Private credit has historically offered strong returns, but its future is debated. Despite frequent media warnings of a bubble, private credit defaults receive disproportionate attention compared to private equity, even though the latter's impairment usually precedes the former. (Cliffwater)

Publicly traded BDCs offer valuable insights into private credit, serving as a proxy for the broader direct lending space, including drawdown funds and private/non-traded BDCs.

The asset class has been surprisingly resilient. Even in 2008, realized losses remained below income, highlighting a margin of safety due to high income generation. (Cliffwater)

While BDCs marked their books down over 16% in 2008 due to unrealized losses, the industry's resilience remains untested in a deep recession since the global financial crisis, potentially masking accumulated excesses. Furthermore, modest leverage in some structures could amplify losses. (StepStone)

Manager selection in private credit is important, even during favorable periods, due to significant performance variations. It is crucial during recessions, a team with workout experience is vital for maximizing value recovery when lenders must seize and manage assets. (FT)

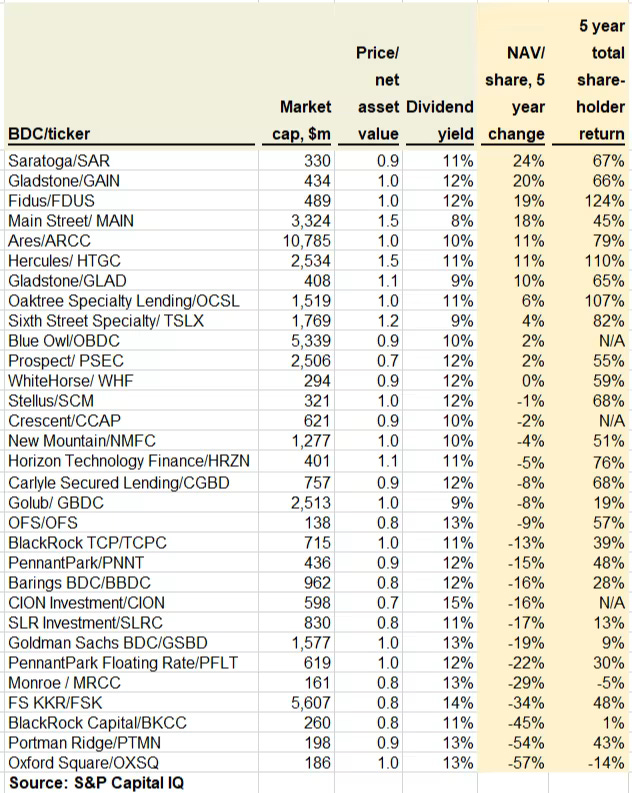

The majority of return of these BDCs comes from distributions but they can also grow NAV. The dispersion and underperformance of some big names is surprising.

A couple of things stand out, in addition to the sheer variety of outcomes on NAV/share over time. One is that total shareholder return, which is dominated by the BDCs’ high-dividend yields, is not all that tightly correlated with stable NAV/share. Some BDCs, by dilution or malinvestment or whatever, have destroyed a lot of value per share but have still managed to post reasonable total returns by keeping the dividend up. This won’t be possible in a proper down cycle.

Another thing worth noting is that some BDCs backed by famous asset managers have not exactly covered themselves in glory. Companies whose names include “KKR”, “BlackRock” and “Goldman” have all lost good chunks of NAV per share. Look at the record, not the name on the tin. The same will go for any private credit investment. (FT)

Even in the current environment, some blue-chip BDCs are struggling while others continue to thrive. (Bloomberg)

The BDC industry as a whole is not experiencing a major uptick in non-accruals, meaning borrowers continue to make payments on their debt. (Cliffwater)

And defaults are benign. (Cliffwater)

Investors are increasingly concerned about the accuracy of private credit portfolio marks due to limited transparency and the lack of observable market pricing. In a rising rate and default environment, there's fear that valuations may lag reality, overstating asset quality and delaying recognition of credit deterioration. Firms use third party valuators and a times different BDCs owning the same loan might value it very differently. This has led to speculation that portfolio marks are not accurate. (Bloomberg)

We can try to triangulate based on other hard data to assess the health of portfolios. Consumer/Retail has the highest default rate, while Technology has the fastest acceleration. Although tariffs could increase defaults, Private Equity's preference for service businesses may mitigate tariff exposure. (Cliffwater)

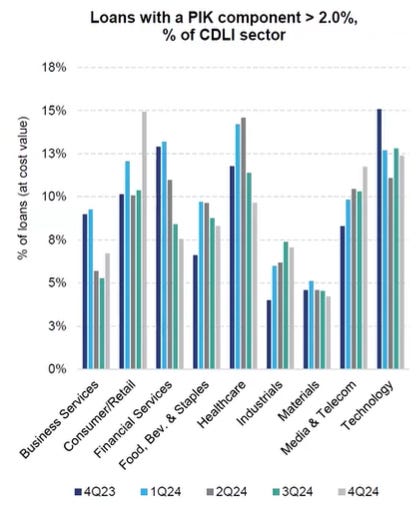

Increasing payment-in-kind (PIK) is a leading indicator of potential portfolio issues. While PIK initiated at the beginning of the loans life can be acceptable, PIK due to a borrower's inability to make payments signals financial distress and a higher risk of default. The increasing prevalence of PIK suggests growing stress within the portfolio.

Loans with >2% PIK can differentiate good vs bad PIK. Data trends vary: improving in some sectors, but declining in Consumer/Retail, likely due to weakening consumer demand.

Stress can be identified by examining marked-down and PIKing loans. Most sectors are performing well.

The financial media often sensationalizes risks in private credit, focusing on negative narratives. Equity is junior and experienced teams can hope to recover value in the event of default. Historically, the asset class has performed well, but the current iteration remains untested. Private credit may outperform if equities muddle along, as its returns are largely contractual.

What the Hali?!?