KKR Family Capital Survey

CNBC is running a NYE like countdown for Nvidia earnings… Irrational exuberence.

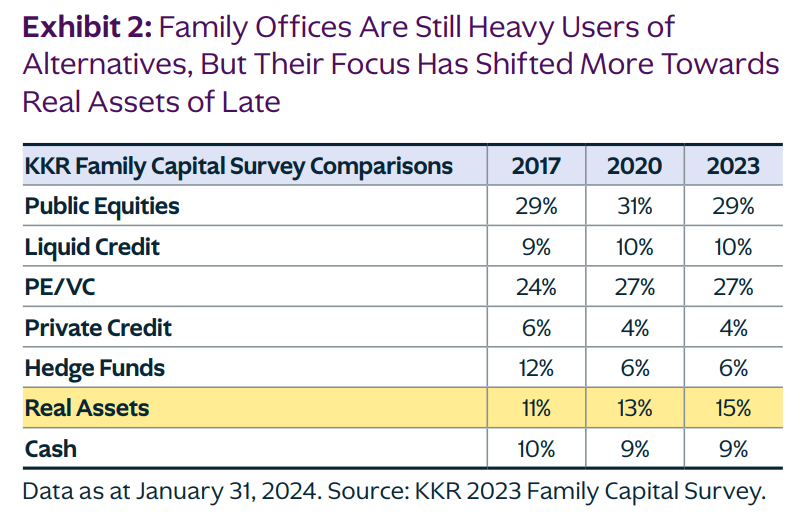

KKR released their periodic Family Capital Survey. Nothing earth shattering but there are some good benchmarks and data points. One of the top takeaways from the survey below:

What seems most important to many CIOs today – and this came through ‘Loud and Clear’ during my travels – is their desire to leverage their longer-term focus as well as their owner/operator mentality to create a sustainable competitive advantage in investing versus more traditional passive investors

Family offices tend to have higher allocations to alternatives than other types institutions.

Drilling into the alternatives exposure, it is mostly private equity/VC. Somewhat surprised by the small allocation to hedge funds, that may be a byproduct of operators having a bias towards owning/operating businesses and mostly not having Wall Street upbringings. The alternative allocation is largely risk-on.

The chart below highlights granular asset allocations and the difference in asset allocations depending on age of the family office. Unsurprising to see the difference with younger family offices as it takes time to develop a privates program and actually deploy the capital. The high cash balance could be earmarked for something or the macro uncertainty + being paid to wait slowed down deployment plans.

Biggest change in intentions over the past 6 years, is an increasing interest in real assets.

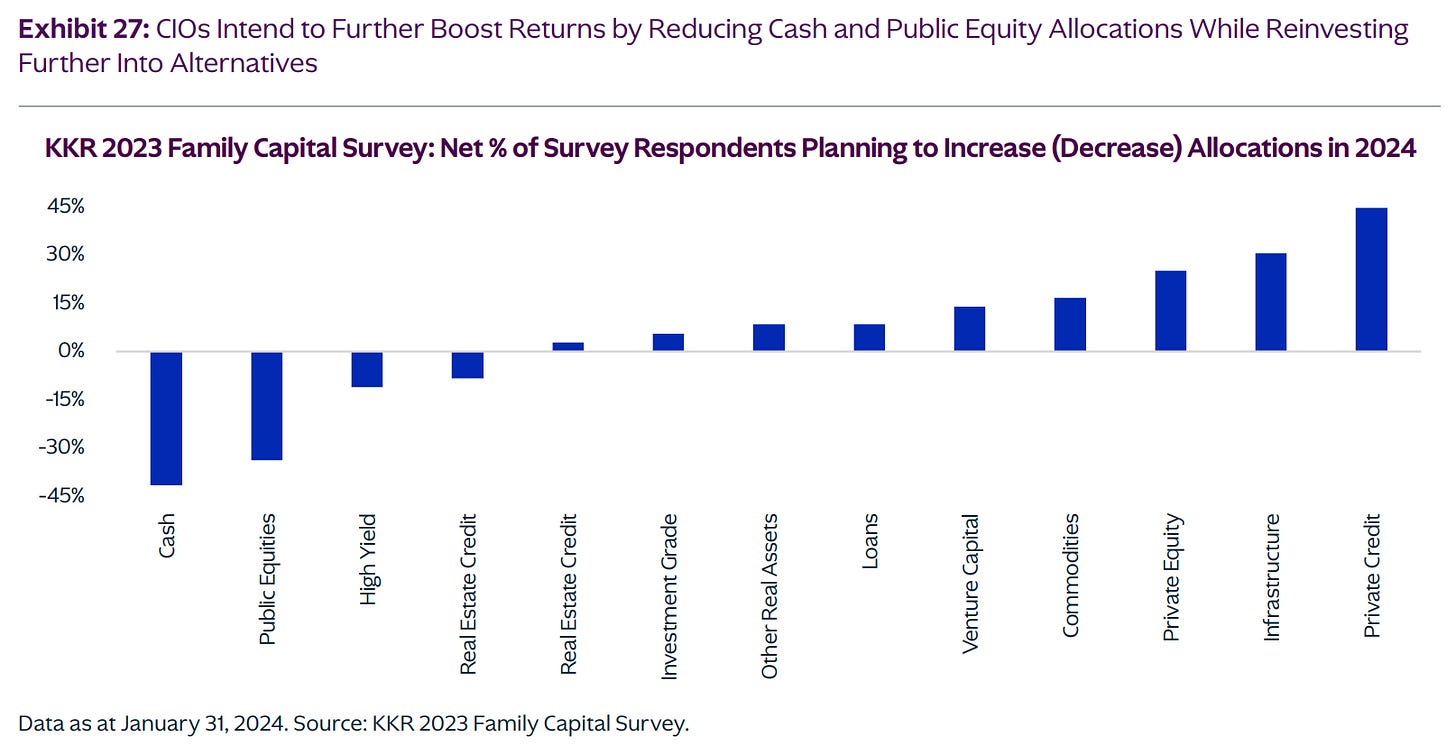

At a time when other allocators are pulling back from private allocations, family offices increase exposure to private market investments again in 2024. Private credit, infra and private equity are the favoured asset classes as families drawdown cash balances to deploy.

Here is more granular data. I think about whether infrastructure makes sense for many Family Offices. These assets are supposed to have a higher correlations to inflation but they often have 15 year lock-ups, at that point are you better of focusing on higher returning private equity or real estate where there is more of a land banking component?

Family offices are most focused on growing their asset bases.

With the top focus of CIOs being asset allocations as getting this right will have the highest impact on performance.

If we continue to live in a world with higher inflation, where bonds have a higher correlation to equities, CIOs are forced to find other asset classes that diversify portfolios. The 60/40 portfolio is underpinned by the negative correlation between equities and bonds.

Co-investments are a key consideration for family offices as they think about making a fund commitment.

Full report attached.

Texas, Arizona and Louisiana have benefitted most from the IRA and Chips Act. $40B of mega projects broke ground in the past 3 years in Texas alone.

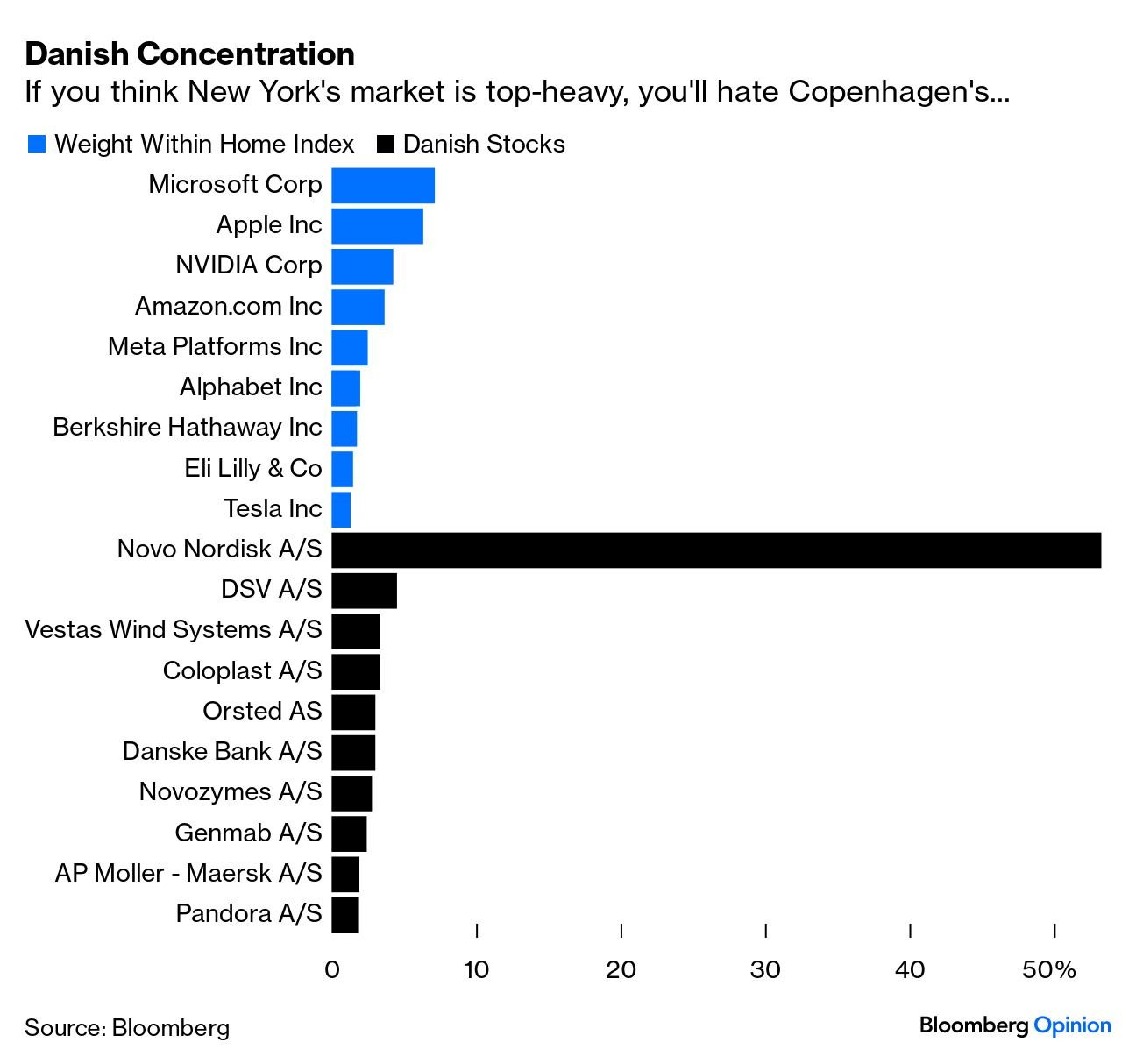

Novo Nordisk is over 50% of the Danish index. Reminds me of Nortel. At its peak, Nortel Networks made up approximately 37 percent of the total value of the Toronto Stock Exchange (TSE) 300 Composite Index.

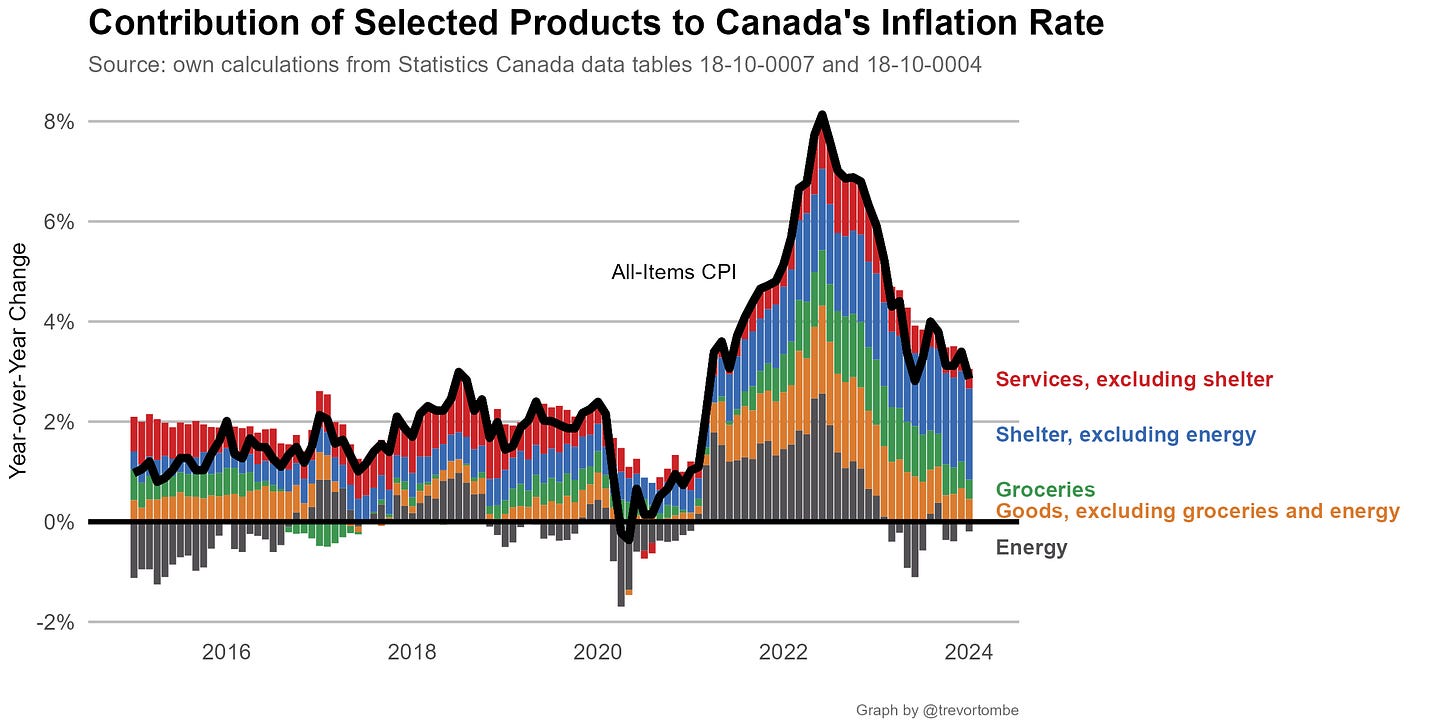

Canadian inflation came in at 2.9%, down from 3.4% in Dec. Biggest contributors to the drop were energy, food, travel. We are now within the BoC’s target range, doesn’t mean we are getting cuts immediately.