The Donnie Show & Bond Let Down

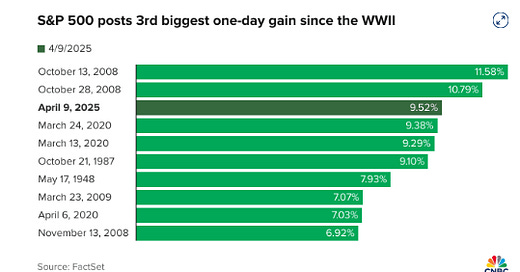

After Trump’s announcement midday about the 90 day postponement of tariffs, the market posted it’s third best day since WWII. Do you think Trump likes having this power? (@neilksethi)

The mini-crisis saw no bond reaction, signaling a breakdown of historical relationships. (BCA)

Bonds' diversifying power has diminished, as evidenced by their recent correlation with equity declines during market sell-offs. This weakens the 60/40 portfolio model, signaling a need for investors to seek alternative equity diversifiers.

The historical inverse correlation between bonds and equities weakened as bond yields approached zero. Investors now need to consider alternative diversifiers like gold, commodities, and absolute return hedge funds. (Blackrock)

The market's strong recovery is surprising given the potential profit impact from Trump-induced uncertainty. This uncertainty should warrant a multiples discount, compounded by declining earnings, estimates already down YTD. The market appears to be overlooking the significant tariffs on China and the vulnerability of companies with Chinese supply chains. (Blackrock)

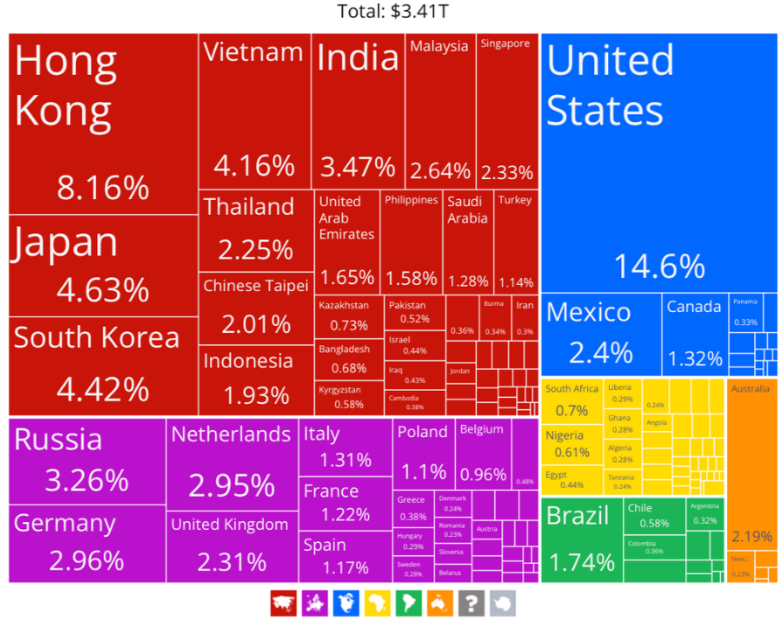

While China could likely withstand a US blockade alone, a coordinated effort involving Europe and other developed nations would significantly damage its economy. The 14.6% of Chinese exports to the US understates the true impact, as it excludes "China +1" manufacturing, where goods are routed through other countries before reaching the US. (OEC)

As mentioned yesterday, electronics exports are most exposed to the trade war. (OEC)

I’ve noticed we haven’t heard many big savings from DOGE initiatives lately. Seems they are finding it harder to cut waste than expected. Spending is actually up from 2024. (@MichaelAArouet)

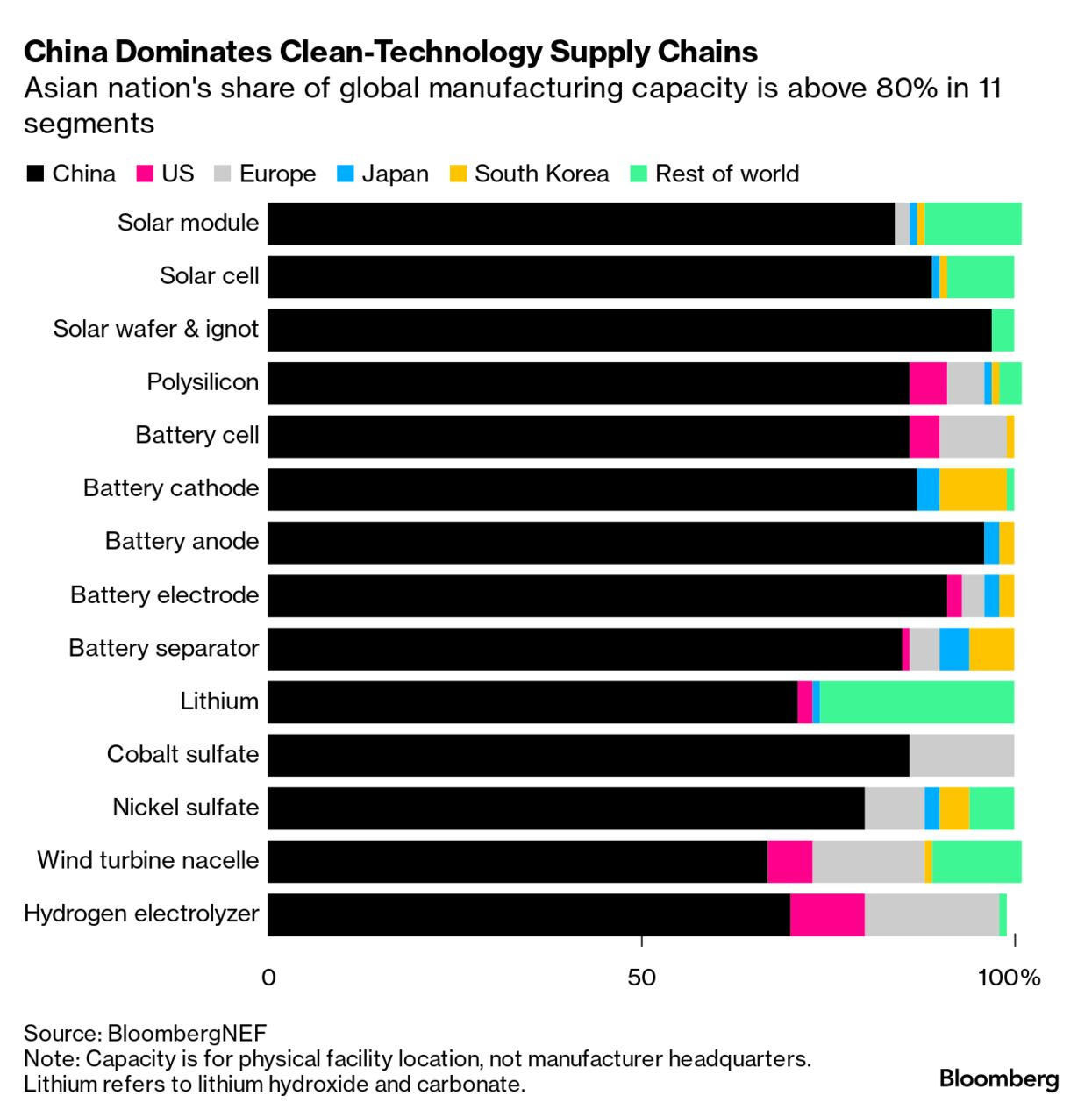

The impact of China tariffs on solar and renewable supply chains will be material (@tphuang)

The VIX closed above 50 Tuesday, a level historically in the top 1%. Historically, subsequent S&P 500 performance after VIX closes above 50 has been positive over the next 1-5 years, with above-average returns. It should have been investors sign to buy the dip… I’d argue this time was different as Trump could have easily taken this market lower. (@charliebilello)

Before the great depression, the government was a small part of the US economy but has grown steadily since. (@Geo_papic)

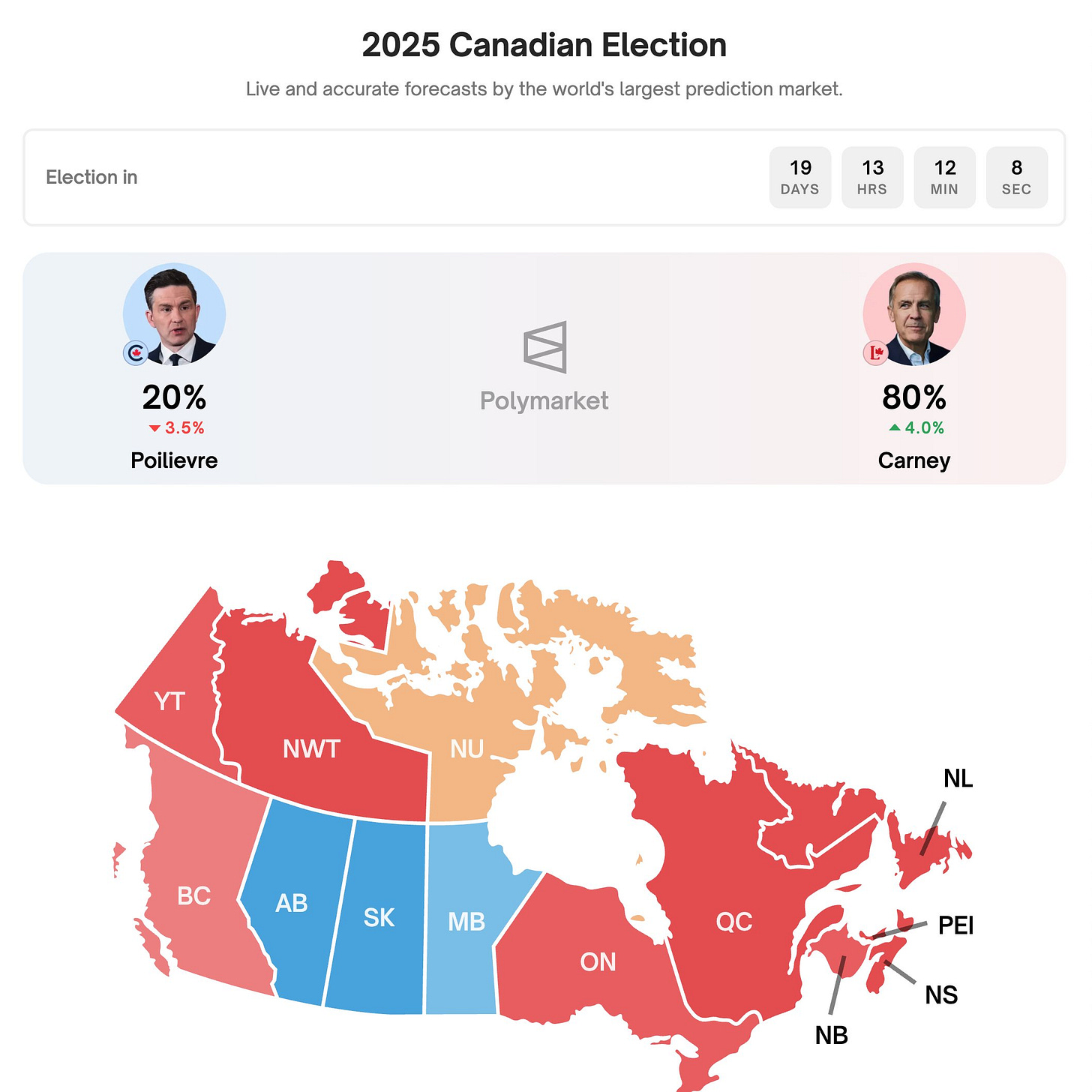

It looks like Canada is ready to back the Liberals again. (@Polymarket)