Retail's Bull Market

Stocks retreated from record highs after heightened trade tensions initiated by Donald Trump. The US dollar had its best week since February. Concerns over tariff-induced inflation impacted Treasuries, while oil markets anticipated US measures targeting Russian energy exports. Global equity markets were mixed. Energy was the top performing sector, Financials were worst performing.

10Y yield was up 7 bps in the US and 15 bps in Canada on the week, resulting in a difficult week for fixed income. Commodities were higher driven by energy as ags struggled. Silver had a strong week but crypto’s week was even better as Bitcoin blasted to all time highs, catching up to Gold on a YTD basis and up over 100% in the past year.

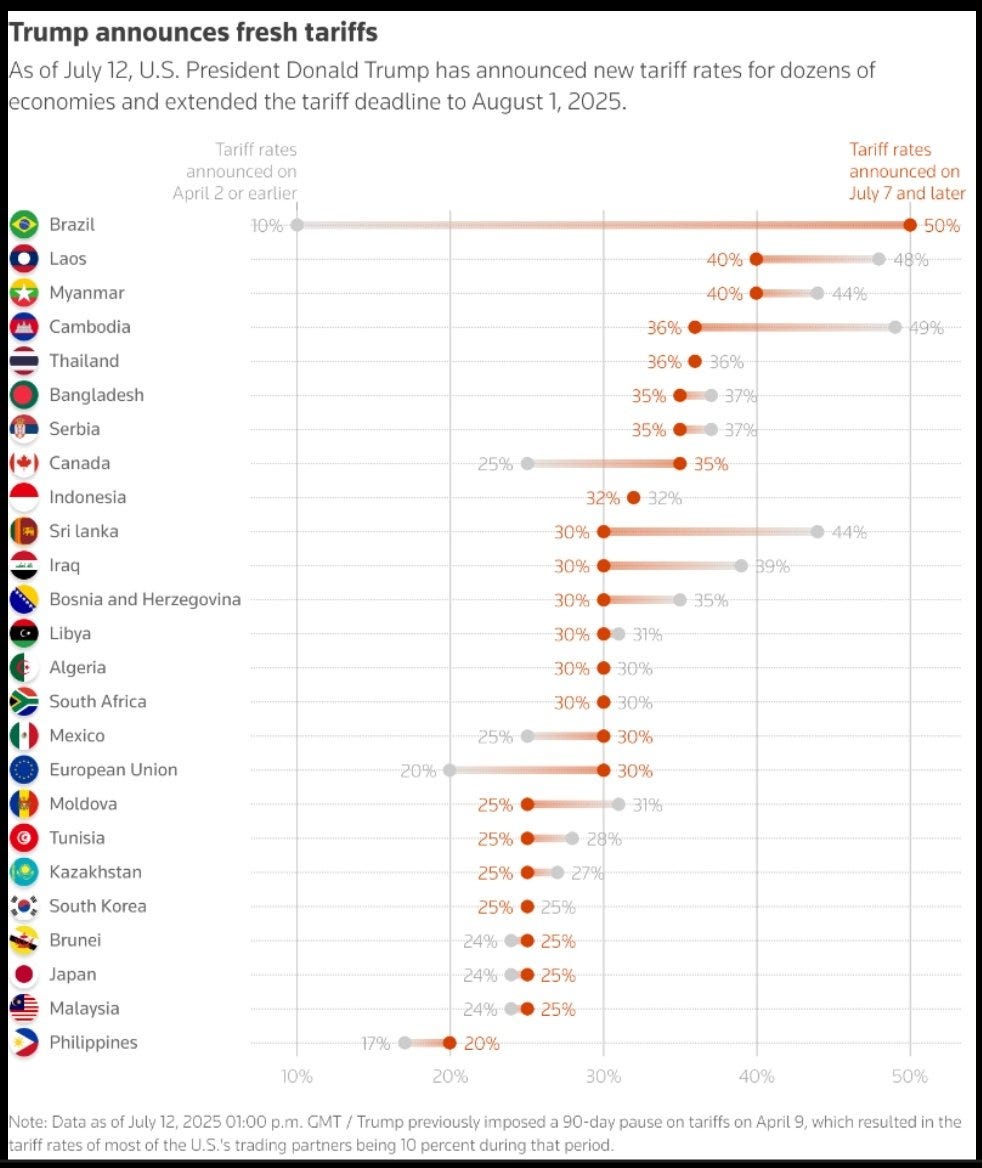

August 1st tariffs are projected to be higher than the original tariffs on April 2nd. The EU and Mexico were hit with the 30% tariff warning on Saturday. Given Trump was mocked he may be willing to take things further this time. It’s surprising how much the market doesn’t care. (@chigrl)

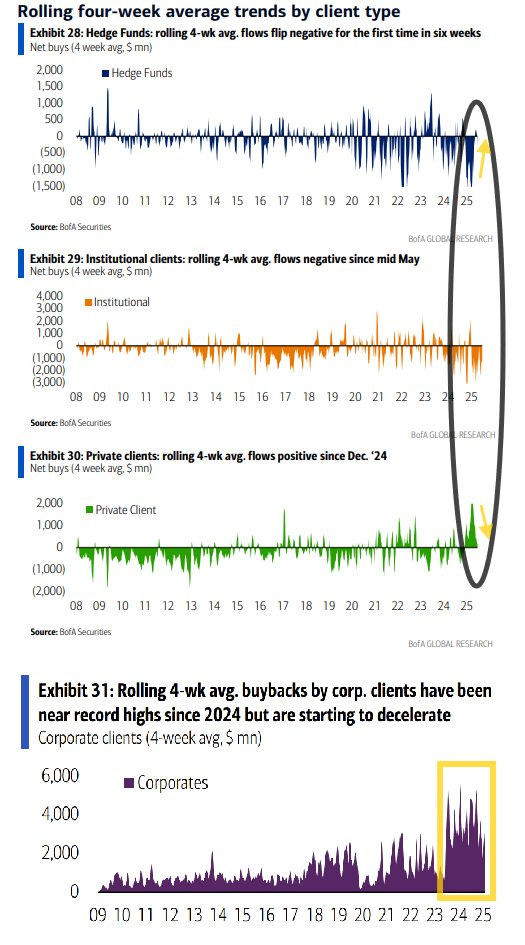

For the past 30 weeks, retail investors have consistently been net buyers, while institutions have largely been net sellers. Hedge funds only recently became net buyers. Retail investors correctly positioned themselves to capitalize on the recent rally, while professional investors missed it and were caught off guard. Retail was right. (@neilksethi)

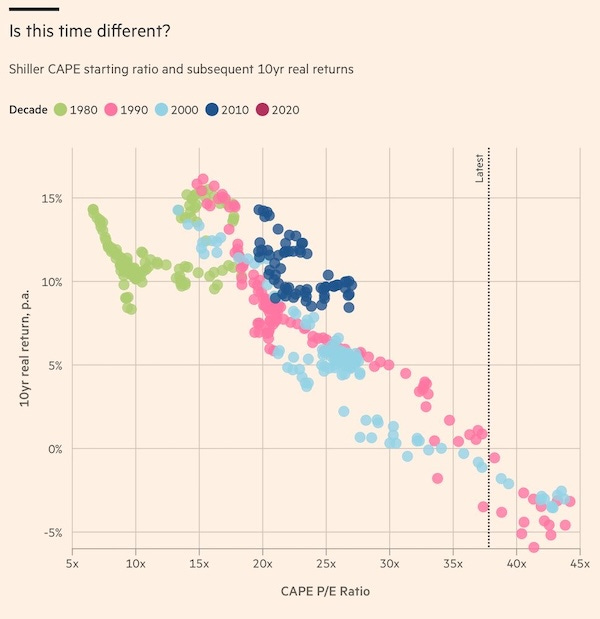

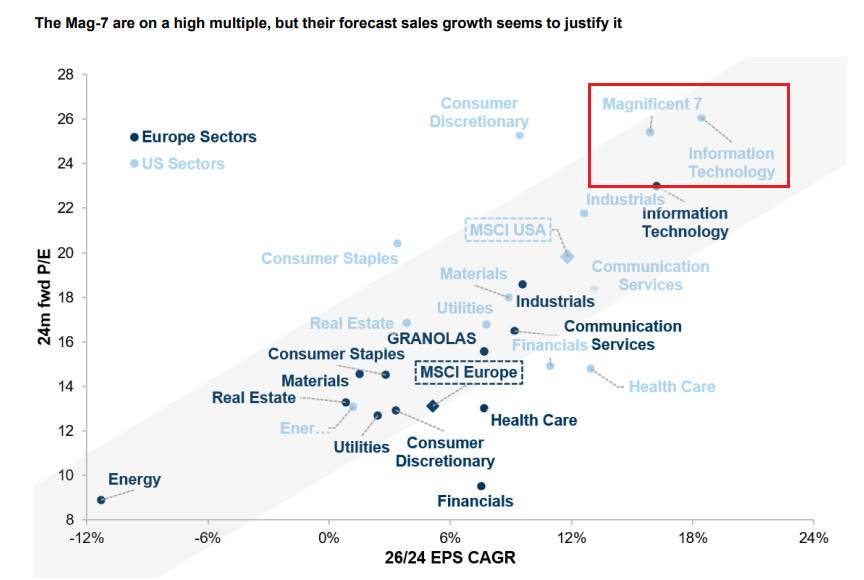

There are some bullish tailwinds such as fiscal stimulus and a weak USD but the market is expensive. Broad based valuation measures would suggest caution. The Shiller CAPE is at extreme levels that are typically associated with low future returns. But retail has been correct thus far in buying the dip. (FT)

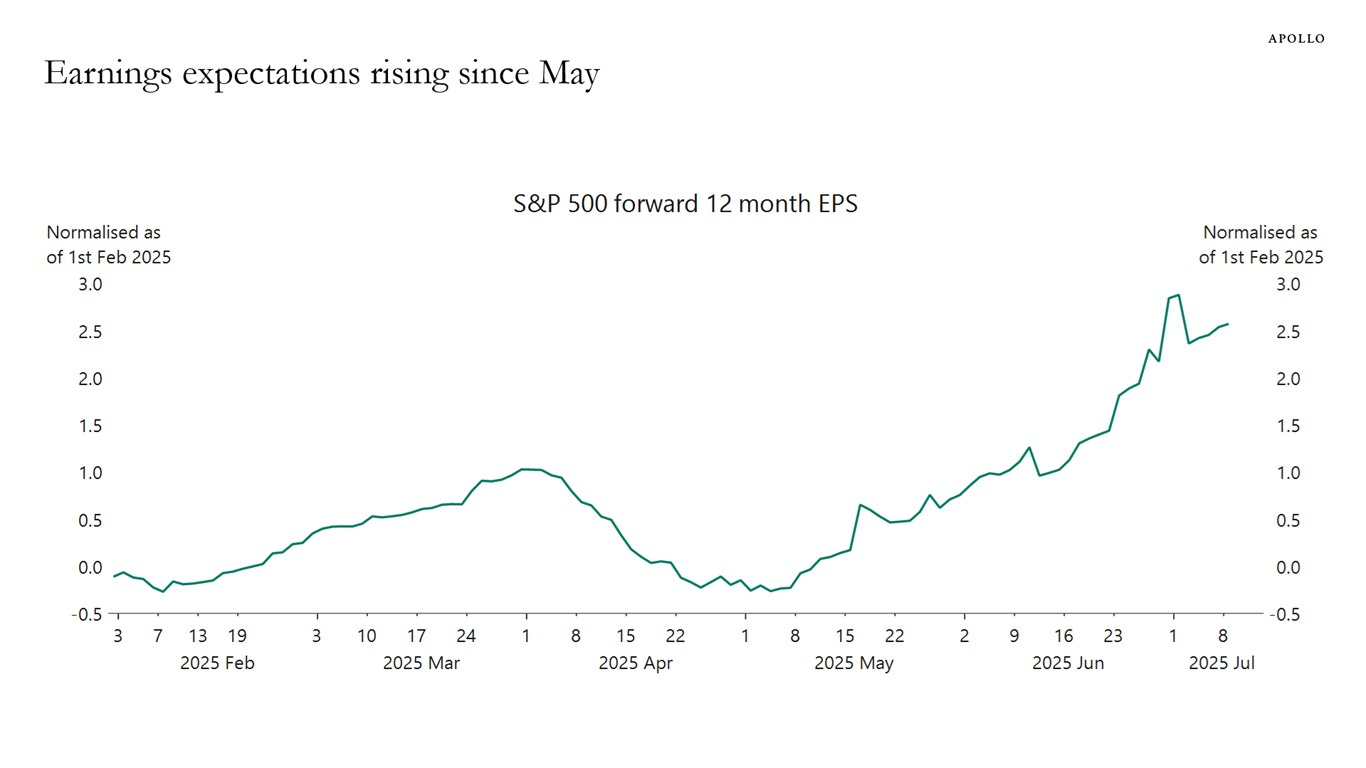

Wall street analysts expect earnings to continue to grow despite the renewed tariffs threats. (Apollo)

Healthcare and Financials stand out as sectors that look reasonably priced relative to growth rates. The Mag 7 and Tech are the expensive but highest growth sectors.(@MikeZaccardi)

According to Goldman Sachs, China is buying a lot more gold than the PBoC is declaring, and, in part on that basis, it is predicting a gold price of $4000 by mid 2026. (Goldman)

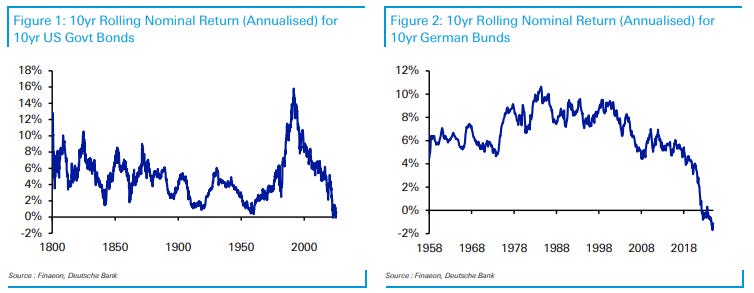

Even in nominal terms, bonds and bunds have been dead money for the past decade. (@dlacalle_IA)

Health care went from being a meaningless employer in 1990 to the top employer in 39 states by 2024. What does this say about the US health care system? (@AlpacaAurelius)

Europe’s resistance to adopting air conditioning means death rates spike when it gets hot out compared to US cities. (FT)

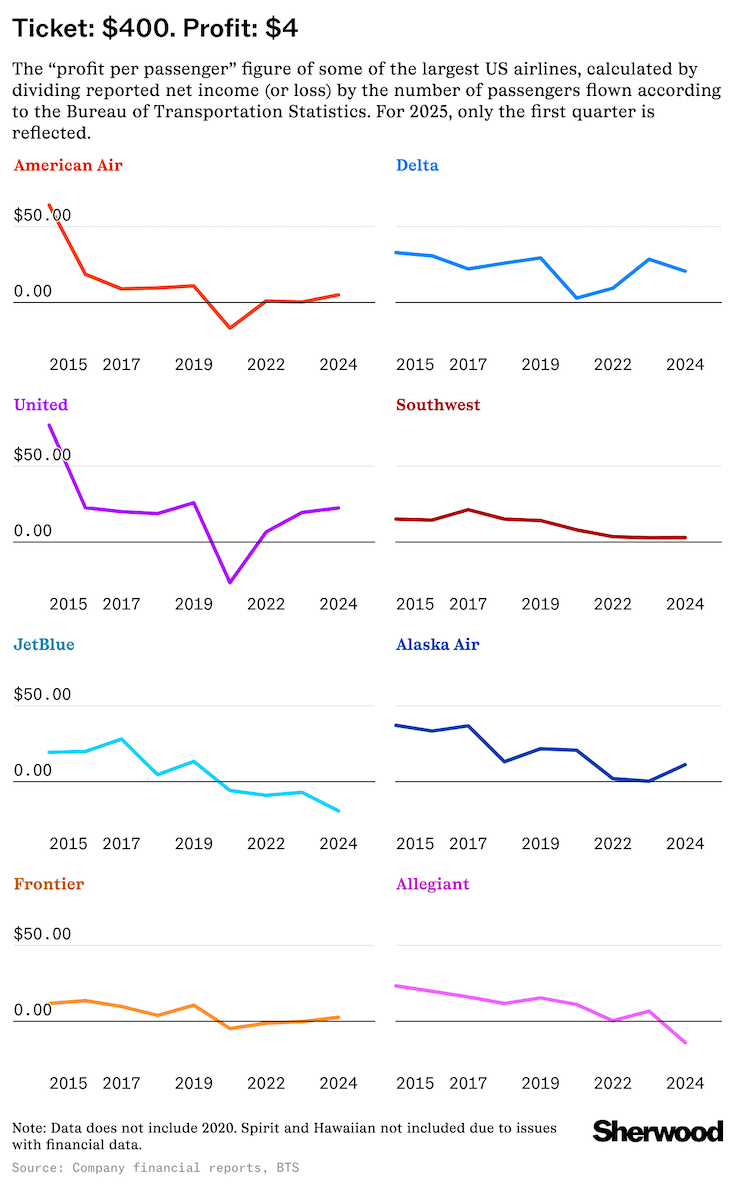

Airline profits are under pressure. As Buffet always said, these are not great businesses. (Chartr)

Shared a clip from this podcast last week. Worth a full listen. Discuss why biotech is interesting right now and unpack why private equity is having issues.