Due to potential regional unrest, Washington is preparing to evacuate nonessential staff from American embassies in Baghdad, Kuwait City, and Bahrain, according to the AP. (Polymarket)

An internet indicator of unusual activity is the volume of late-night pizza orders near the Pentagon, particularly from the Domino's on L St NW in Washington, DC, suggesting government workers are working late. @PenPizzaReport

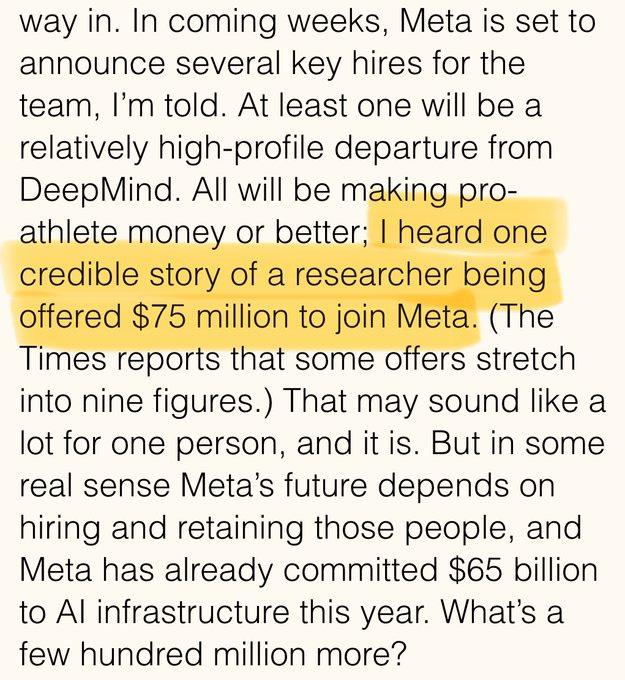

Forget becoming a pro athlete, AI research is where the money is. (@buccocapital)

At year end 2024, the S&P 500 outperformed the Private Equity index over all time horizons. This is really a story of dominant Mag 7 performance. Reminder, dispersion is high across alternatives, some funds still outperform. It still calls into question the need for long lock-ups for the average investor. (

)Poor performance and the lack of distributions has hurt private fund fundraising. (Pitchbook)

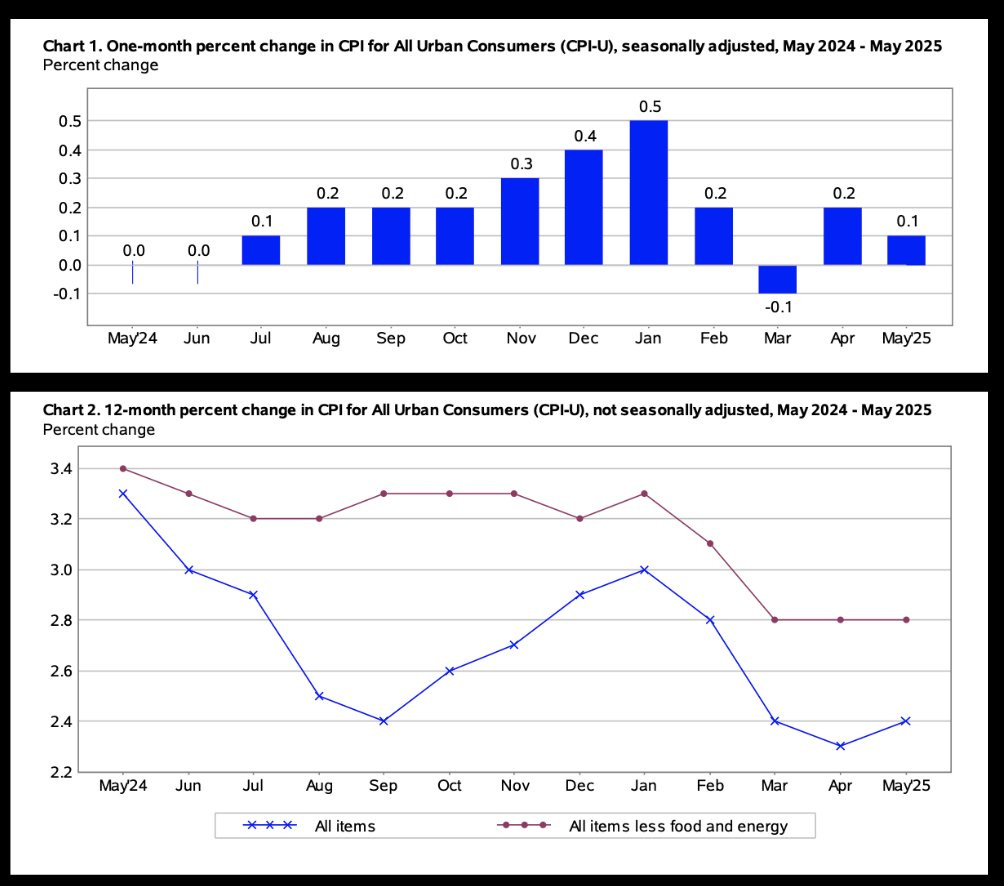

Another good inflation report, May CPI came in lower than expectations at 2.4%. (

)Economists expect tariffs to have a larger impact on inflation in the second half of the year. (John Authers)

“The reality is there’s no real way to restructure our debt without defaulting on it either explicitly or implicitly via inflation. So, if the economic Hail Mary that the administration is throwing fails to connect, things are going to get real ugly. Every jump in gold tells you that the market sees the risk of this scenario as higher. Bitcoin too.”

(Eric Peters Weekend Notes)

Debt forecasts don’t look good and these forecasts have historically been too optimistic (The Daily Shot)

It’s extremely problematic that the population is hooked on handouts and unconcerned about deficit levels. This will only encourage more spending until it is too late. Unfortunately, the bill eventually comes due. (The Daily Shot)

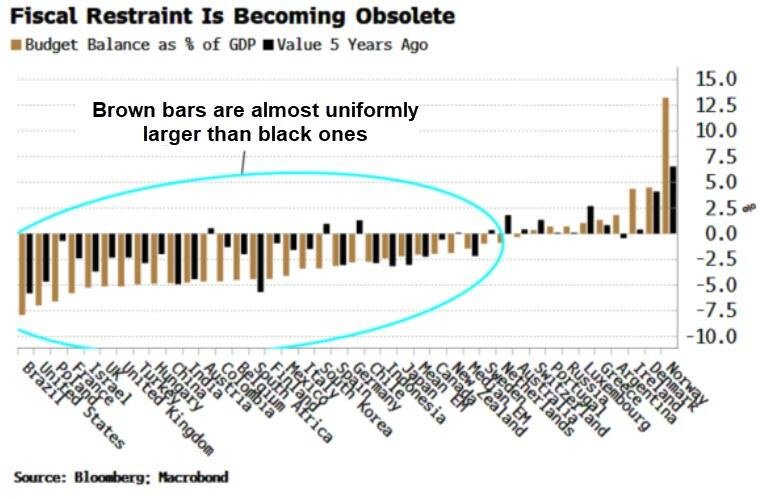

Budget deficits as a % of GDP have increased compared to 5 years ago across most of the developed world, it isn’t only a US problem. (@dailychartbook)

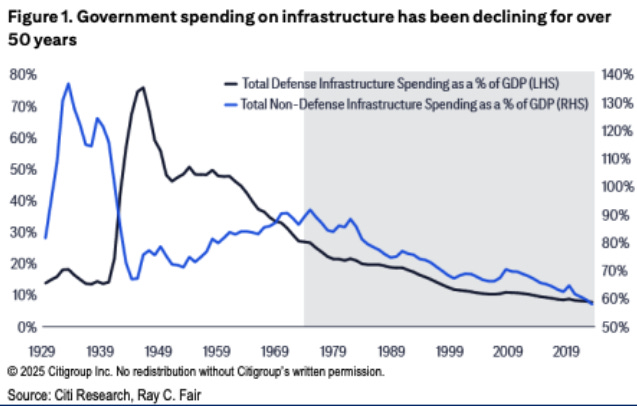

Increased deficits are not funding productive infrastructure investments. The West will eventually need to invest in infrastructure upgrades as the existing system age. (@TheIdeaFarm)

Total debt levels are at unsustainable levels and will have to be dealt with. (The Daily Shot)

Gold has surpassed the Euro as the second most important reserve asset for Central Banks. (FT)

I subscribed to you randomly at some point in the past, recently I have gotten more time to sit down and go through your stuff, and this is some excellent stuff!!! Thank you Andrew!