Real Economy vs Financial Markets

Dallas Fed Manufacturing Index down to -14.4 vs -11.5 expected. Comments are an interesting sentiment check on the state of the REAL manufacturing economy (Link). They are fairly negative.

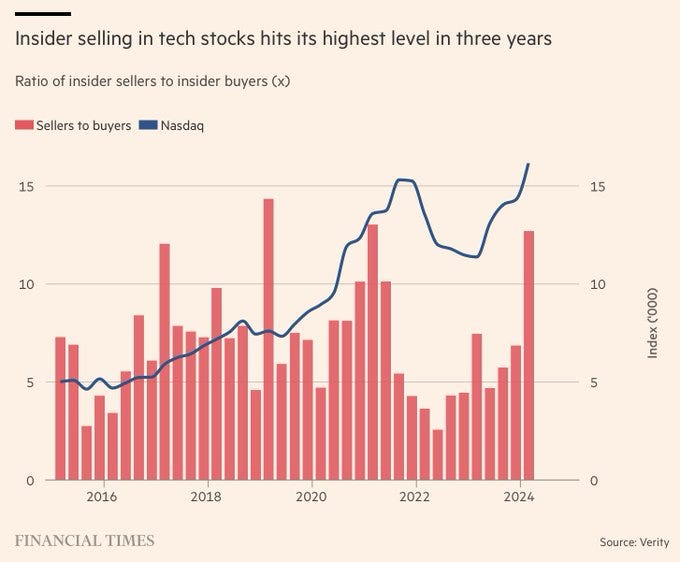

There has been a large uptick in insider selling to begin 2024. Are executives better traders than Wall Street? Are executives noticing a divergence between their stock price and the same issues captured in the Mfg survey above? Something to watch.

Many of the biggest sales this quarter have come from technology executives. Thiel, co-founder of data analytics group Palantir, sold $175mn this month, according to regulatory disclosures, his biggest sale since offloading $504.8mn of the company’s stock in February 2021. Amazon founder Bezos sold 50mn shares worth $8.5bn in the ecommerce group in February. Andy Jassy, Amazon’s chief executive, sold $21.1mn of stock this year, compared to $23.6mn in 2023 and 2022 combined. Zuckerberg, Meta’s chief executive, has sold millions of dollars of the company’s shares for years. But he has increased selling this year as its stock hit all-time highs. In early February, he sold 291,000 shares for $135mn, his first sale of that size since November 2021. He still has 13.5 per cent of the company’s outstanding shares, which makes him its largest shareholder.

AI usage is expected drive data center energy usage to reach 35 GW by 2030, up from 17 GW in 2022.

Layer in EV electricity demand and other industries striving for electrification… We are going to need more power.

The average age of America’s industrial, power and highway infrastructure is near its highest since records began in 1925. Relevant to the chart above, average age of power infrastructure is creeping up to 30 years. Somehow, extended government budgets will need to make room for reinvestment in infrastructure. How will we pay for this?

Part of the solution is private capital. Infrastructure fund assets under management worldwide have soared beyond $1T, more than six times their level in 2008.

Used Tesla prices continue to tank.

Despite the recent antitrust case against Apple (read more). The Dems have gone soft on antitrust.

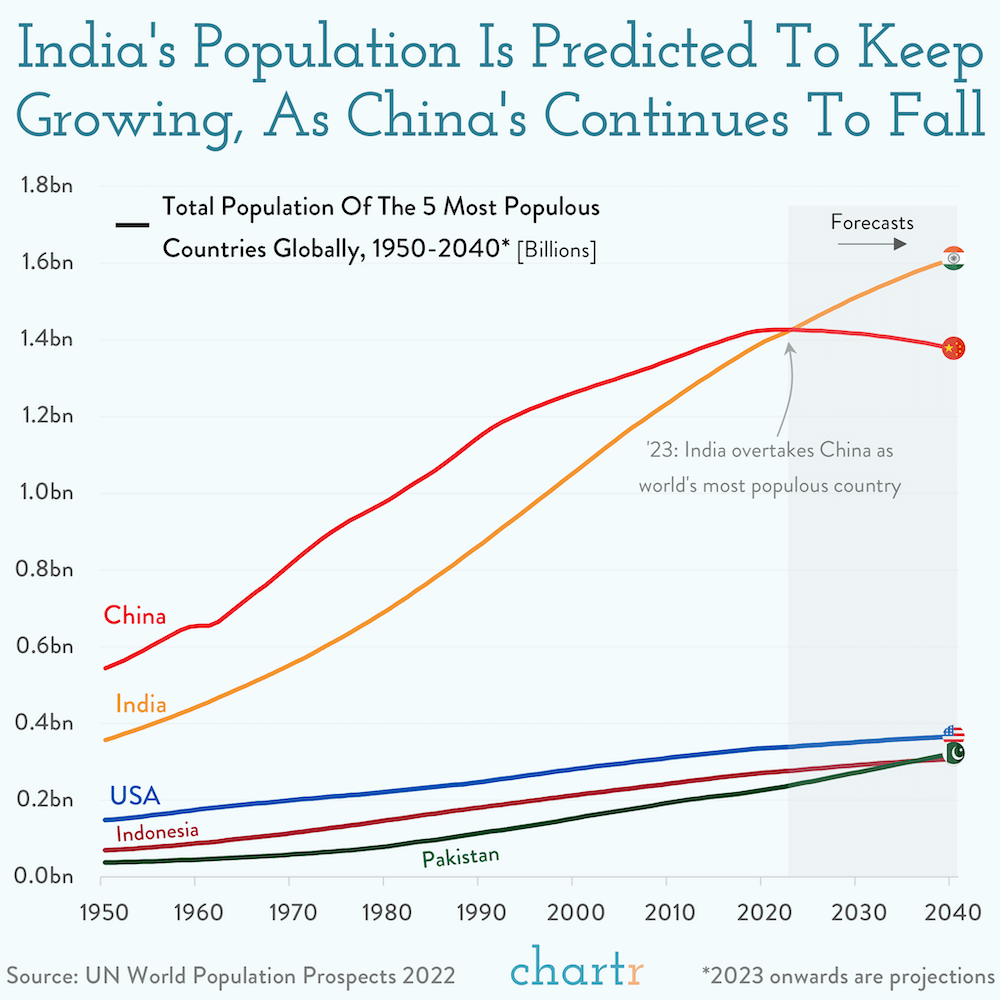

India is the new China from a population perspective and is expected to continue to grow.

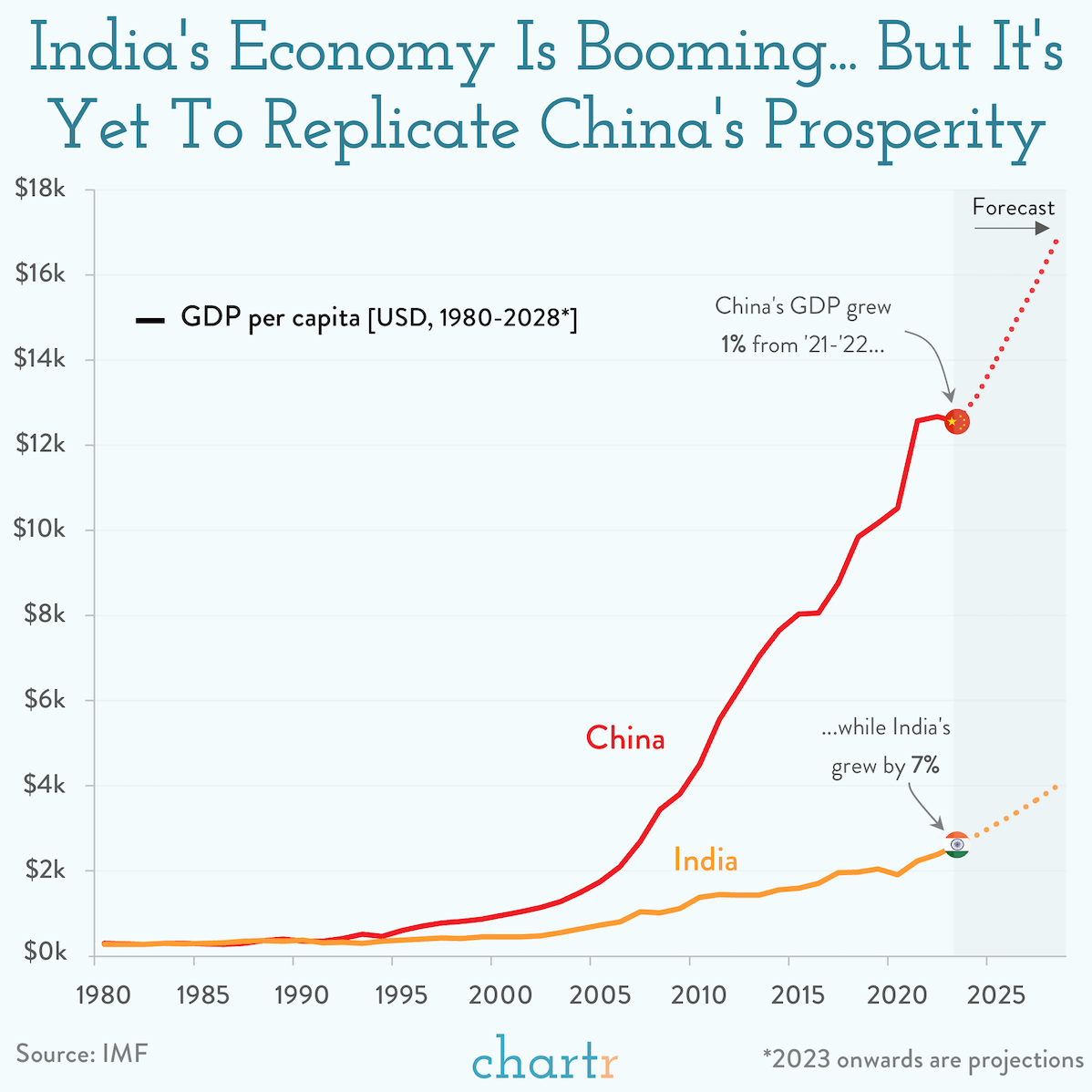

India still has a long way to go on the economic growth side to catch China. Will India be able to grow like China did in the 2000s?

Are we going to see more countries dump treasuries in favour of stores of value? Chinese and HK gold imports are surging.

It’s been a while (274 consecutive trading sessions) since the S&P 500 had a daily decline of 2% or more.

This was a cool visual FT article looking at chip manufacturing. Current technology is pushing the frontiers of technology and is becoming more costly.

Joe Rogan stands alone as the king of podcasting.

Not overly insightful but entertaining conversation about investing.