Private Markets Update

McKinsey released their annual Private Markets report. Below are the takeaways that caught my attention.

Elevated multiples remain one of the biggest challenges in the space. Elevated purchase multiples are making it difficult for Private Equity GPs to hit their return targets.

Previously, multiple expansion and leverage were significant return drivers, but these drivers are now stalling due to elevated interest rates reducing debt accretion and extended entry multiples limiting opportunity for multiple expansion.

Sponsor to sponsor transactions were 45% of private equity deals in 2024.

Across Private Equity, including Venture, fundraising fell 24% in 2024. Venture and growth have been hit the hardest. Buyout remained close to its 5 year average.

The top 100 Private Equity firms represent 68% of the capital raised in the space in 2024, above the long term average. The big are getting bigger.

The number of private funds has collapsed since 2021, primarily driven by a reduction in Venture Capital funds.

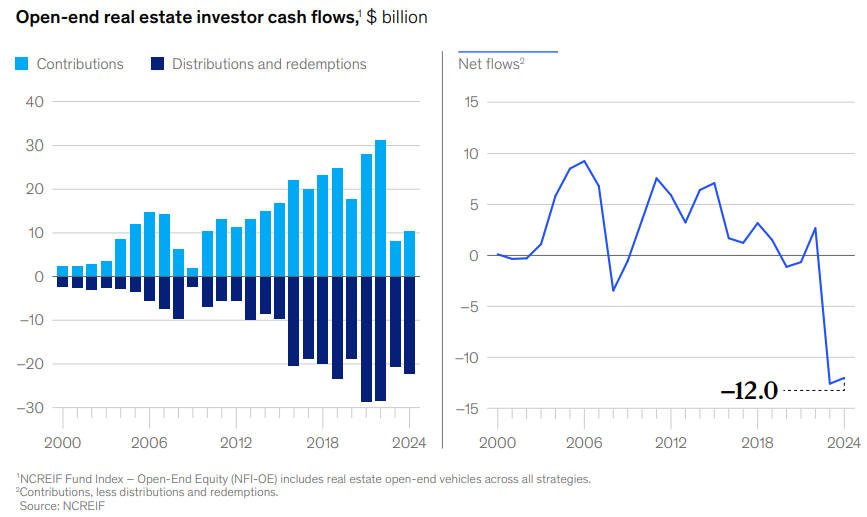

Real Estate is one of the most stressed segments of private markets as capital calls are outpacing distributions by the most on record due to contracting valuations.

Private Debt fundraising is much more concentrated than Private Equity. The top 5 firms represented 38% of all fundraising and the top 25 firms are almost 80% of fundraising.

Private Debt has a much tighter dispersion of outcomes compared to the rest of private markets.

LPs are prioritizing distributed to paid in capital (DPI) in todays environment.

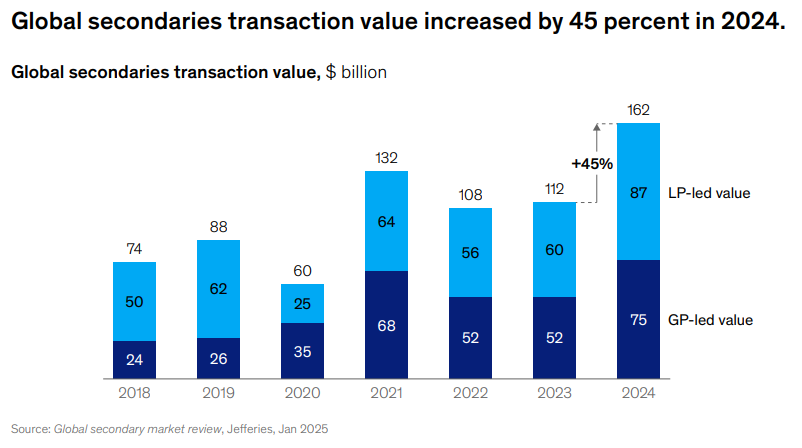

Secondaries continue to gain popularity with transaction volume increasing 45% in 2024.

Secondary pricing is a strong indication of where real prices are vs private marks; not fully as you would expect a discount for being a liquidity provider. Venture/Growth and Real Estate are seeing the largest discounts and this doesn’t reflect reality as I’m told, it is only the quality assets trading at the levels below.

The growth in secondaries can likely be attributed to the segment offering some of the best return on risk over the past decade.