Tech Rules

Great discussion with Jensen Huang around founding Nvidia and new markets, going back to first principles, what it takes to succeed and AI.

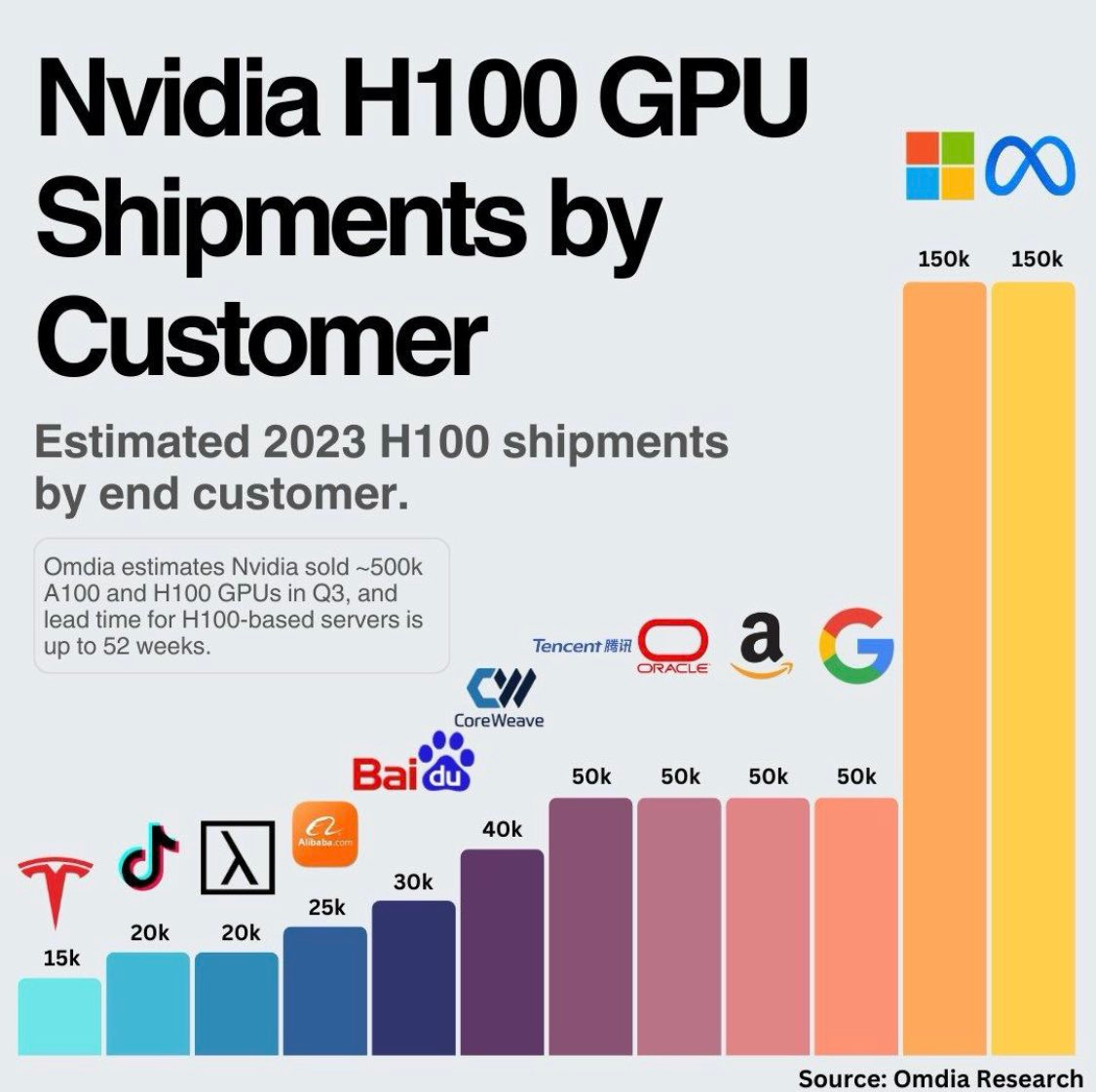

Who is Jensen selling his chips to? Mostly big technology companies. What are the implications of being reliant on a handful of big tech customers?

Equity markets no longer trading off the rate cut narrative. S&P 500 has continued to rise as rate cuts have been priced out of the market.

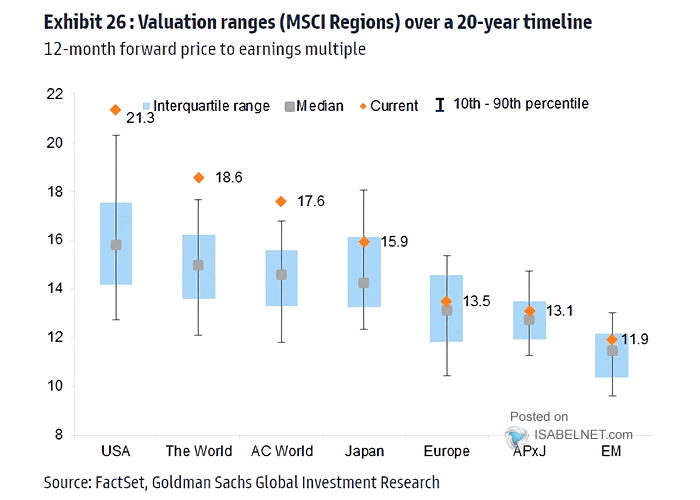

Markets, specifically US markets, look expensive right now.

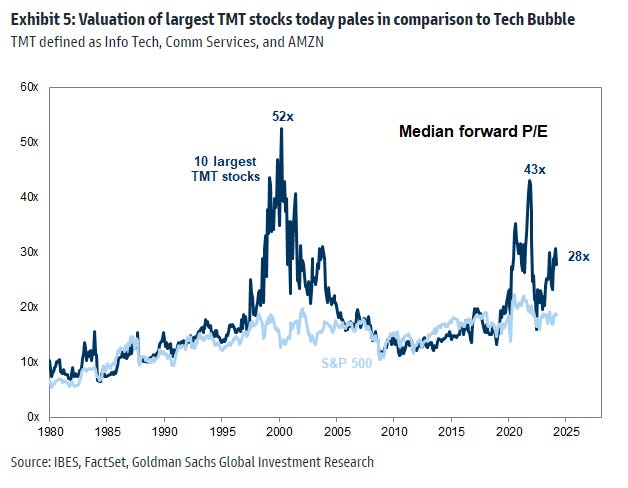

Again, the index level data is skewed by big tech, which is trading at richer multiples than the rest of the market.

You did well if you had bought these companies at below market multiples in the 2010s. For buy and hold investors it is much more of a question whether entering at current multiples will result in strong future returns.

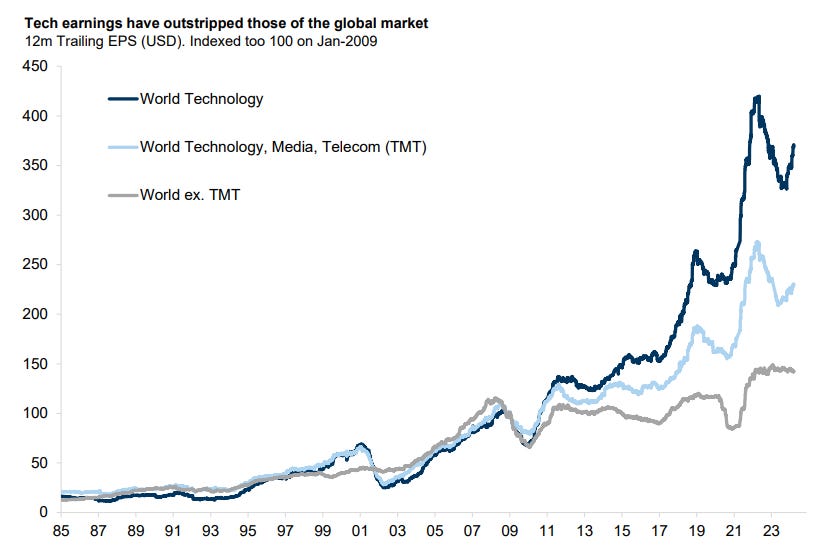

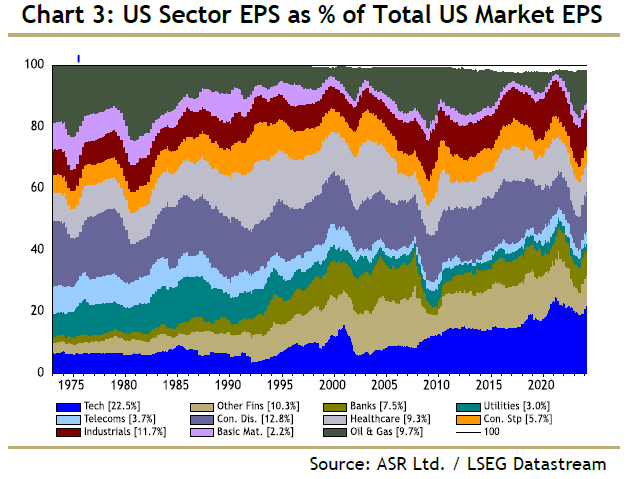

It was in the mid 2010s when technology stocks began blossoming and showing extraordinary earning potential compared to other sectors.

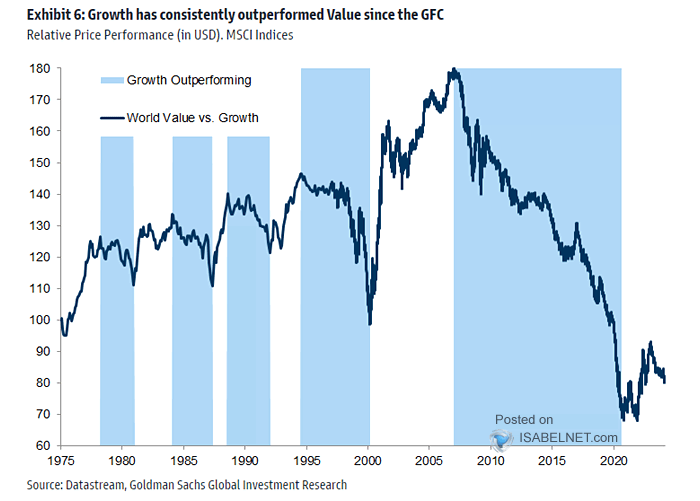

The earnings growth led growth to drastically outperform value in the 2010s.

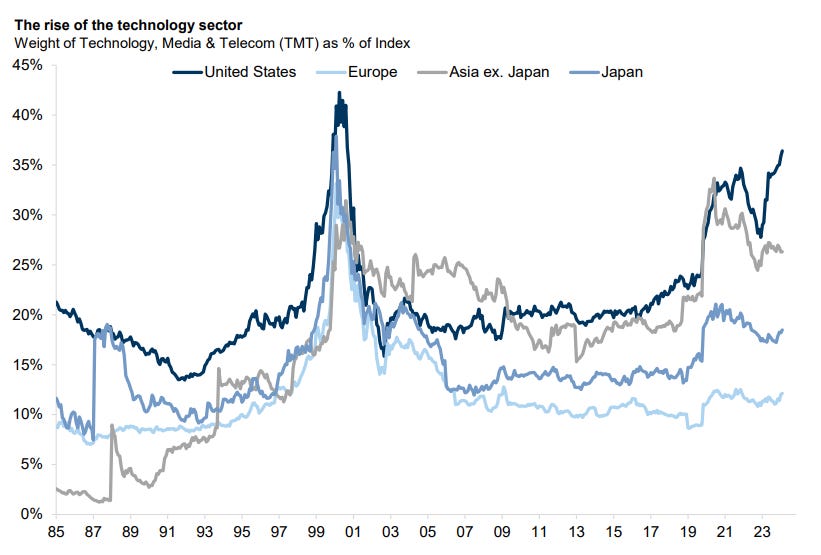

TMT has become a much larger part of the market in the US and Asia.

Tech is steadily becoming a larger part of US earnings. Do you think this trend will continue? Are they just better businesses?

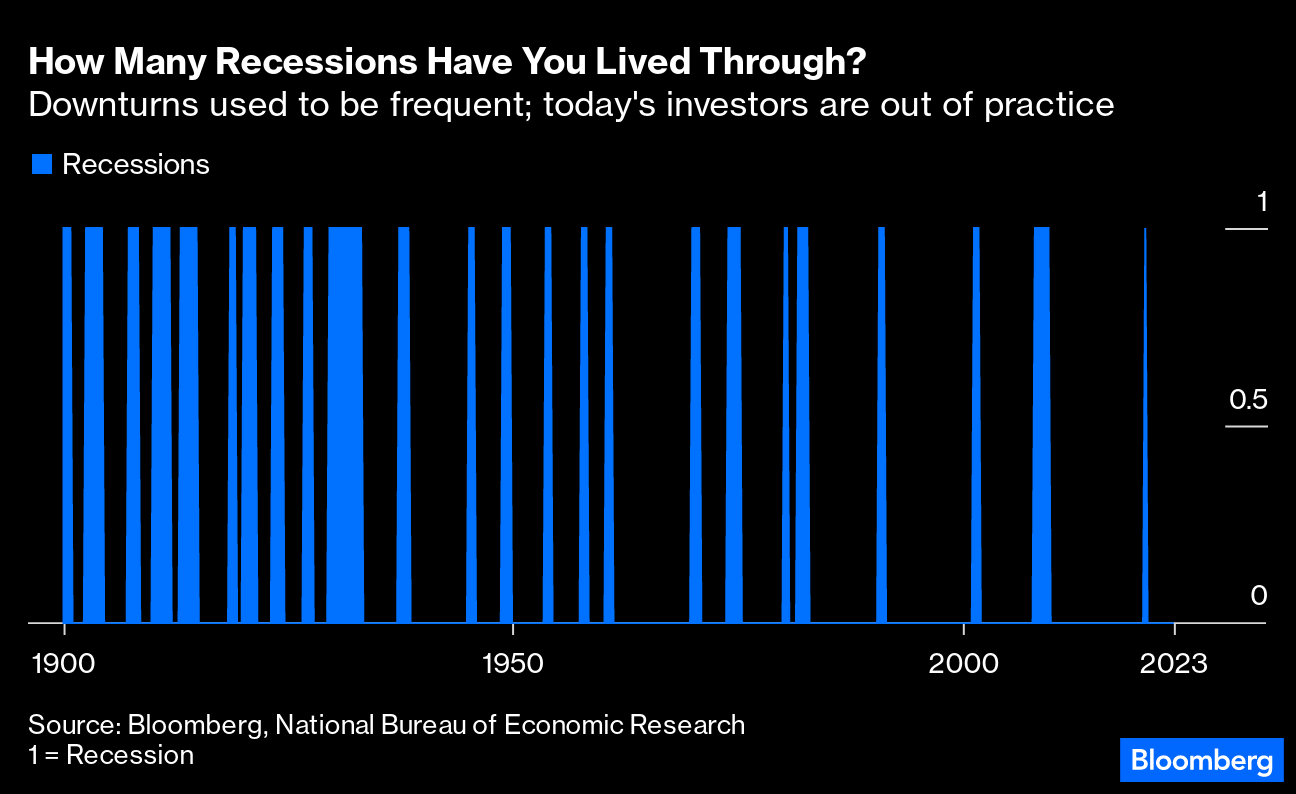

Recessions have become a lot less frequent as central banks have become more involved in managing economic cycles.

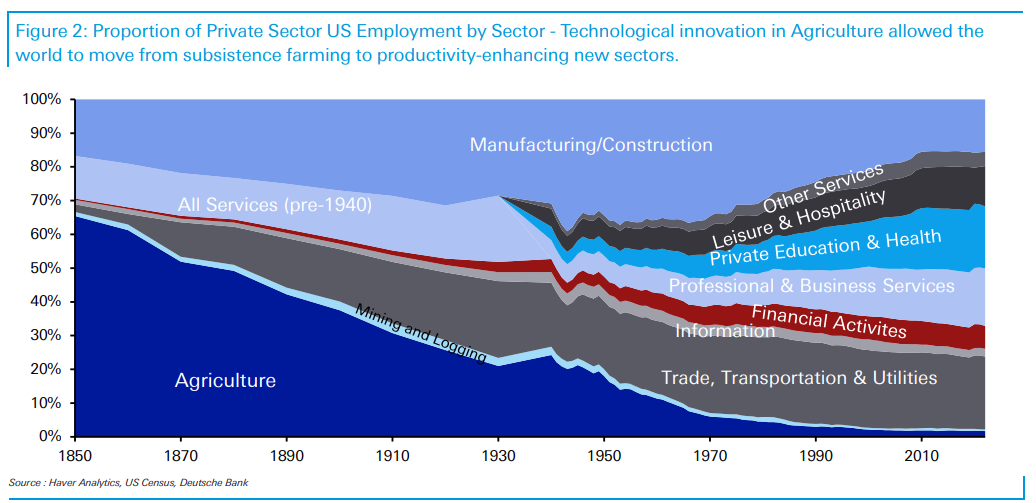

In the US, the economy has shifted from agriculture to manufacturing to a much more diversified employment base.

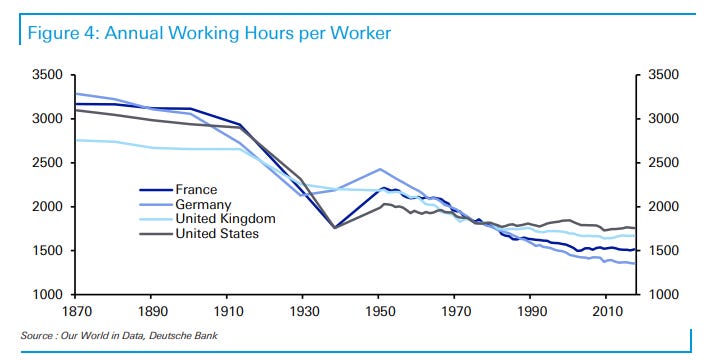

Technology has allowed workers to reduce hours worked over time.

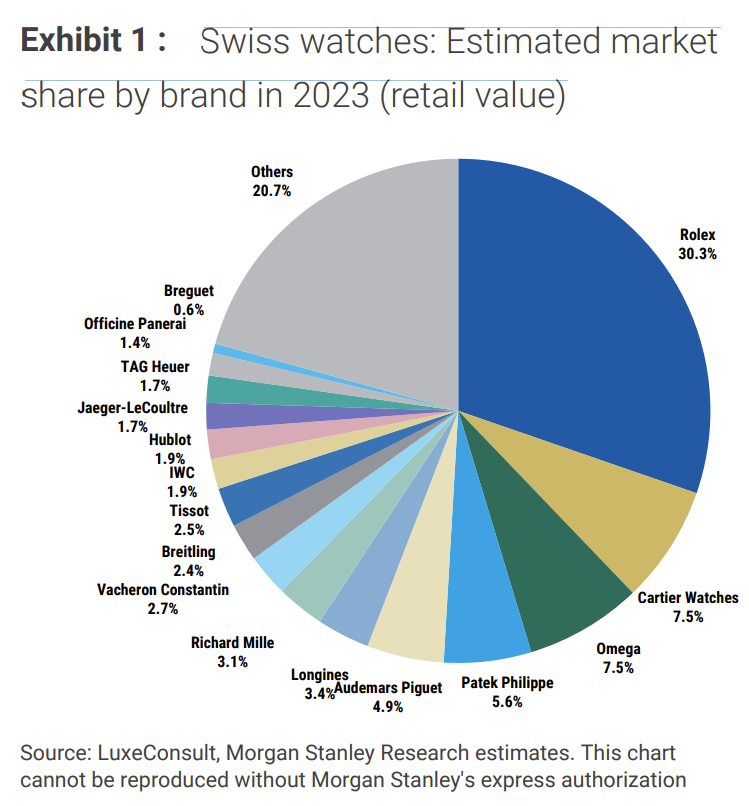

Rolex is the king of Swiss watches.

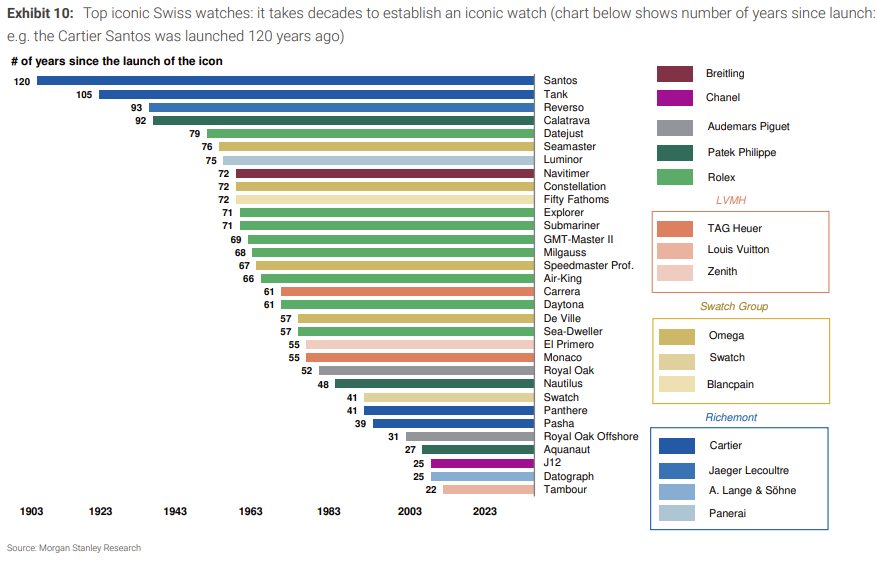

It takes decades to establish an iconic watch model.