PC & SBC

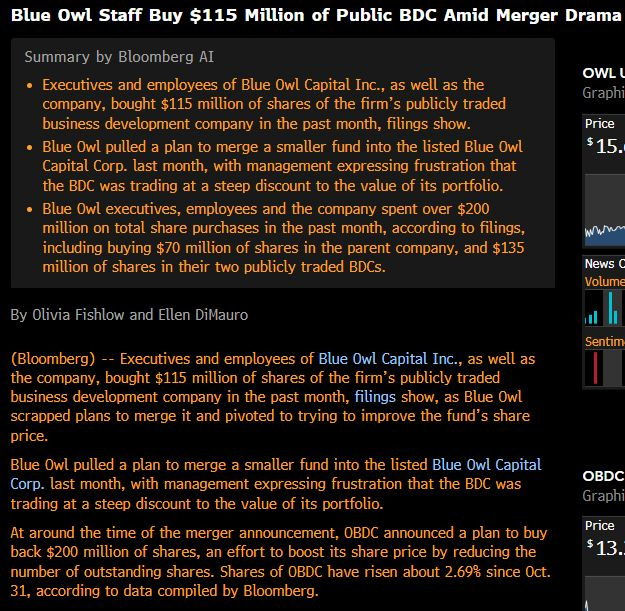

Interesting development in the Private Credit mark to myth debate. Blue Owl employees bought $115M shares of a Blue Owl BDC that was trading at a double digit discount. Putting their money where their mouth is.

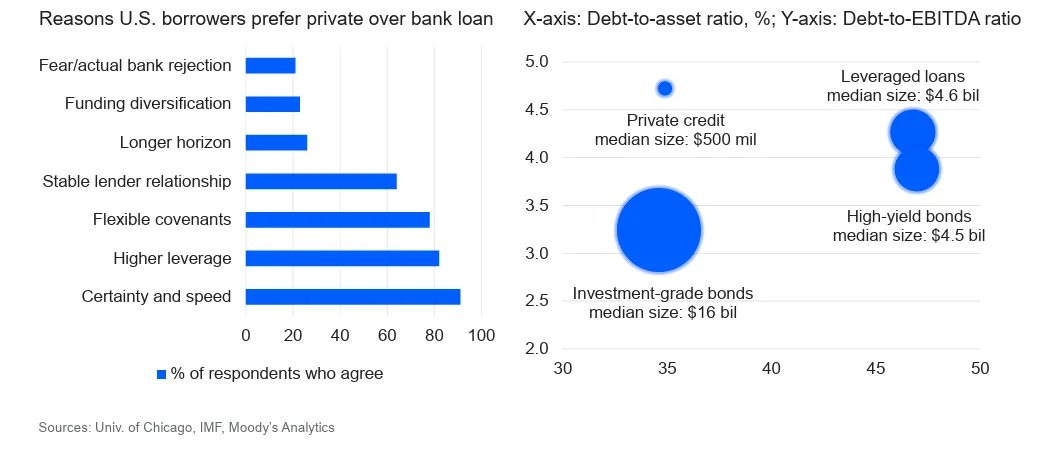

Borrowers cite certainty and speed + higher leverage as the reason they prefer Private Credit over bank loans. (Unicus Research)

If you want a reason to sell your bonds, check this podcast out.

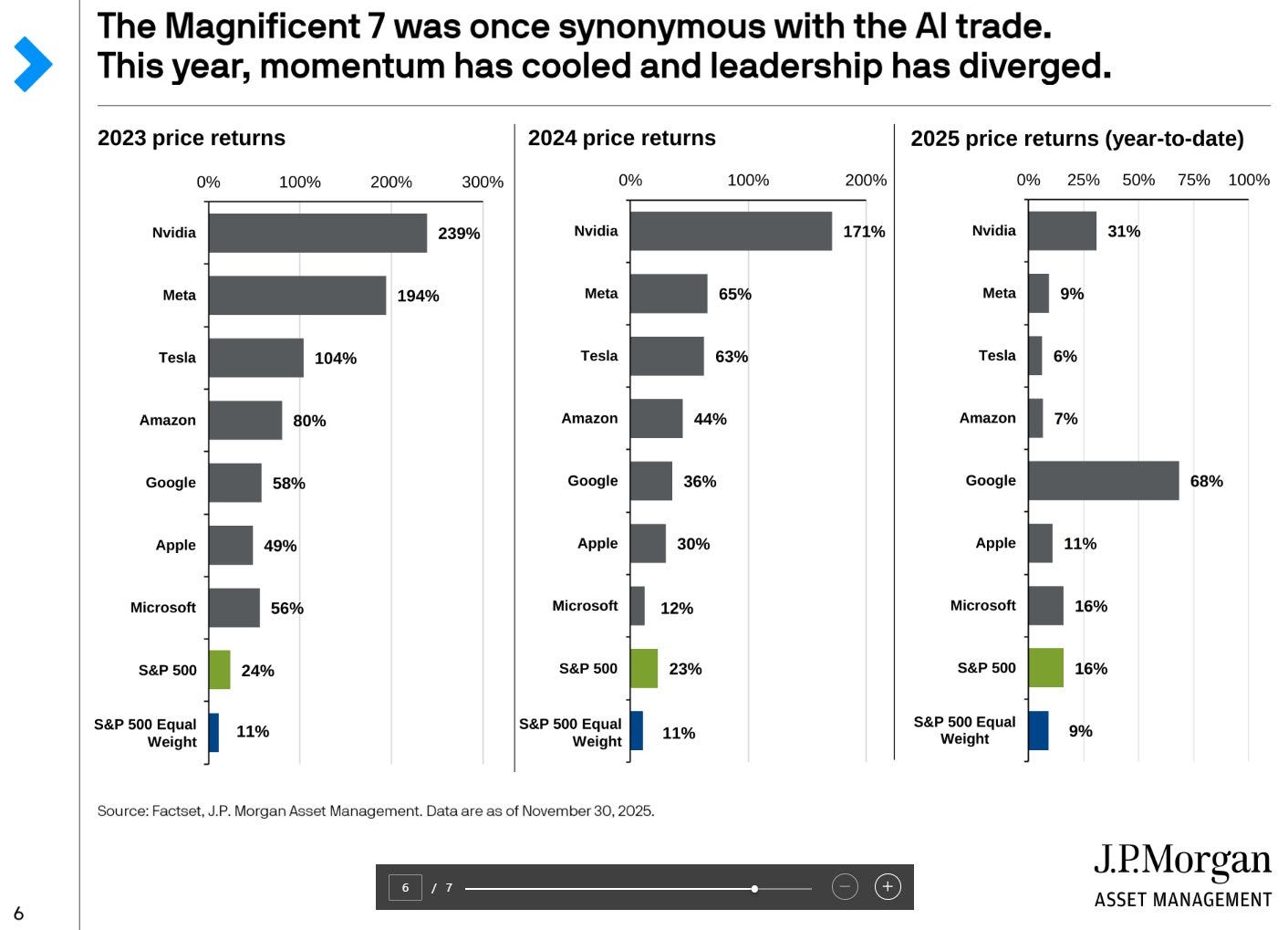

While the same Mag 7 stocks were the consistent winners in 2023 and 2024, Google has outperformed in 2025. The S&P 500 is also currently surpassing most of the "Magnificent Seven" in performance. (@MikeZaccardi)

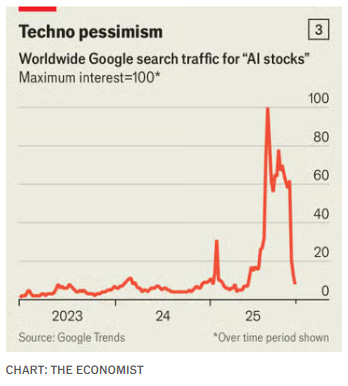

Attention on AI stocks from retail investors seems to be waning. (@mastersinvest)

Peaking google searches has not tended to be good news for performance.(@mastersinvest)

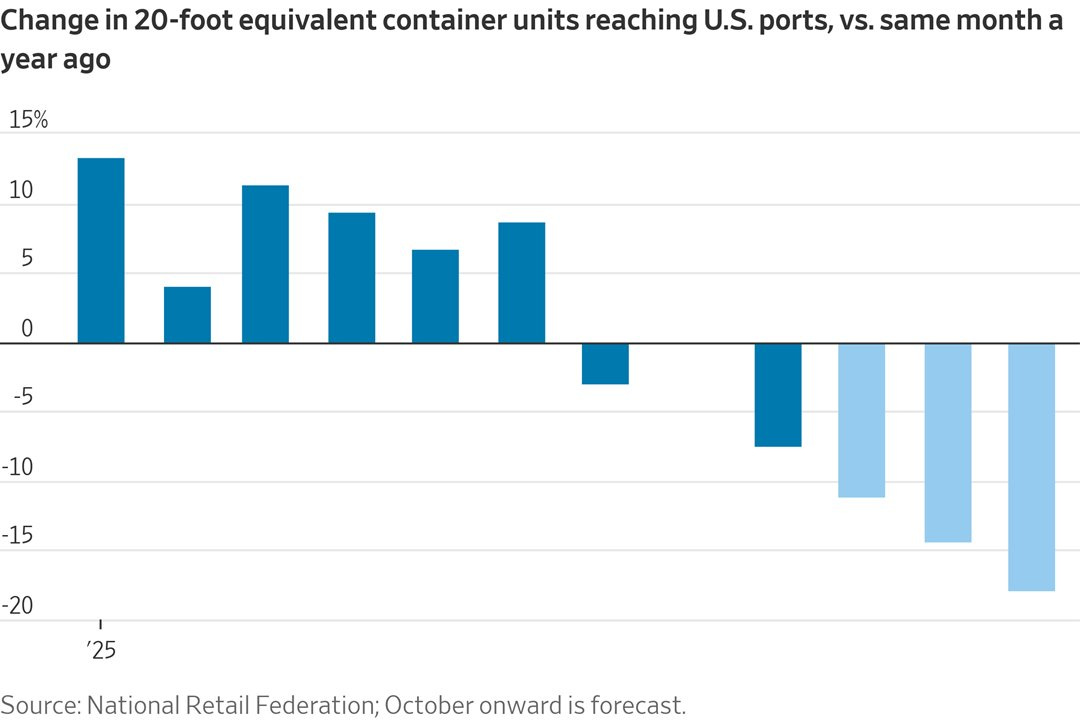

U.S. port traffic in the first four months of 2025 was up almost 10% year-over-year, but the NRF forecasts a 13% decline in the final four months. (@dailychartbook)

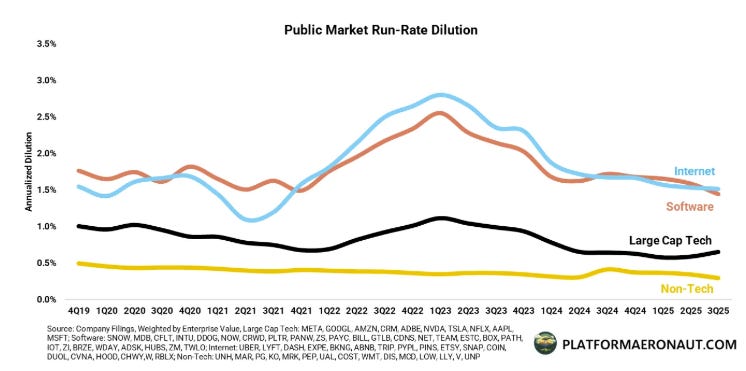

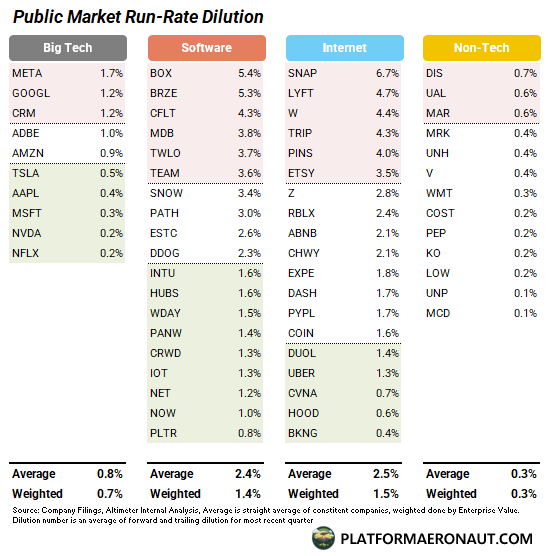

Interesting piece on hidden equity investor dilution via stock based compensation (SBC).

Tech companies tend to be the worst culprits of excessive stock based compensation.

Smaller tech companies experience higher dilution due to: lagging growth (e.g., TRIP, BOX, BILL, GTM), hypergrowth strategies prioritizing expansion over dilution (e.g., SNOW, MDB), or weaker business models requiring larger workforces (e.g., W, PINS, LYFT) compared to the "Mag 7."

There are a handful of companies diluting the equity investor base by 5% a year.

Netflix is the most discipline while Snapchat is the worst offender. Buyer beware.

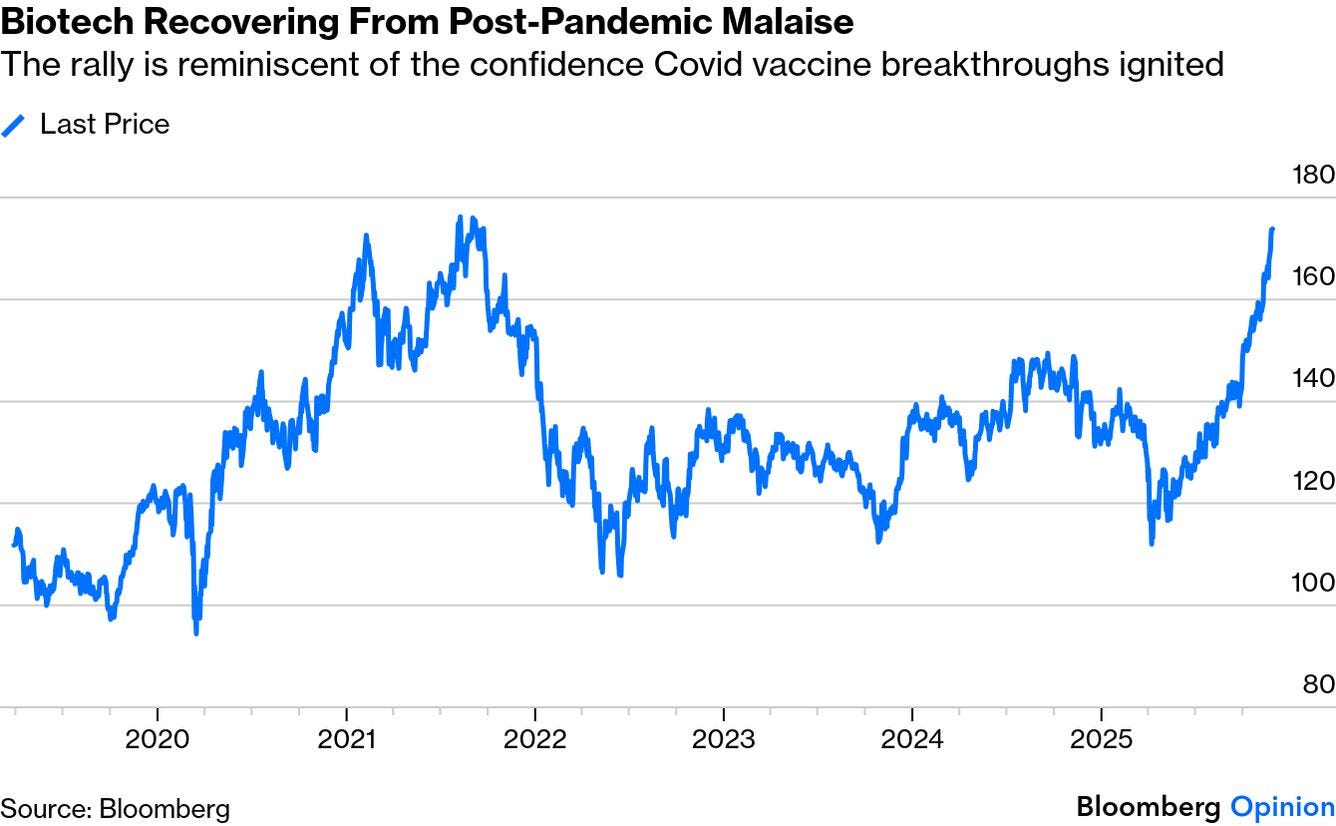

The iShares Biotechnology ETF is on its longest winning streak since 2012, having risen for six consecutive months. It is now poised to surpass its all-time high, set during peak Covid vaccine optimism. (Bloomberg)