Institutions are currently hamstrung by the lack of Private Equity exits and previously made commitments, net cashflows are at GFC levels. Depending on your liability profile this can be an issue. Princeton’s Endowment who has 40% exposure to the asset class is one of these situations.

I can tell you, there are deals done in 2021 where there is no equity left at current rate levels.

Private Equity and Venture have let investors down over the past few years. There are also issues around valuations. You can build a model and have an auditor sign off on private marks but that is not necessarily what public markets or the next buyer is willing to pay for these assets. The poster child for this is Real Estate, where public and private markets have diverged; public markets are likely more accurate.

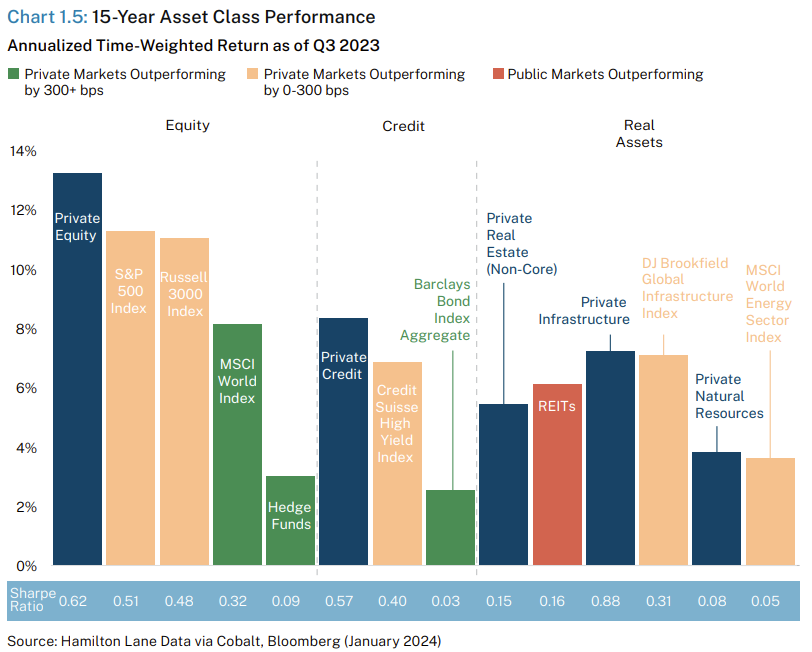

Investors have piled into privates over the past decade on the promise of higher returns.

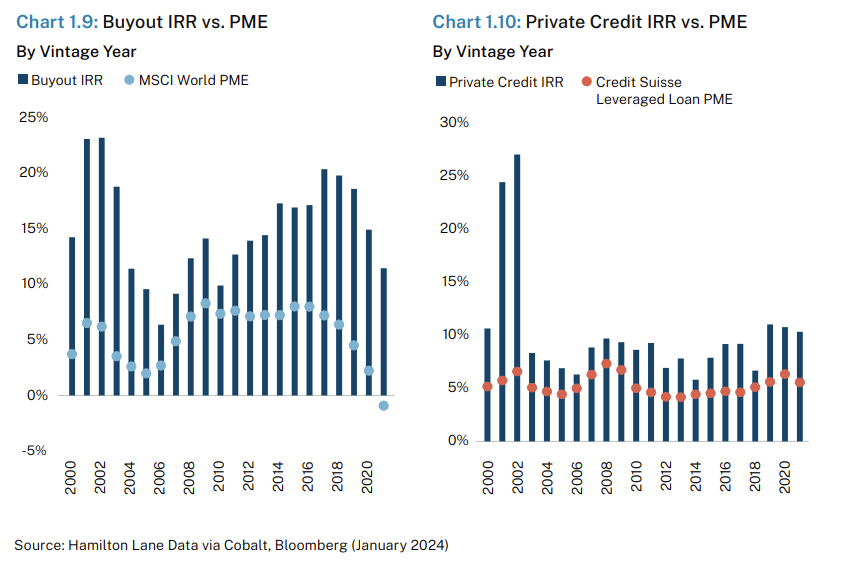

One of the challenges of measuring private market performance is creating a public market equivalent (PME) to benchmark. Another one is, a private market firm will always tell you privates are better, that is their business. The below is from Hamilton Lane:

Pooled buyout returns (not only top quartile, not a curated portfolio), on a PME basis (same dollars into and out of the public index) have outperformed public market returns in every one of the last 22 vintage years! And how did credit stack up? Why, credit also outperformed leveraged loans in each one of the last 22 vintages. (If only we could insert an audio clip here of angels singing Hallelujah...) That pretty much says it all and, again, makes you wonder why there is so much skepticism about private markets. Sure, things might turn out differently going forward. But ask yourself, “Why will it be different? Didn’t you, oh Hamlet, fret and moan over pretty much the entirety of these last 22 years about whether that outperformance could continue? The markets were up, you worried; the markets were down, you worried; the markets were flat, you worried; the markets were closed on weekends and holidays, you worried. As you worried, private markets outperformed, year in and year out.”

Looking at the data in recent years, there should not be a discrepancy as pictured below.

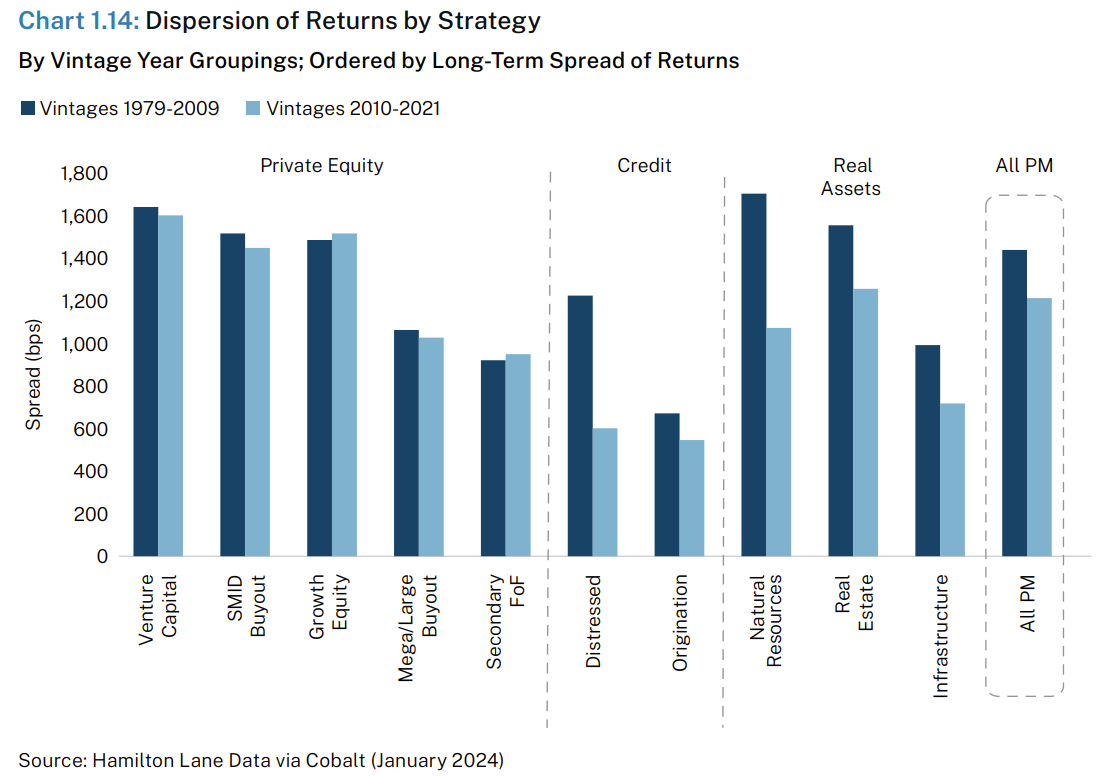

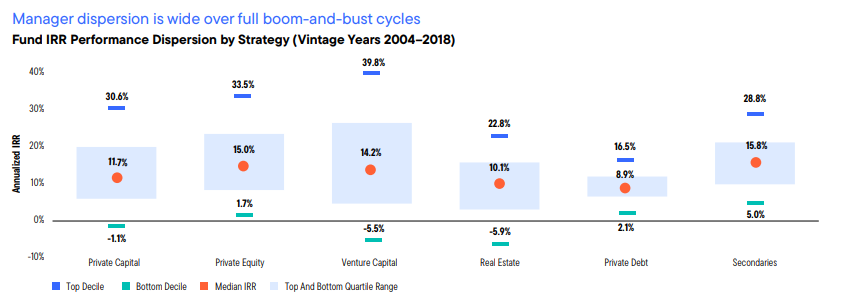

It might not always be fair to look at average return. From experience, you do see some fantastic outcomes in private markets but there is a big difference between the best and worst funds.

Due to the high dispersion, manager selection is much more important in private markets. If you can identify a top quartile manager, big “if”, you likely received some very nice returns. To have a fighting chance at this, you need to interview tons of managers. Allocating to the manager that shows up on your door step is no guarantee of great returns.

The median return across private market sub strategies may not be enough to warrant the lack of liquidity. Secondaries have recently delivered strong performance with strong upside and lower downside.

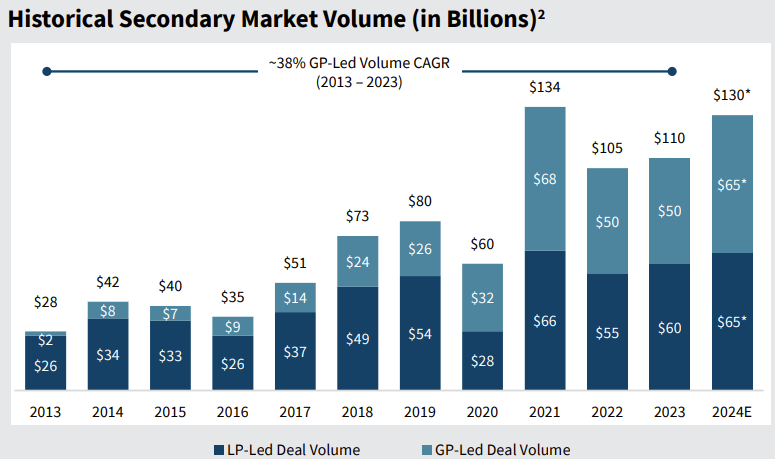

This has led to an uptick in secondary volume. Lack of public market exits has also driven some of this volume.

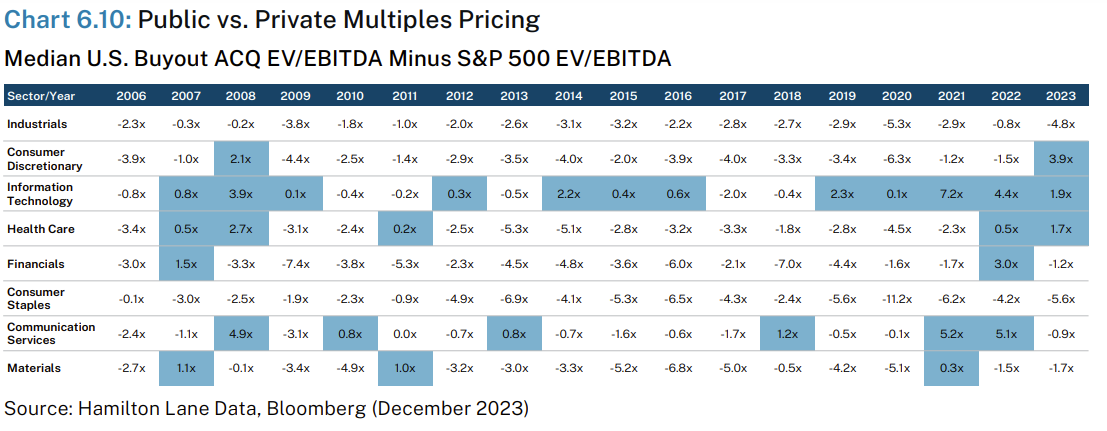

Broadly, I tend to think that an equity is an equity whether it is public or private. It probably doesn’t make sense to overpay if the asset is private. Again from Hamilton Lane:

We know this looks too busy and we hesitate even to show it to anyone, but we are convinced it is the most important chart in the overview. What does it say? What bolt from the blue did it create? Those blue shadings tell us that the private markets are buying at a premium to the public world, but now we are looking at different industries, and not at aggregate numbers. Speak to us chart; tell us what you want to say! It seems so obvious, but so outlandish, even to us. Here is what we believe: Yes, private assets are selling for more than public assets today, just as they were in 2007 and 2008, but very focused in certain industries and generally avoiding some. Private never buys at higher prices than publics in industrials and consumer staples. Why? What do they know that the public doesn’t? But look at how private buys at higher prices today and during the GFC in healthcare and information technology and even in consumer discretionary. Again, why? Now look at how private equity has consistently bought at a premium to the public markets for the last 15 years in information technology

An area that I’m interested to go deeper on is search funds. According to Stanford, the returns have been outstanding. I am curious whether real world experiences confirm the data below. Debt levels of search funds seem problematic in the current environment. These companies are too small for most institutions to spend time on but if they are the end buyer at higher multiples it could make sense. I do believe there are better opportunities in the lower middle market at least. Tony James, former Blackstone exec, recently launched a fund focused on smaller companies, I see this having some information value.

With smaller companies comes more customer concentration and more things that can kill a company. This is apparent in the 27% loss rate searchers experience.

I’m a believer in Private Markets. There is good and bad, if you have the access and time to invest in amazing teams, I have seen fantastic outcomes. The higher levels of debt these companies use will lead to interesting outcomes in the current environment. High fees are certainly a headwind and I think the average non-institutional investor has the odds stacked against them.

Related... Funds Are Booking Big One-Day Windfalls Buying Private-Equity Stakes https://www.wsj.com/finance/investing/funds-are-booking-big-one-day-windfalls-buying-private-equity-stakes-664f3423?st=6tx8rgulwwjekfm&reflink=desktopwebshare_permalink

Very good note. Agree with your summary. PE is not for everyone, lack of transparency a negative and challenging for retail investors.