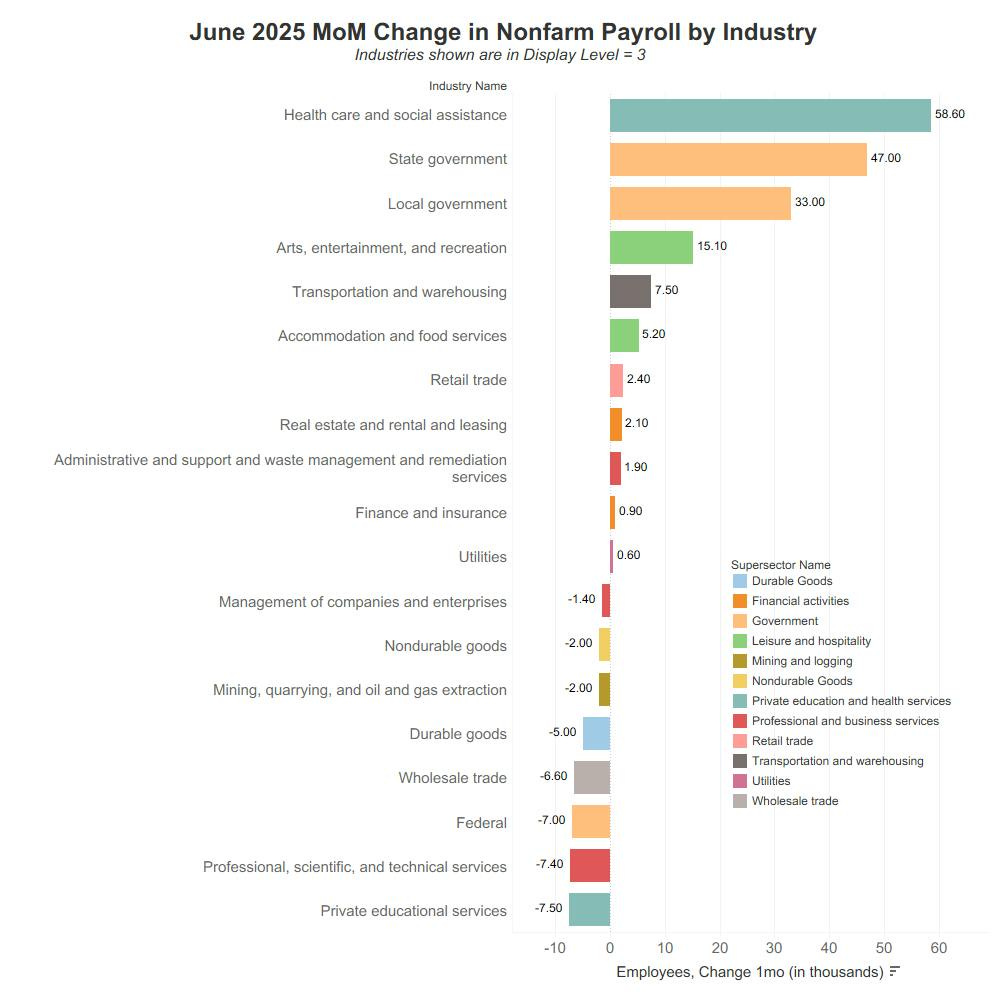

Tariffs, Yields, and Unicorns 🦄

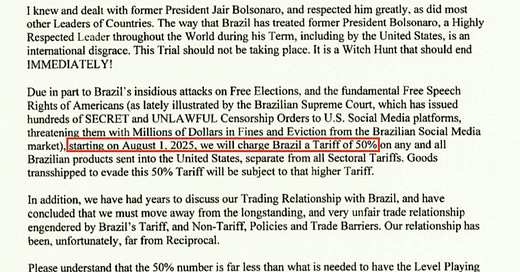

The US threatened 50% tariffs on Brazil, despite Brazil's trade surplus, suggesting the move targets China-aligned nations (BRICS and Belt and Road). Markets remain unfazed, anticipating the US will retract the tariffs.

Long bonds in the UK, Japan and US slowly becoming unglued. UK and Japanese 30Y yields are at 15 year highs. UK 30Y is now above the point that caused the BoE to intervene.

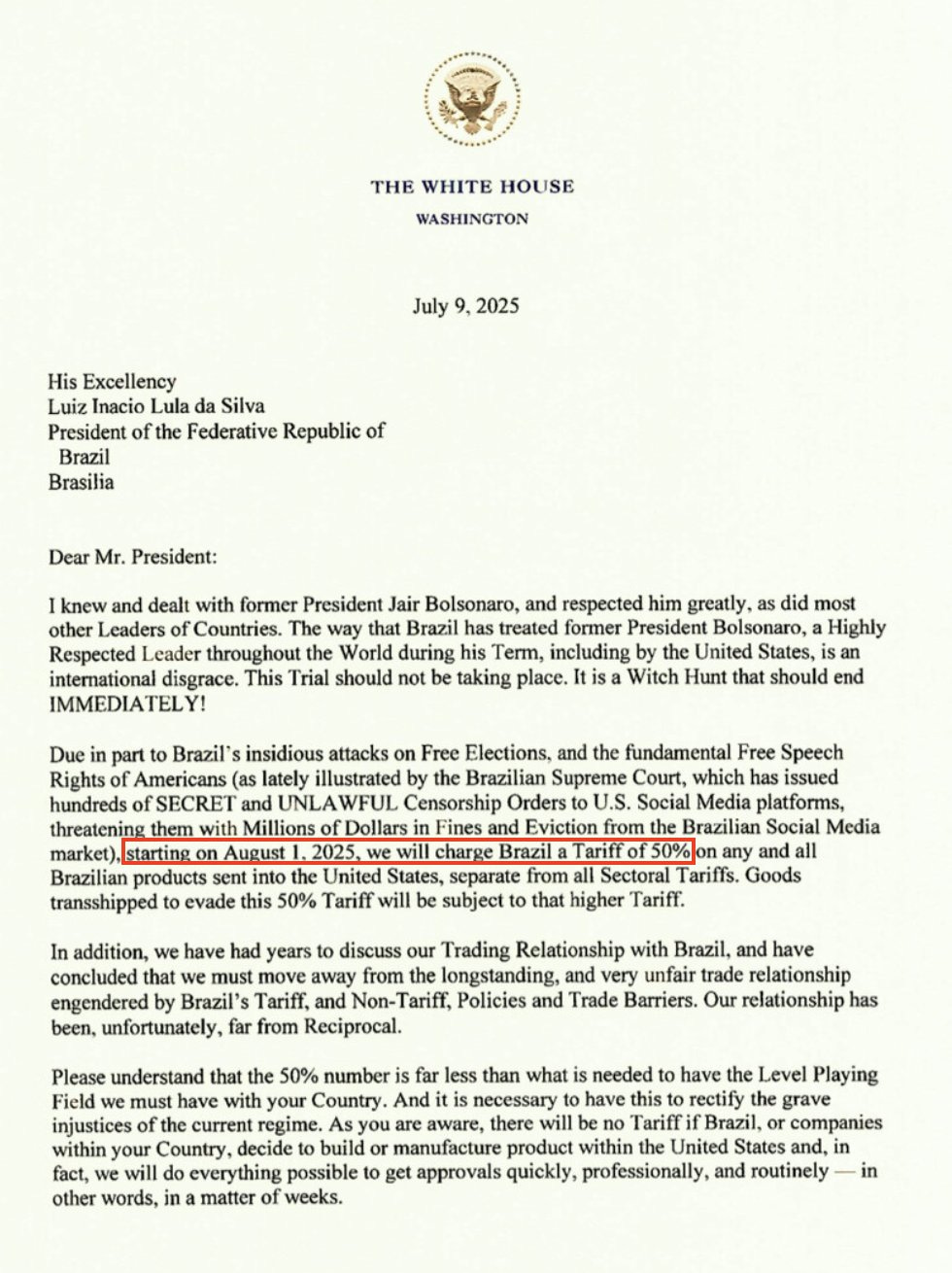

Last week's nonfarm payrolls report was weaker than the headline figure suggested. While the headline number showed a gain of 147,000 jobs, exceeding the consensus expectation of 106,000, 94% of these gains came from government and healthcare/social assistance sectors. The remaining sectors of the job market added only 8,400 jobs in June.

Public SaaS companies have seen their median revenue multiples compress from 19x in 2021 to 7x. This represents an overall compression of 3:1, with valuations declining by 50-70%. Top quartile multiples fell from 33x to 11x, while bottom quartile multiples decreased from 12x to 4x. One would have expected private marks to follow in most instances but that hasn’t really been the case. (

)There's a ~0.5–2.5% chance that a venture backed company, at seed, will produce a unicorn outcome. Data simulations suggest a spray and pray approach could deliver better outcomes. (@PeterJ_Walker)

Dan Rasmussen recently broke down the structure of the Biotech market. You should pay attention when value investors become interested in growthy sectors. Biotech has delivered real returns for investors.

His top down valuation measure would suggest that Biotech is the cheapest its been since 2012.

Biotech is interesting because it represents a small portion of market cap but has a high number of individual companies.

Most companies are pre revenue and are typically very small.

Only 30% of these biotech companies end up delivering positive returns, making index investing suboptimal. The top 10% of stocks deliver outsized returns compared to other sectors, validation that an active approach should be taken if allocating to the sector.

New copper tariff threats saw copper surge to its best day since 2008. (John Authers)

Bitcoin once again taking a run at all time highs. Bitcoin ETPs are rapidly approaching the total AUM of gold ETPs. IBIT, the Blackrock Bitcoin ETF has quickly become one of it’s highest revenue producing ETFs. (@intangiblecoins)

While Bitcoin has done fairly well in 2025, the rest of the crypto space has been clobbered. (@dailychartbook)