Survival of the Fittest

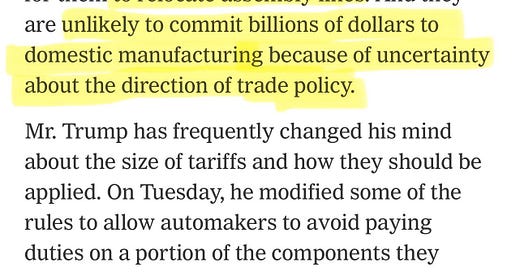

Ford suspended their guidance for the year yesterday, this is what the CEO had to say about how trade policy was impacting them. (@SpencerHakimian)

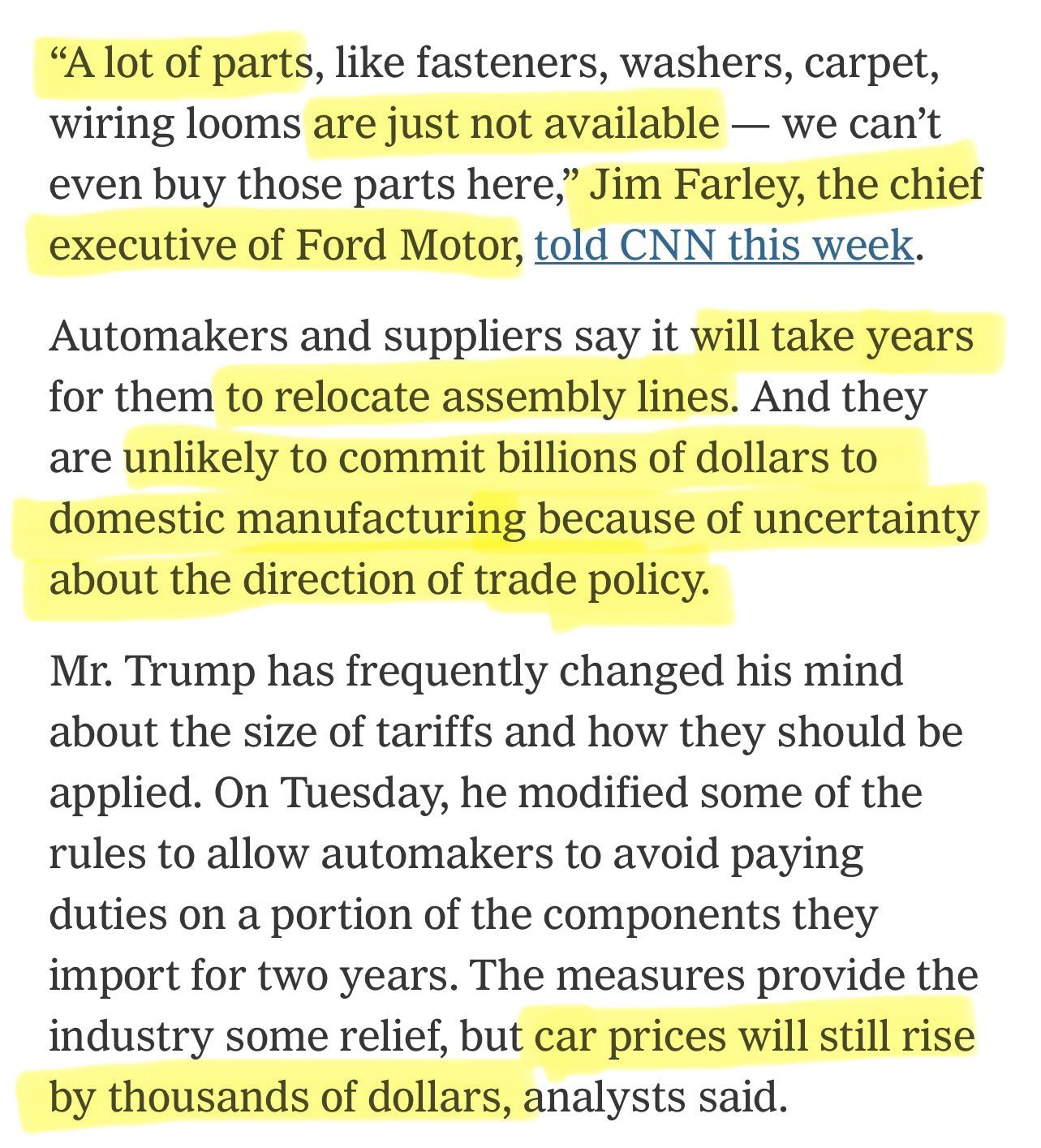

Palantir was off double digits after earnings last night, memeification has taken their valuation to levels that don’t make sense. (@VladBastion)

This is how Apollo sees the tariffs impacting the US goods economy.

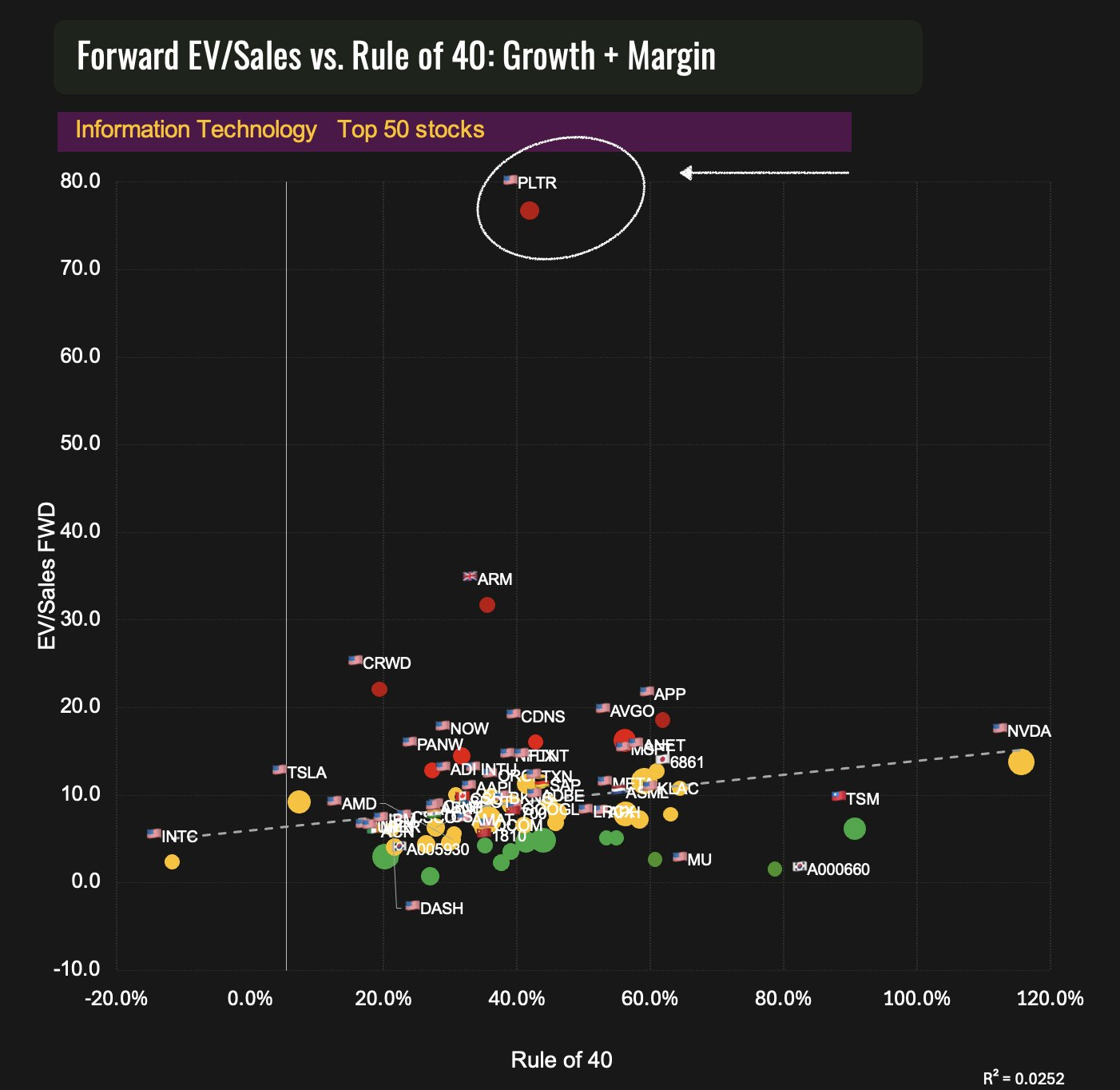

US corporates are most exposed to China restricting distribution inside the country. (Apollo)

This podcast was an interesting discussion on some of the dynamics at play within venture today. Josh Kopelman, one of the original architects of seed stage investing. Josh co-founded First Round Capital, which has invested at the earliest stages in companies like Square, Uber, and Roblox.

From 2012-2025, just 9 funds led the Series A rounds of over 50% of today's $5B+ startups. (Excludes China and blockchain companies.) (link to data, @ColeRotman)

From 2013-2018, Benchmark-led Series A rounds resulted in $5B+ outcomes 25-33% of the time. (@ColeRotman)

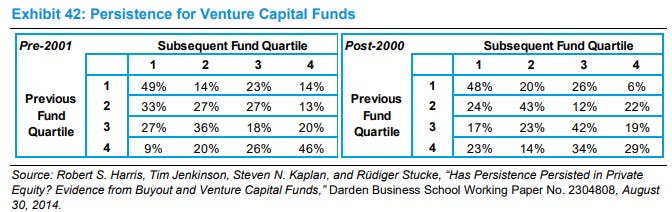

In venture capital, prior success often unlocks future opportunities, a dynamic less pronounced in other asset classes. (Mauboussin)

You can see previous success is not as predictive of future success within Private Equity. (Mauboussin)

Venture funds can be painful if you invest in a dud. Cash locked up for over a decade to generate a sub 10% return in the bottom quartile and could be 0% in the bottom decile.

Venture managers with lackluster returns are struggling to raise their next fund. (The Daily Shot)

There is a surprising amount of dry powder in Venture. However, some of this capital is earmarked for current portfolio companies. (Pitchbook)

IPO activity in the US remains depressed. (@ISABELNET_SA)

Energy did not recover like the rest of the S&P 500. Combination of recession fears and increased output from OPEC+.