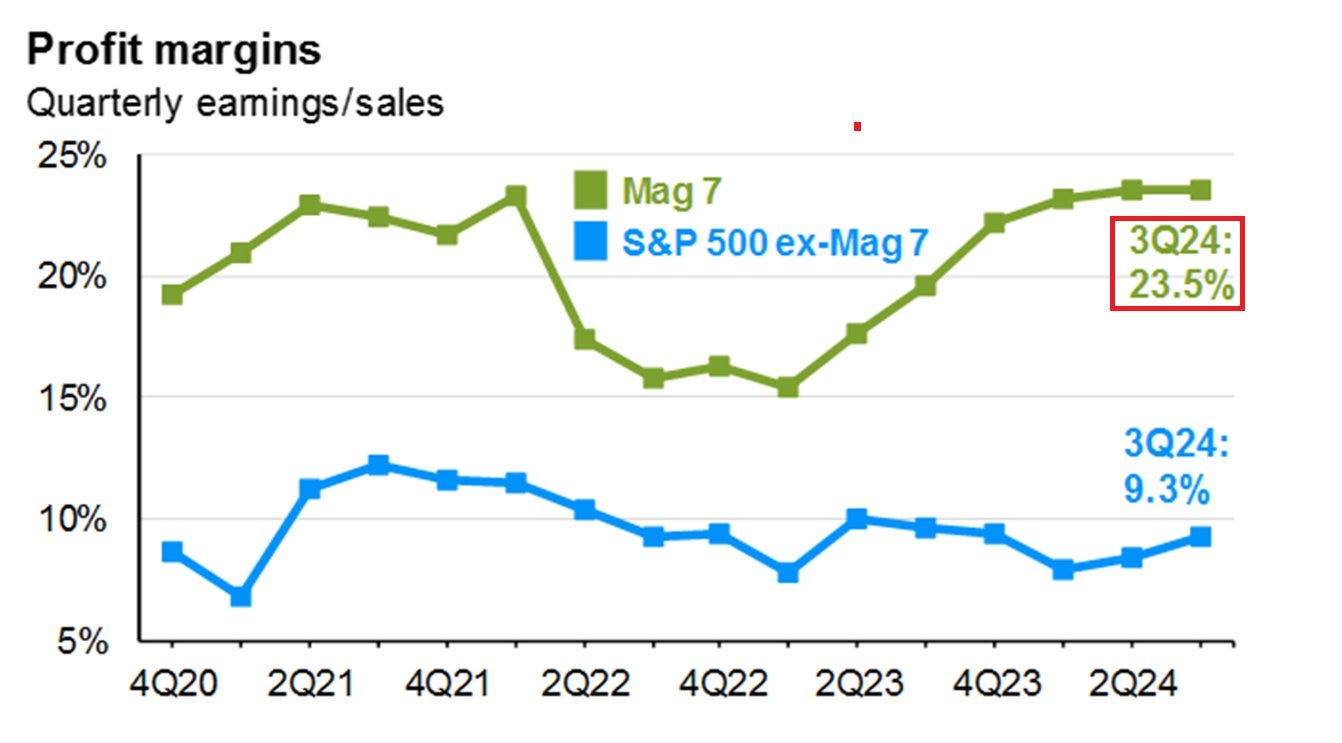

Drilling down further, in hindsight, investors should have simply bought the Mag 7 and took the past 9 years off. In 6 of 9 years, these stocks were up over 40%.

These are truly outstanding companies, the main questions remains how large they can grow and will they be disrupted? Trees don’t grow to the sky.

Mag 7 outperformance have caused large caps to outperform midcaps.

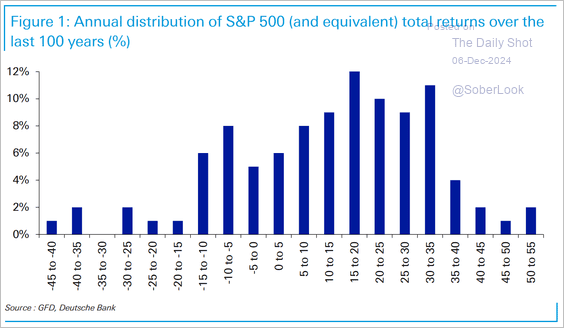

We will see where we go in 2025. The annual distribution of the S&P 500 over the past century. Roughly 39% of the years have seen >20% returns.