State of the Unicorn Economy 🦄

Good presentation from Thomas Laffont of Tech Hedge Fund, Coatue at a recent conference.

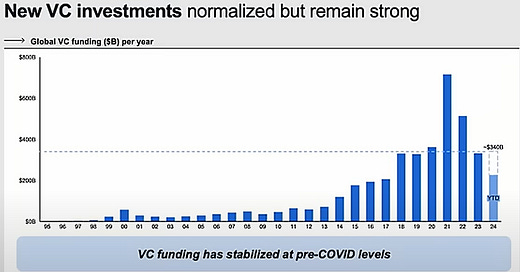

VC investments are normalizing and are still elevated compared to most of the 2010s. Lots of dry powder was raised during the bubble and funds are forced to deploy it.

But exit activity remains depressed. The lack of IPOs accounts for most of the decline.

This is creating issues for funds and LPs who have yet to receive meaningful distributions from their venture portfolios. Funds between 5-10 years old have only paid out 5% of their value. Paper marks are great but you can’t pay the bills with paper marks. Similar outcomes over longer periods is leading to lower IRRs.

The venture industry as a whole is calling much more capital than they are returning to investors. VC is already known for their long lock-ups but having to wait longer than 10 years may become unpalatable for investors.

Part of this can be explained by companies staying private longer. There is a backlog.

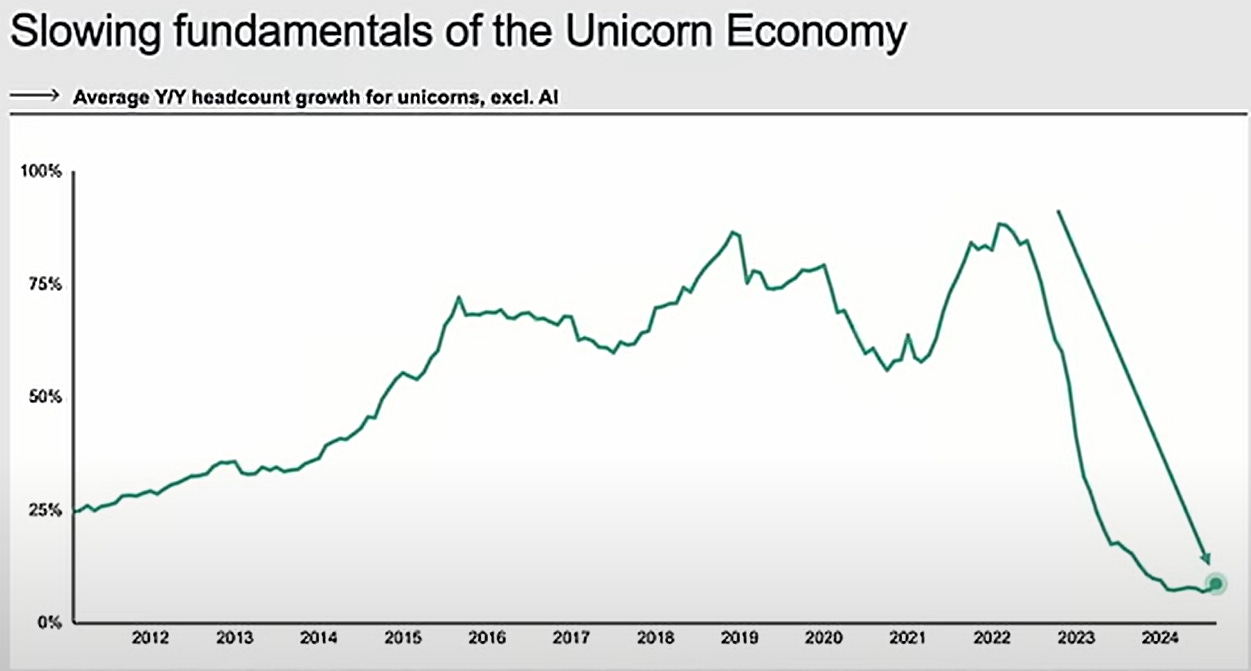

But unicorn growth is slowing as measured by headcount additions. Companies are being more discipline with burn given the uncertainty around future capital raises.

It’s clear, it is becoming harder to raise capital with it taking longer and bridge + down rounds are becoming more common.

Unicorns are stuck. Public markets are challenging for young tech cos and private investors are being more discipline compared to the bubble.

You’d think a stock market at record highs would be good for tech unicorns.

Under the covers, the market has been less kind to smaller public tech companies.

Even great companies are down substantially from their highs.

Investors have soured because IPOs have incinerated capital in the public markets.

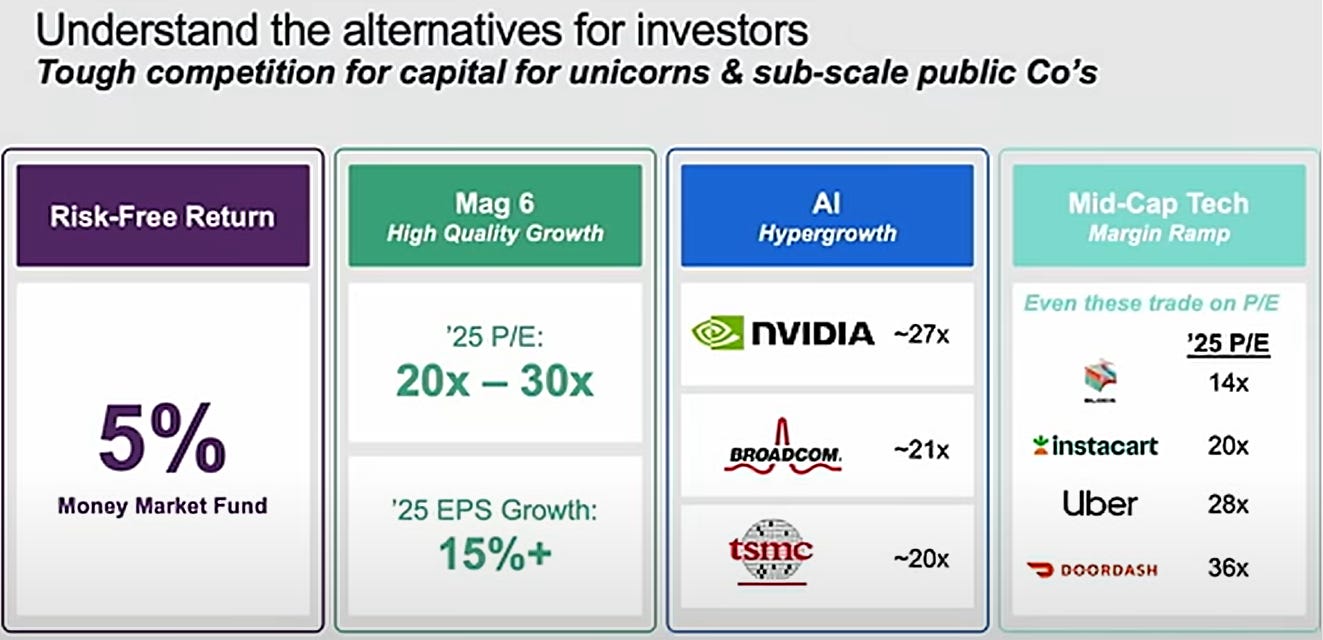

And tech companies must compete for capital with lots of different public options. It’s easier as a private tech company to only be compared to their other private peers, that is not the case once you go public. The Nasdaq’s run over the past decade beat 90% of venture funds and it was daily liquid.

Despite the turbulence, technology will continue to disrupt legacy businesses and the average age of the largest companies in the US will continue to get younger.

Full video here. Chamath calling himself courageous for launching SPACs leading to losses for retail as he earned massive fees was the low light.

s