The Industrial Renaissance 🏭

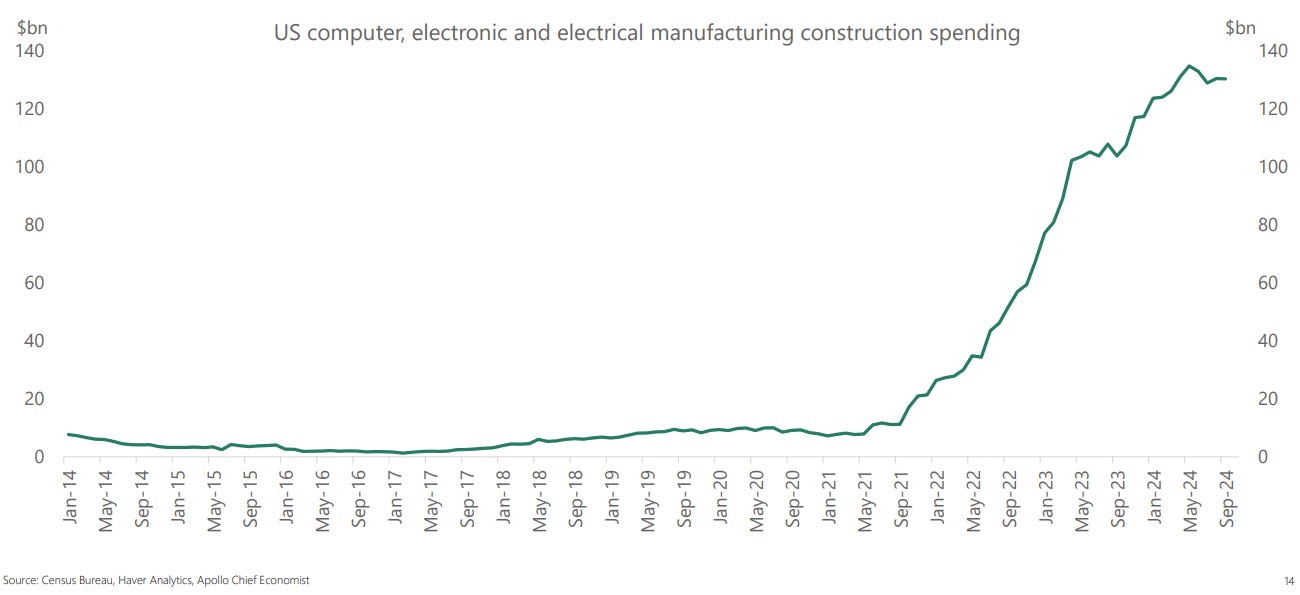

Manufacturing capacity is increasing in the US for the first time since 2007.

Across the entire developed world, manufacturing employment as a percent of total employment has fallen. Asia and automation took these jobs.

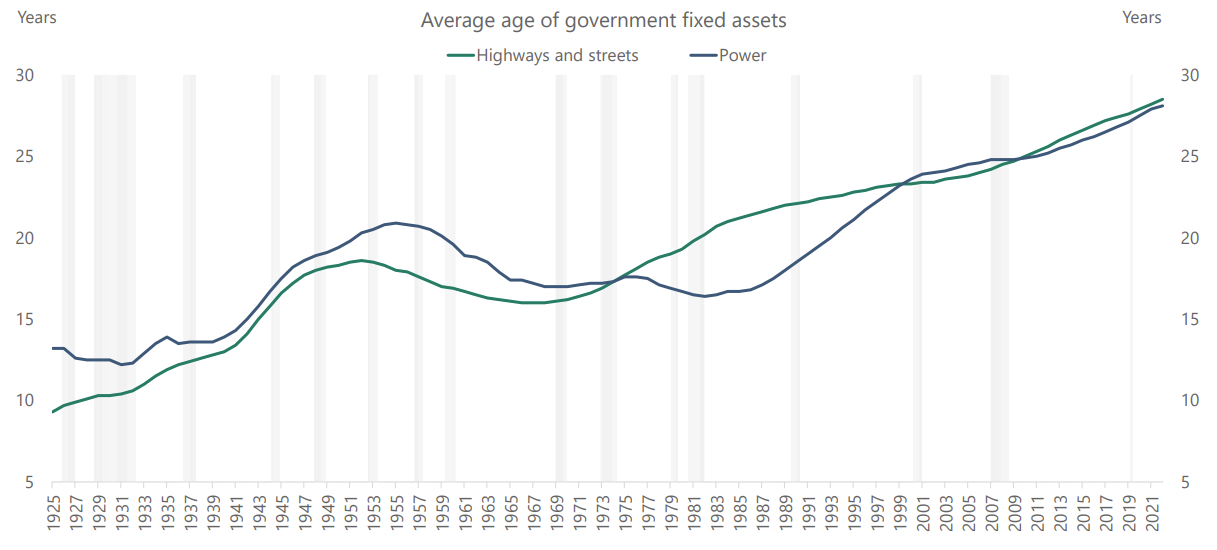

Additionally, US fixed assets have continued to age and new investment has been neglected.

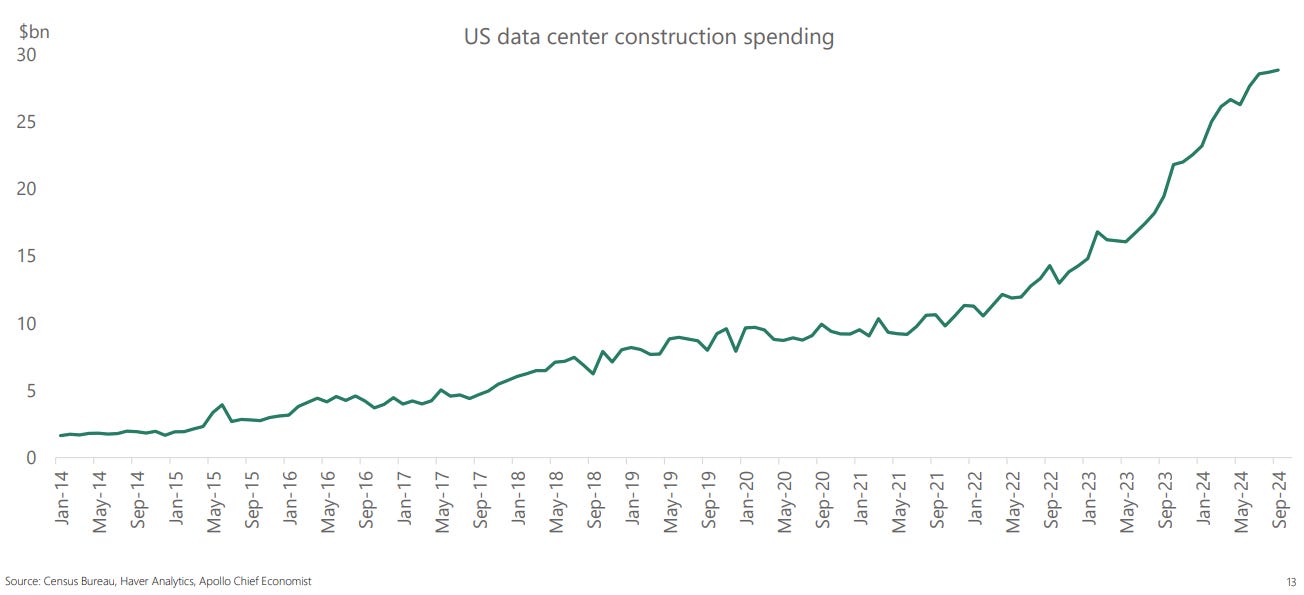

One of the large drivers of manufacturing construction and power demand has been data centers. The problem for governments with these investments is they make the grid less reliable and after construction, they create few jobs.

The US dominates the data center industry.

It is projected, 3 New York cities worth of power capacity are need to be added in the US to satiate data center demand.

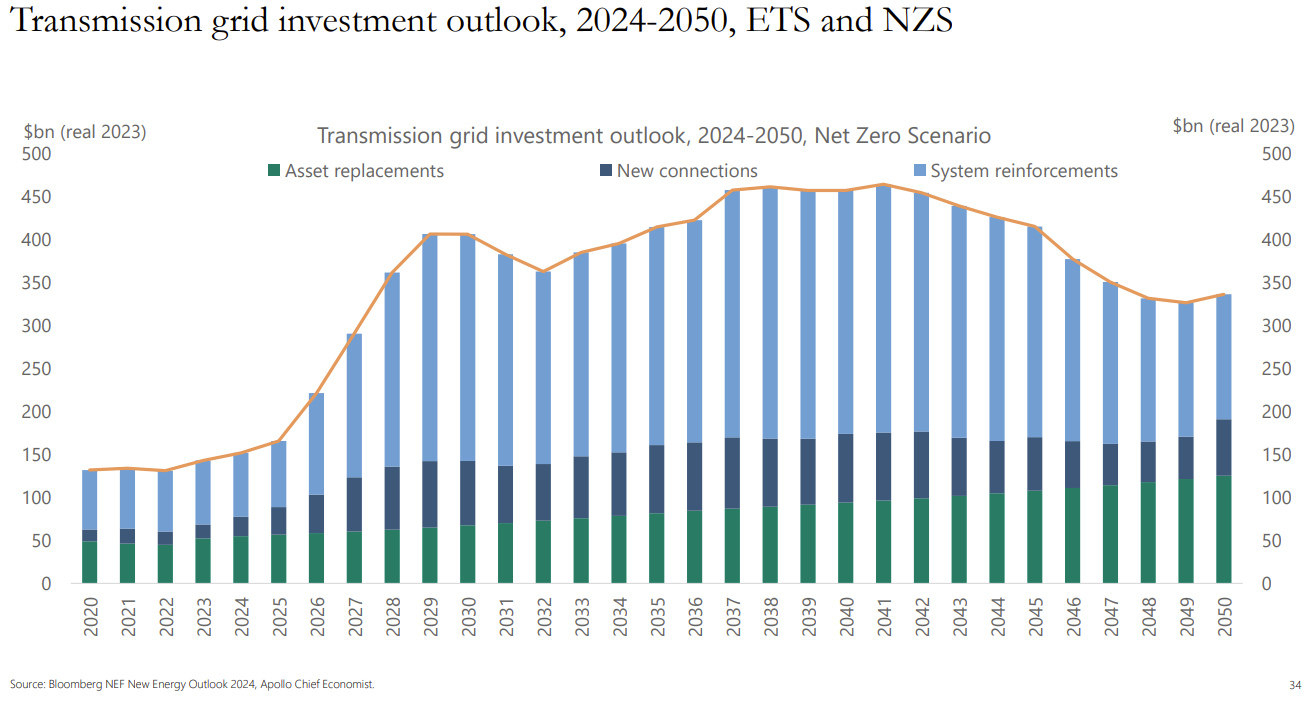

Global and US electricity demand will need to double by 2050.

Over the next few years, transmission grid investment is expected to significantly ramp up to support the surge in power demand.

The CHIPS act has also spurred investment in the electronics sector.

Increasingly, clean energy is being leveraged to support increasing power demand.

Conventional wisdom held that energy companies were much more capital-intensive than technology firms, primarily because energy companies require significant tangible capital for extracting, refining, and distributing fossil fuels, while technology companies invest more in intangible assets like research and development (R&D) and software. This was reflected in the capital expenditures of leading energy companies, which were about five times those of top technology companies in 2003, and 6.5 times greater in 2013. However, by 2019, capital expenditures between the two sectors reached parity, and by 2022, technology companies spent twice as much as energy firms on capital, particularly for data center construction. Over the decade, the ratio of energy to technology capital expenditures shifted from 6.5:1 to 0.6:1.

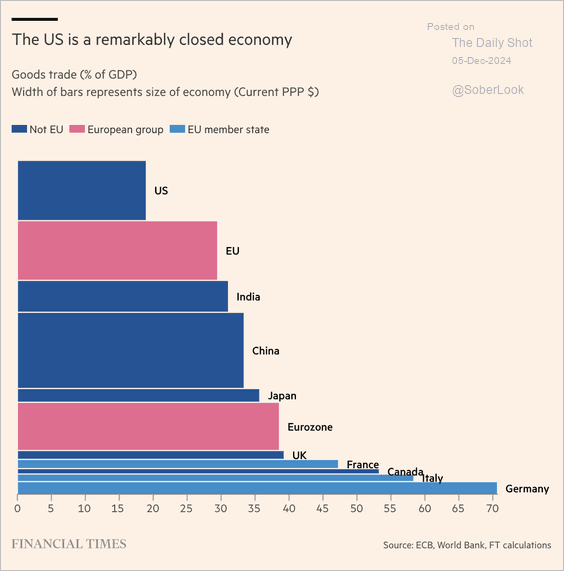

The US economy is surprisingly closed, this is part of the reason they are able to threaten tariffs on the world, they are less dependant on trade.

Still waiting for the death of the dollar.

This is likely part of the reason Musk got involved in government.