RE Redemptions

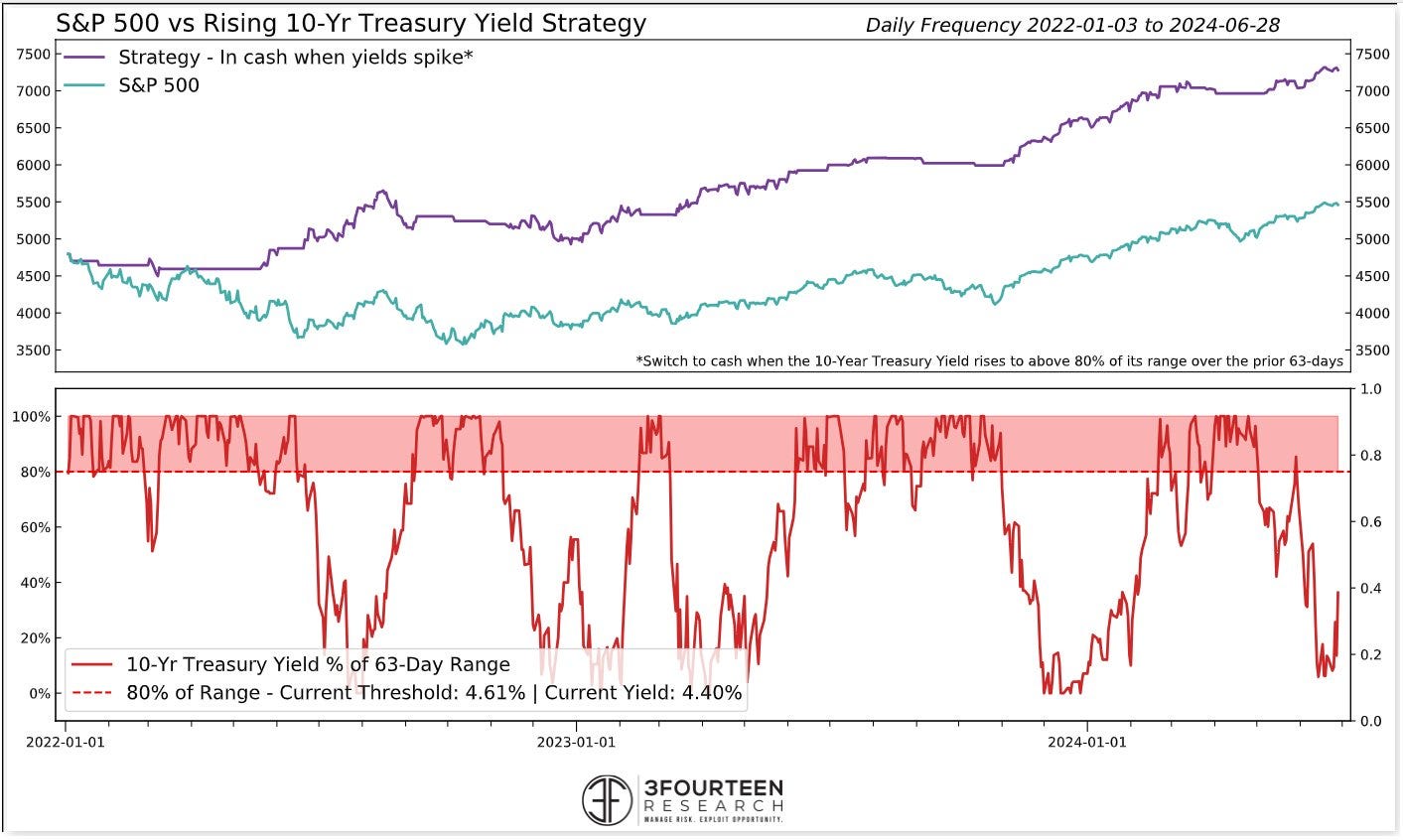

10Y yields have backed up post Presidential debate. At what level do yields begin to impact stock performance?

According to 3Fourteen Research, since 2022, it has not been a specific level. Rather, when yields move to the 80th percentile of their rolling one-quarter range, the S&P 500 has tended to suffer. 4.61% = the level to watch.

First 10 trading days of July are the seasonally strongest period of the year.

As we approach earnings season, Deutsche Bank sees S&P 500 earnings up 13 % YoY. Tech expected to lead the way. No forecast of an earnings recession.

Energy has been outperforming the S&P 500 during market sell-offs, since the beginning of 2021.

Rates starting to bite commercial real estate starts as higher rates don’t justify new construction.

Elevated rates have not been kind to commercial real estate. Here is a list of some of the top disclosed valuation disclosed.

There is still a wall of redemptions trying to get out of open ended real estate funds. Approximately $50B of redemptions outstanding representing 15% of the open ended fund market NAV.

As an investor, you are incentivized to redeem if you believe the marks may not be accurate. The outperformance of BREIT over the public REIT market is hard to believe and may not reflect reality (This is a good read to go deeper).

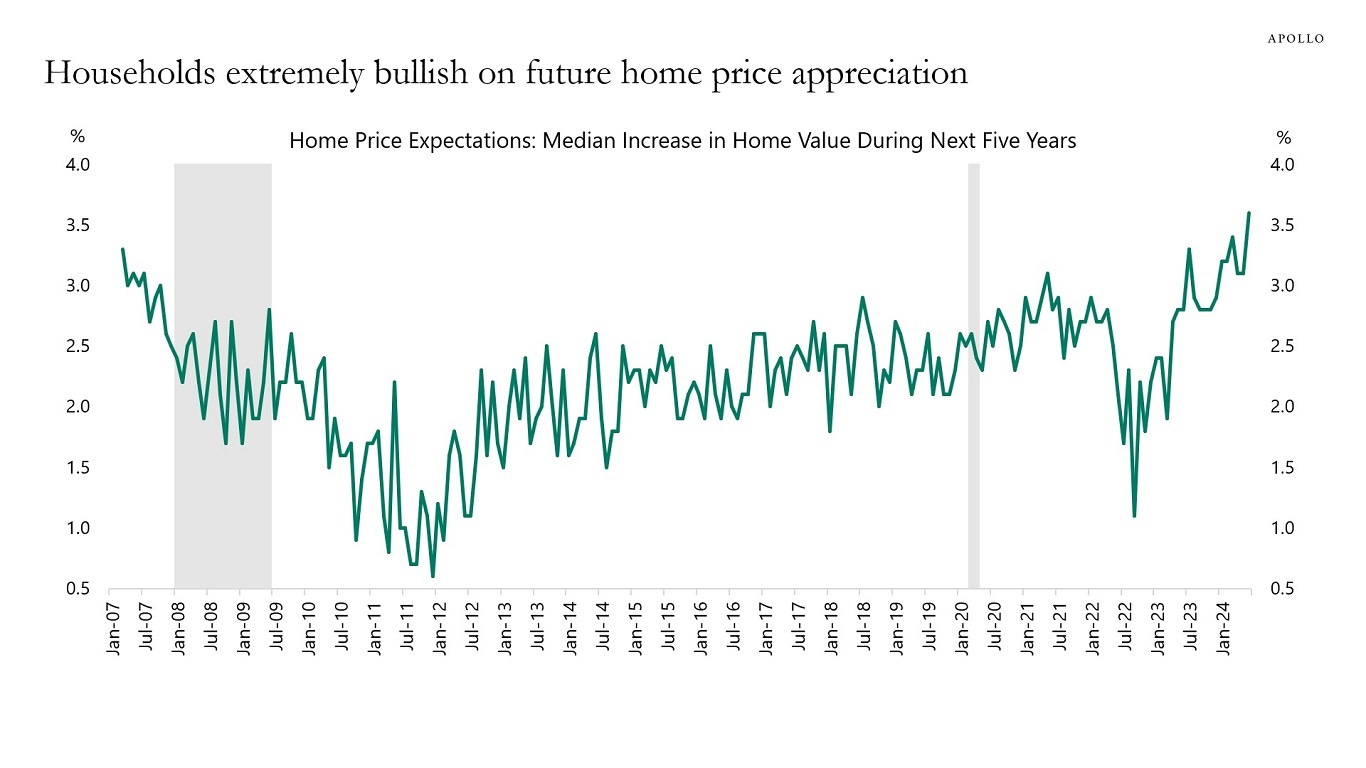

People expect home prices to appreciate at a faster pace than any time in the past 15 years. Households have been conditioned to buy the dip and will return to the market when they believe interest rates are going to decline.

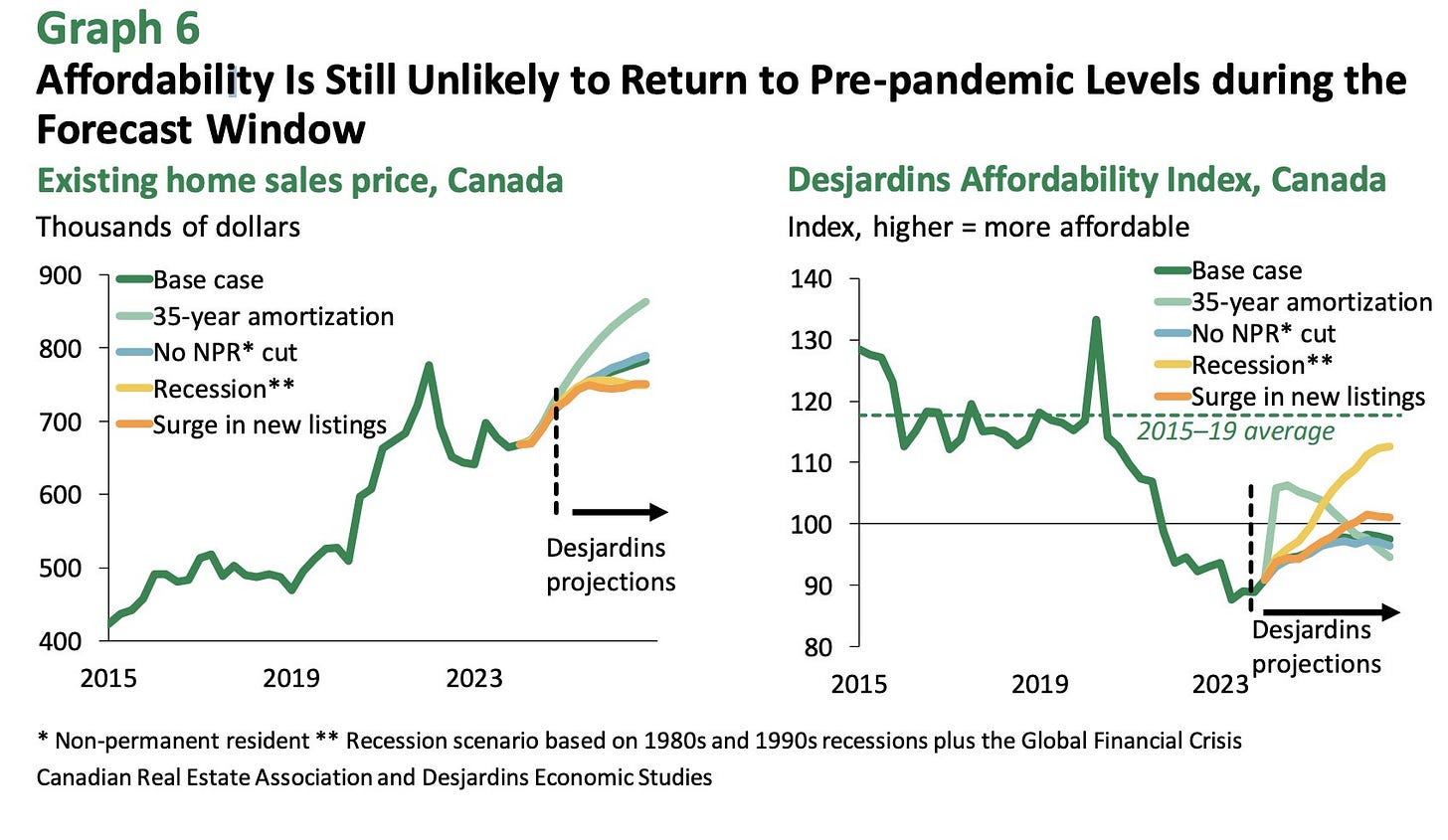

The dip buying dynamic above is a reason why Desjardins believes we will not see affordability return in Canada. There are buyers on the sidelines waiting for mortgage costs to fall.

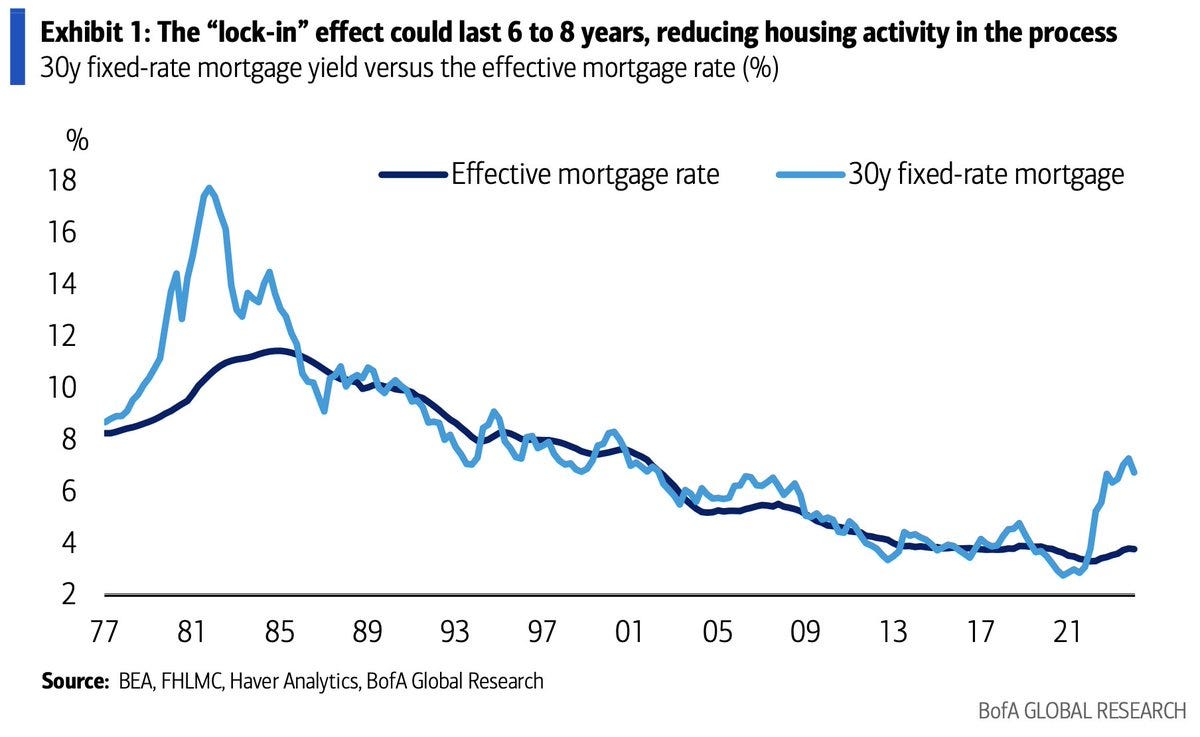

In the US, 30Y fixed rate mortgages have meant that many homeowners haven’t felt the impact of higher interest rates.

25% of outstanding mortgages are still below 3%.

Millei’s battle against inflation in Argentina is starting to pay off. Eric Peter’s on how it relates to the US below:

Some look at Millei’s election in Argentina as an indication of what’s to come. But the real lesson of Argentina is that it can take more than a century of overspending, mismanagement, political division, and chronic corruption, for a great nation to finally grow so agitated by hyperinflation and economic depression that it votes for austerity. The west is far away from that. So, France will vote today. The UK on Independence Day. And the US election is now anyone’s guess as the Democrats will almost certainly replace Biden. But no matter who runs this year, in no election will austerity be on the ballot.

This year, amid the equity rally, the cost of volatility, or hedges such as put options, has moved lower.

“Even if you are not overly bearish, it makes sense to buy protection for your portfolio, given how cheap vol is,” Matcham says. “We don't believe the market is sufficiently pricing the potential tail risks. These include the upcoming French elections, the US elections, potential escalations of conflict in the Middle East, and potential trade and tariff turmoil with China.”

Phillipe Laffont of Coatue sat down with Bloomberg to discuss AI’s potential, betting on AI infrastructure and why he built Coatue in America over his birth country of France.

Stan Druckenmiller told me he had made 120% of his profits in obvious ideas and lost 20% in everything else.