This is the chart that summarizes it all. Following the 2015 energy price collapse, Canada's real GDP per capita, once comparable to the US, has stagnated for a decade, while US living standards have continued to improve. (@RichardDias_CFA)

Canada's high household debt-to-GDP ratio, driven by rising housing prices, will hinder economic growth. (@RichardDias_CFA)

Already on its back foot, the Canadian economy was hit by Trump’s trade war, making matters worse. Canadian employment has declined for 3 months in a row. (@RichardDias_CFA)

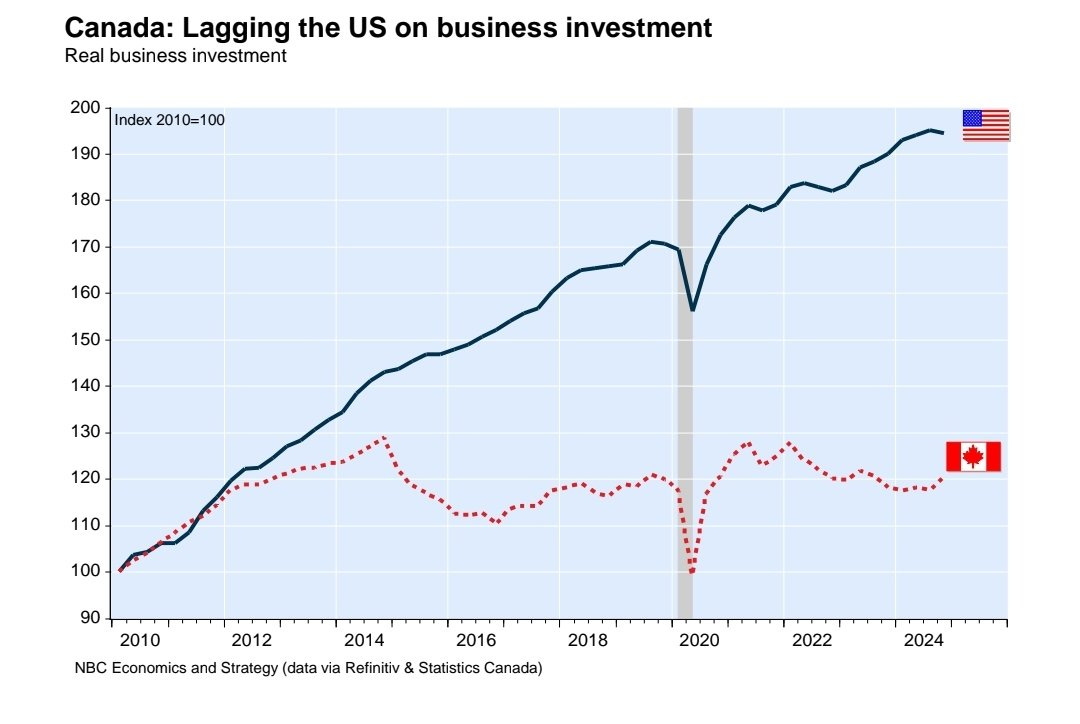

Part of stagnating real GDP per capita has been the stagnating levels of real business investment in Canada. The reason investment has favored the US over Canada is unclear, but addressing this imbalance is crucial. (National)

Despite a bear market in commodities, it is natural resource exports that allow Canadians to afford imported goods. (@RichardDias_CFA)

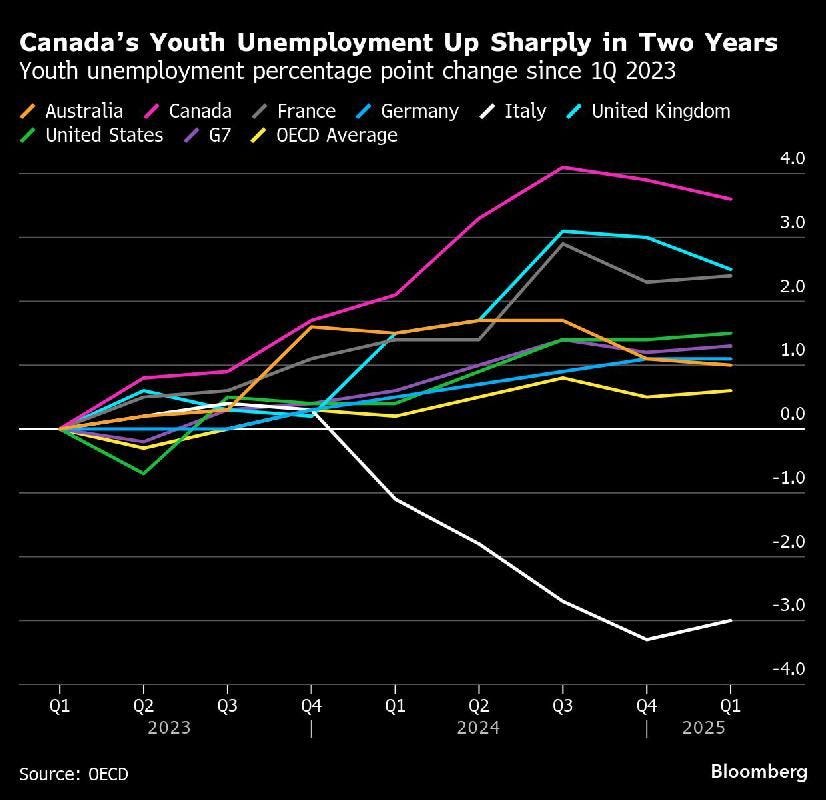

The Government aggressively pursued a pro immigration agenda post covid. It’s hard to rationalize this behavior, this was the playbook used over the past decade to show growing GDP as productivity faltered. But, immigration outstripped the amount of jobs available, leaving everyone unhappy. (@RichardDias_CFA)

Elevated levels of immigration and the trade war has impacted the outlook for youth in Canada. Canada's youth jobless rate rose the fastest among leading nations in the first quarter, at least its not the highest in the OECD at 13.4% vs. Spain's 26.2%.(Bloomberg)

As it becomes more difficult for young people to find jobs; in Canada’s largest cities the dream of homeownership is also out of reach for most. (RBC)

Housing affordability in Canada was only worse in 1990. (RBC)

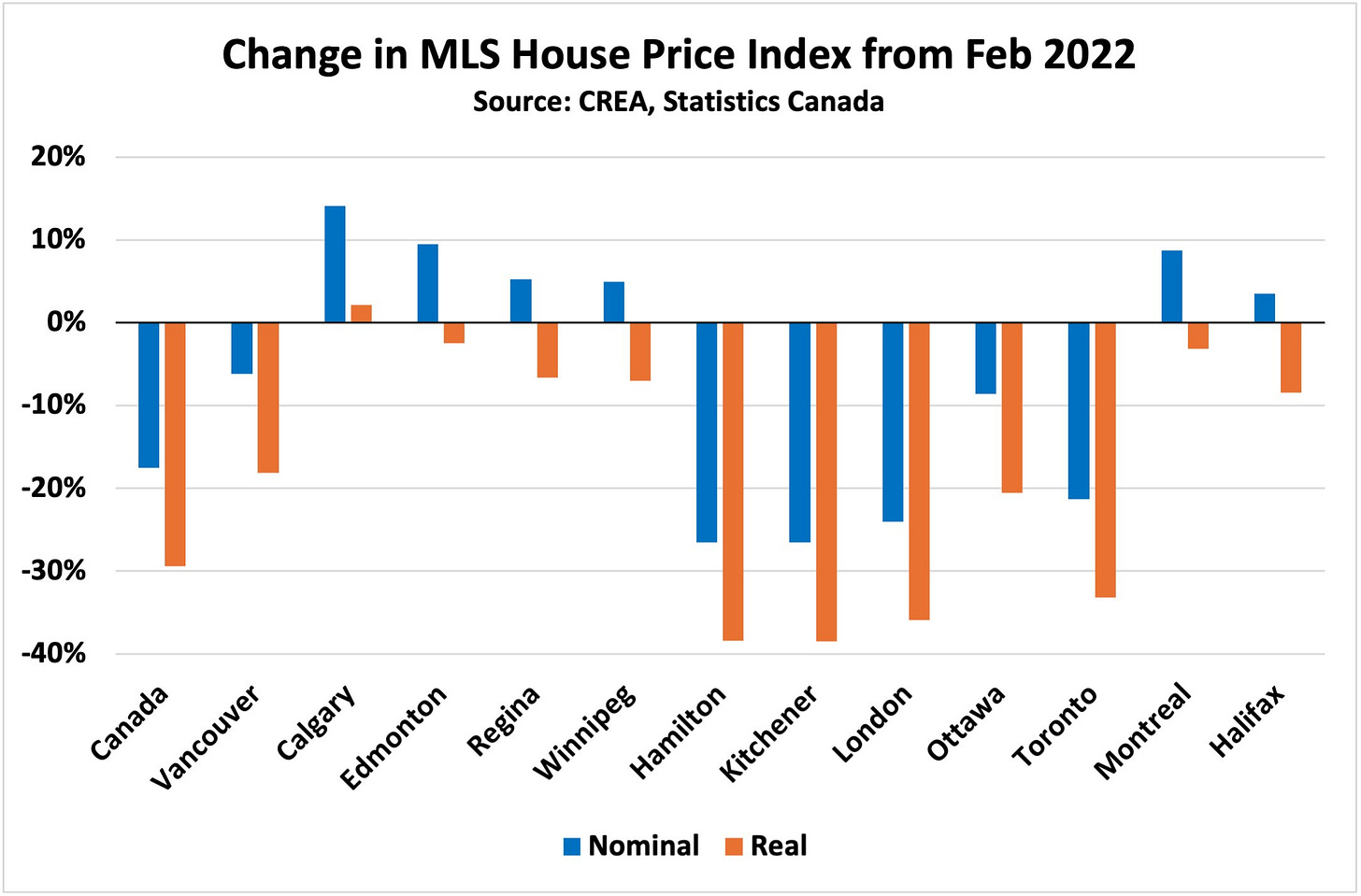

The Canadian housing market has cooled off since the peak with some cities in Ontario experiencing 20% nominal housing price declines since early 2022. (@BenRabidoux)

A slowing influx of newcomers is likely also contributing to declining rents in many Canadian metros. (@BenRabidoux)

Some real world examples. This house in Vaughan sold for $700k below its 2023 sales price. (@ShaziGoalie)

This Toronto condo sold for below its sales price in 2018. (@ShaziGoalie)

Canada's economy, facing trade war pressures, relies on housing, financial services, and natural resources. While increasing housing supply is a partial solution, current economics hinder development. Financial services growth is likely tied to GDP. Thus, leveraging natural resources presents the most accessible path to recovery, contingent on evolving Canadian attitudes. Optimism is emerging from the new government.

Long-term prosperity hinges on a thriving tech sector, demanding housing affordability to retain skilled workers. Hardworking young people should be able to afford homes, ensuring they remain in Canada.