I love GOLD 🪙

China is going all in on chip manufacturing. US is trying to block them from accessing the latest technology. It will be interesting if being cut off spurs China to develop internal capabilities and surpass the West.

Many experts predict the fabs in the US won’t work because of American work culture. These fabs need to be on 24/7 and require workers to commit their careers to them.

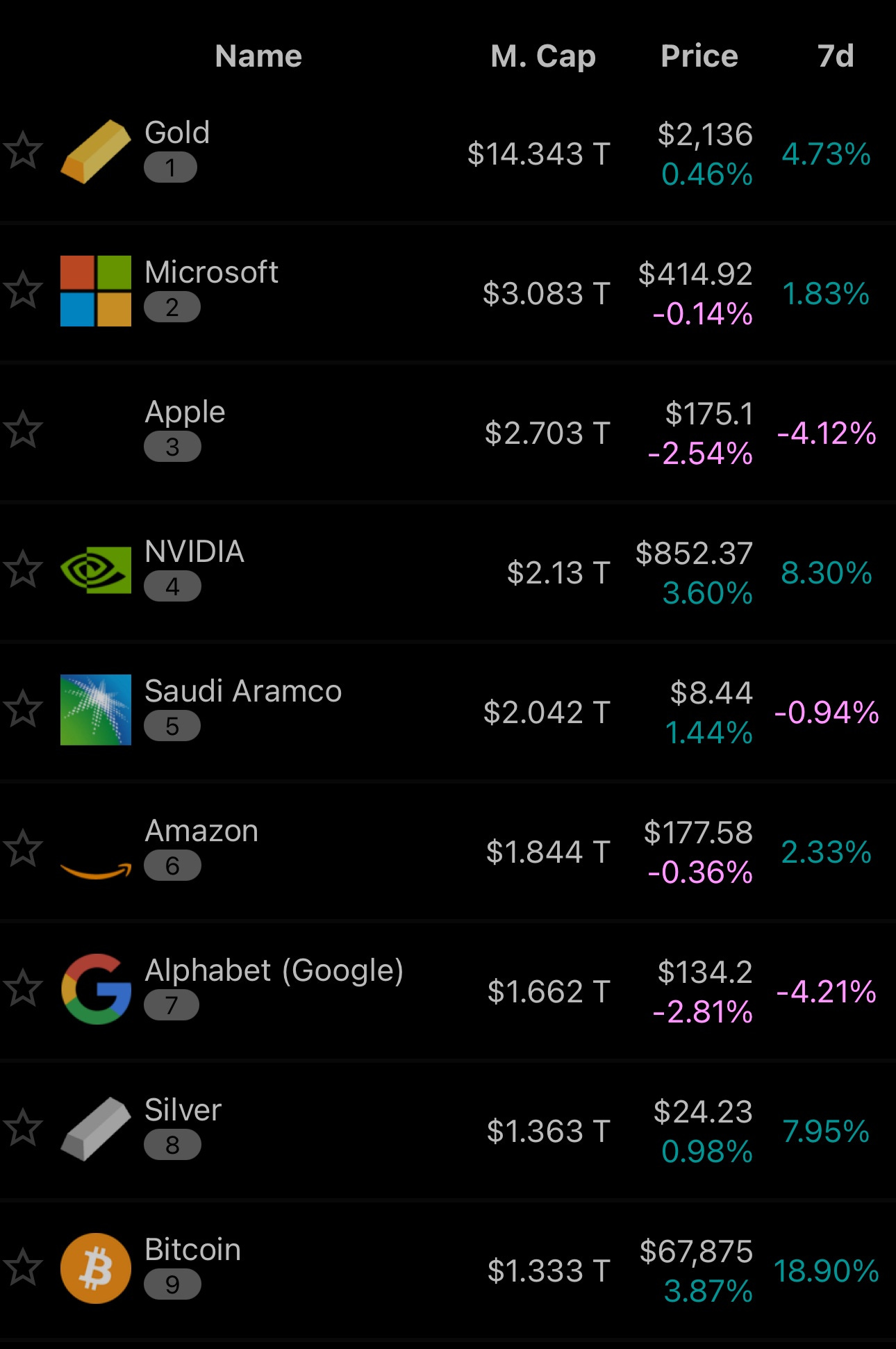

Spot gold prices hit an all time high yesterday. Interestingly, this is the biggest divergence in the 20 years of trading between ETF flows and price. The demand from non-ETFs (Central banks?) is greater than ETF selling.

From 2H 2023, rates drove the stock market lower in Q3 then higher in Q4. In 2024, stocks and gold have broken away from interest rates.

This is good perspective, gold has added 50% of bitcoin market cap in the last 7 days.

Sentiment is strong but not quite in over extended territory.

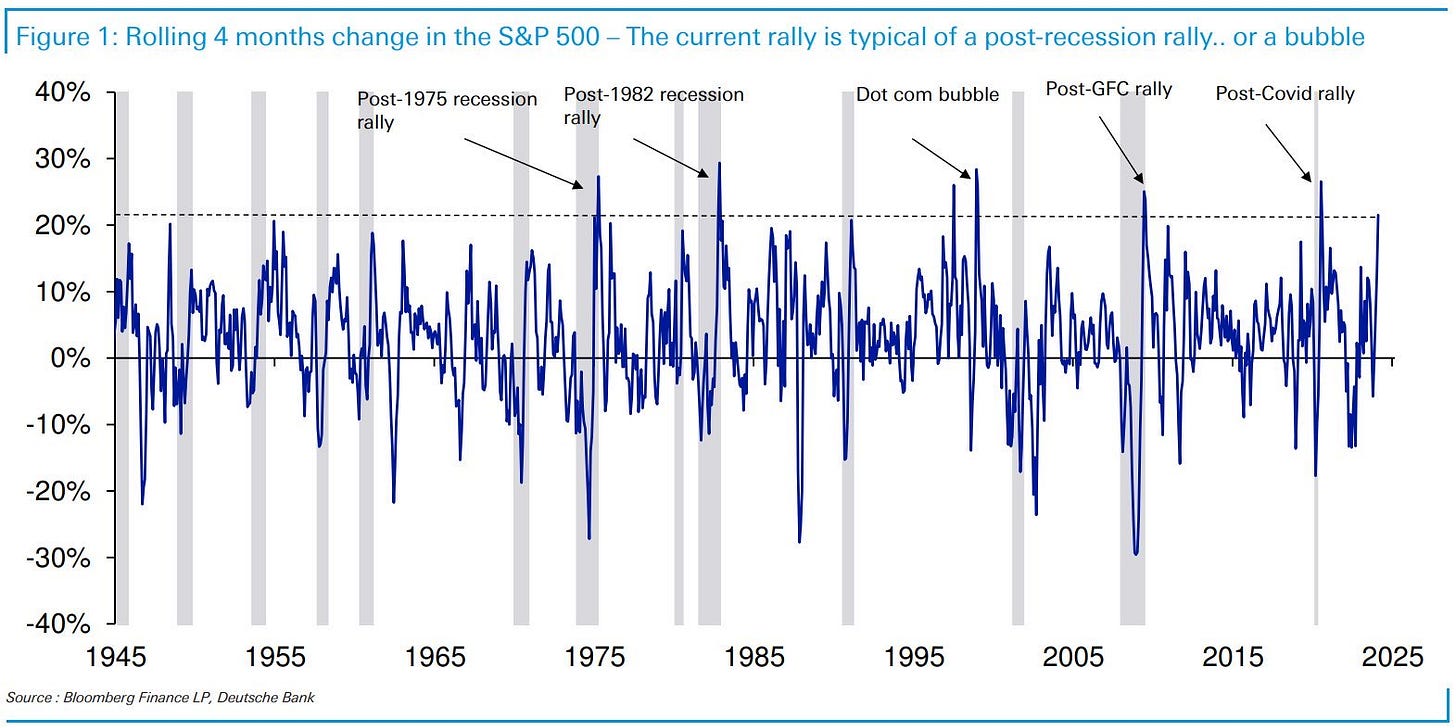

The recent rally is reaching levels typically only associated with post-recession rallies and a bubble.

Market is probably due for a breather but, that is just a feeling.

Meme stocks have had a good February.

Was looking for this chart yesterday. Meme coins have joined the party.

This tells me that financial conditions are easier than real rates would indicate. They don’t necessarily need to tighten if this doesn’t set off inflation.

Bubbles, in both physical and market forms, are liquid phenomena. More liquidity available to investors will mean they spend it on something. If they buy stocks, as is often the case, then valuations can start to surge. Mike Howell of CrossBorder Capital in London measures speculation by dividing market capitalization by liquidity. The more liquidity there is, the more stocks will naturally tend to rise. What should be worrying is when stocks take up an ever greater share of available money. That implies the final mania stage has arrived.

It isn’t here yet, at least as long as money is fungible and the S&P 500 benefits from global liquidity and not just money created in the US. This is the long-term relationship between the S&P and Howell’s measure of world liquidity. It’s startlingly close:

Turns out Jerome Powell didn’t need to cut to ease financial conditions in December. Talking about cutting was sufficient to ease.

Nobody cares about commodities anymore.

Market is implying that tech companies can ratchet up profitability.

In Canada, spending on salaries of government employees, grants, subsidies and capital expenditure - direct program expenses - has risen to about 10% of the GDP currently from 5% in 2015. In the first nine months of the year, these expenses have already surpassed last year's number by a third.

Yuck.

At least, we aren’t running eyewatering deficits like the US.

This week the Raptors back-up center signed a deal that pays him as much as Auston Matthews. It pays to be a basketball player.

The players are benefitting from the institutionalization of sports as salary caps continue to rise.