Private Debt Pt. 3

Despite expectations that increased capital in direct lending would tighten spreads and converge with syndicated loans due to competitive pricing from private credit firms, direct lending has maintained higher spreads. (Cliffwater)

Private credit lenders claim these factors allow them to command higher lending rates and gain market share from the syndicated market. (Hamilton Lane)

Closer relationships: The ability of a small lender group to work collaboratively and efficiently with their borrower on incremental facilities and amendments.

Speed of execution: The ability to provide financing in a short period of time.

Greater financing certainty: Public markets may shut down during periods of volatility while private credit typically remains open due to its committed capital nature.

Ability to understand complexity: Public markets are not always receptive to transaction complexity, including business carve-outs and divestitures.

Stricter confidentiality: The ability to limit access of sensitive information to a small private lender group vs. sharing it more broadly in the public markets.

Another way to look at Private Credit’s dominance over the syndicated market. (MS)

Direct Lenders also claim that the majority of their deals have covenants. Many investors speculate that the close relationship between borrower and lender may help obfuscate true protections. (StepStone)

As opposed to the syndicated loan market that has moved almost entirely to cov light deals.

Market stress creates trading opportunities for public BDC investors who anticipate recoveries, as other investors panic over expected portfolio markdowns. (Franklin Templeton)

Despite concerns about the health of the market, Direct Lenders are forcing Private Equity GPs to increase equity contributions in their deals.

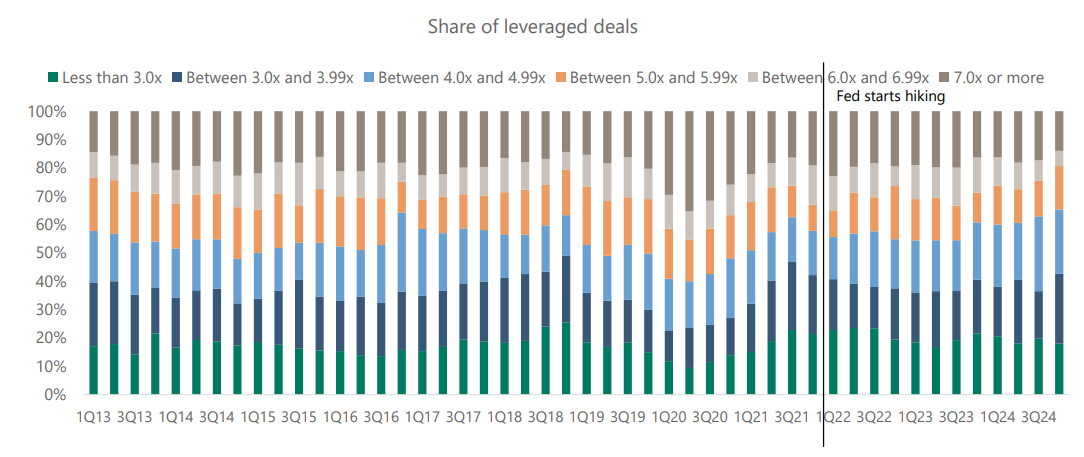

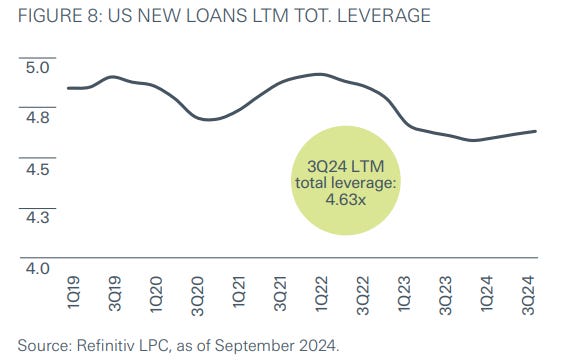

And leverage levels have come down. (Apollo)

The average new loan has 4.6x leverage. (StepStone)

So far, the asset class has remained resilient and defaults aren’t an issue. (Cliffwater)

In the event of default, lenders still have an opportunity to recover value. (StepStone)

Morgan Stanley reports that large caps have underperformed the middle market, contrary to the typical private credit argument that larger firms' diversified revenue provides better downside protection. (MS)

The Focus of these past issues has been on direct lending/senior debt but the Private Credit asset class is rapidly evolving to include many forms of private loans. (Cambridge Associates)

And if you still aren’t satiated after the last 3 notes on Private Credit, this podcast explores Apollo, one of the pioneers in the space.