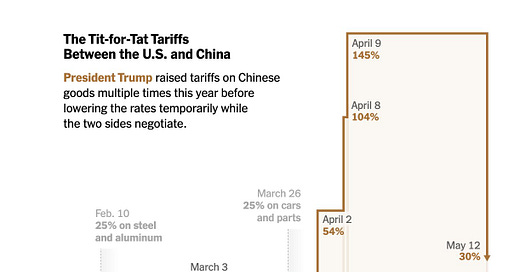

All the volatility for nothing, US-China agree to to reduce tariffs on each other's goods for 90 days. Still hard to believe the US doesn’t want to begin decoupling in the long run. (@TheTranscript_)

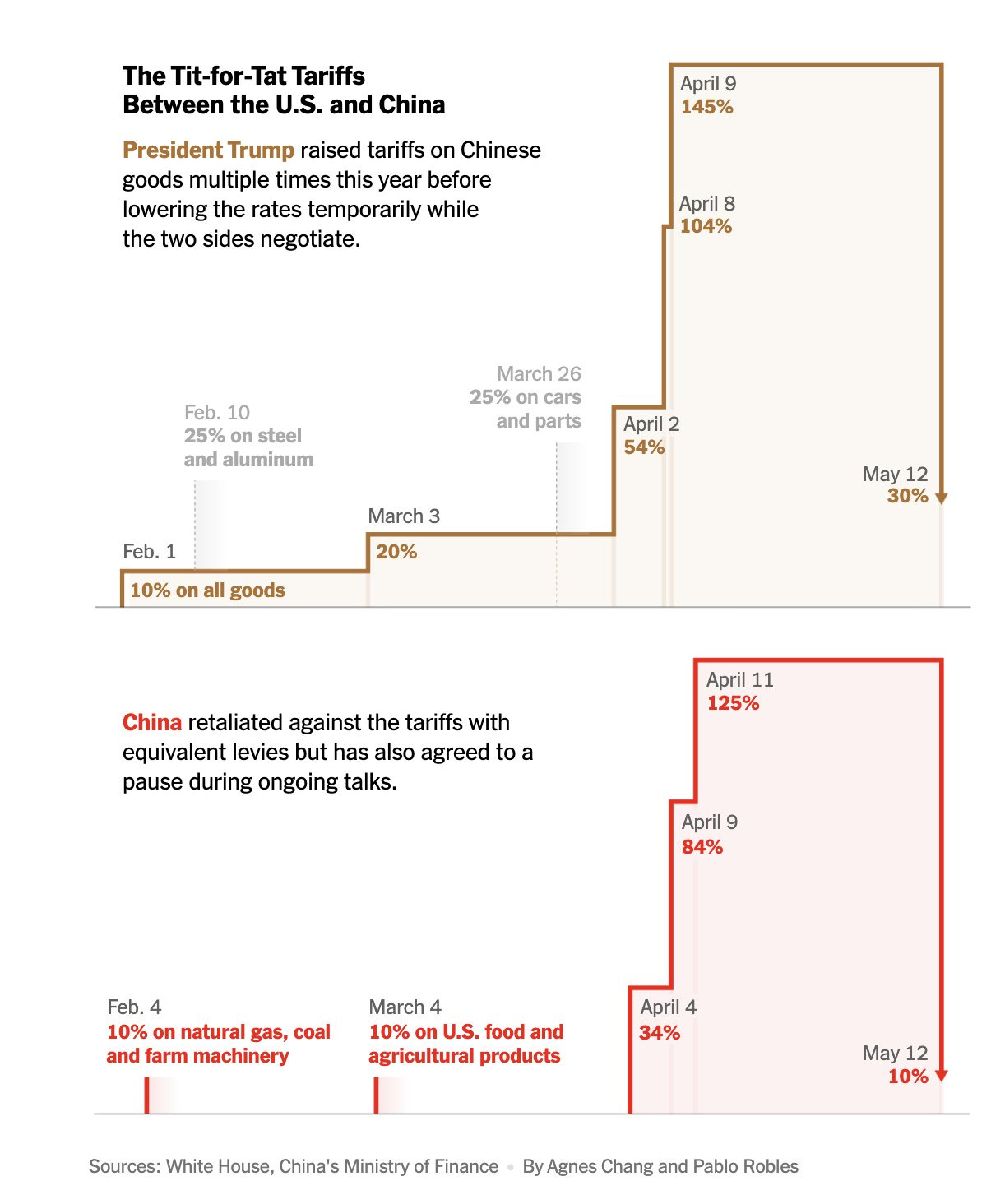

Trump also announced he is going after Pharma pricing in the US. Trump thinks US consumers should have a most favoured nation clause and pay the lowest price globally. I’m not an expert but I imagine this will be easier said than done to implement and would stall biotech innovation. (@michaeljmcnair)

Healthcare and biotech face significant policy-driven uncertainty. Elevated short-term implied volatility in sector ETFs, relative to longer-dated levels, signals heightened near-term uncertainty. (The Daily Shot)

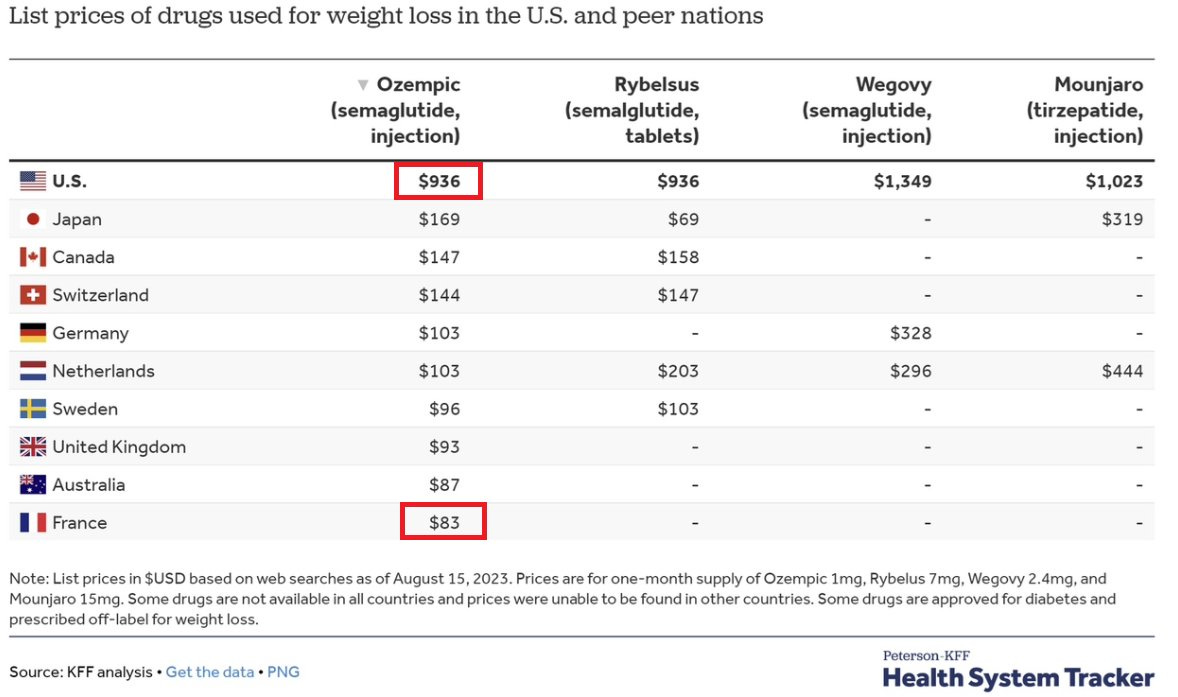

The Mag 7 are still the most resilient companies with pristine balance sheets. Albeit, higher expectations are baked into multiples. (@MikeZaccardi)

Mag 7 is now outperforming gold since liberation day. (@biancoresearch)

Equity risk premium is now at a 24 year low. Simplistically, this is a measure of equity attractiveness relative to bonds. (@ISABELNET_SA)

Absolute valuation levels have eased but remain expensive. (@MikeZaccardi)

Next time you are shown a seed deal remember this stat; after 8 quarters, only 15.5% of Start-ups have advanced to series A. 2 years ago this number was twice as high. (@PeterJ_Walker)

Swiss bonds are back in negative territory. The first indication parts of the world are back in a zero interest rate world. (BofA)

Major global central banks around the world are collectively cutting rates. Japan is the outlier. UK and the US have rates stubbornly high compared to peers. (@RichardDias_CFA)

If the US doesn’t continue to unwind their chaotic approach to trade policy, we may see an interesting situation where inflation is rising in the US but other developed countries experience deflation. Ex-US could be a dumping ground for excess Chinese goods. (Apollo)

A wide variety of goods are actual experiencing deflation in the US. (@EricLDaugh)

BTW, great work.

Informative, insightful and succinct.

Your first sentence says it all!

Don’t need the Art of the Deal to know the one who makes first major concession is the one in weakest position or who is most anxious for a deal.

The Disruptor in Chief blinked first and essentially got nothing in return from the party who had the most at stake.

So was this just a show for effect or admission of realizing he was in weaker position.

Only thing known for sure is the only thing certain is pervasive uncertainty.