US Housing Affordability

Apollo's 100 page deck of the US housing market points to emerging weakness. However, household debt levels suggest a crisis is unlikely, and absent widespread job losses, the market should remain soft rather than collapse.

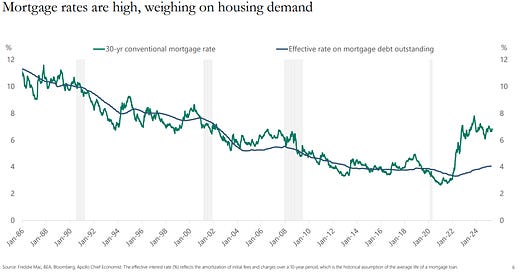

Elevated US Treasury yields are keeping US mortgage rates elevated. This also discourages homeowners who are locked in at lower rates from moving.

The average monthly mortgage payment has doubled.

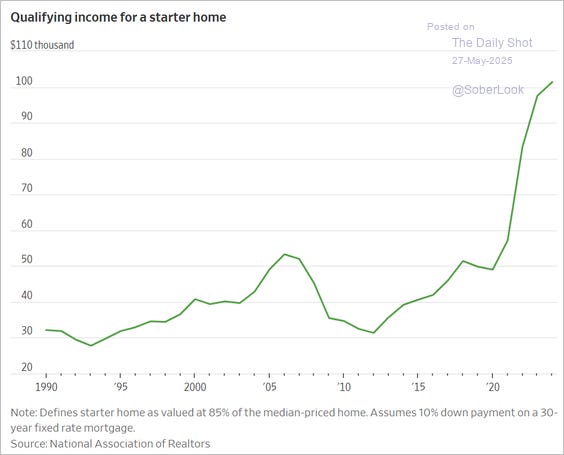

Without a coinciding drop in housing prices to adjust for financing costs, US housing affordability is below pre global financial crisis levels.

Another way to look at unaffordability is the amount of income to qualify for a starter home. This suggests that entry level homes have been disproportionately impacted by higher prices. (The Daily Shot)

Stretched affordability has meant lower homebuilder traffic.

Demographics are supportive of housing demand.

But unaffordability is driving the median homebuyer to 56 as younger people are priced out.

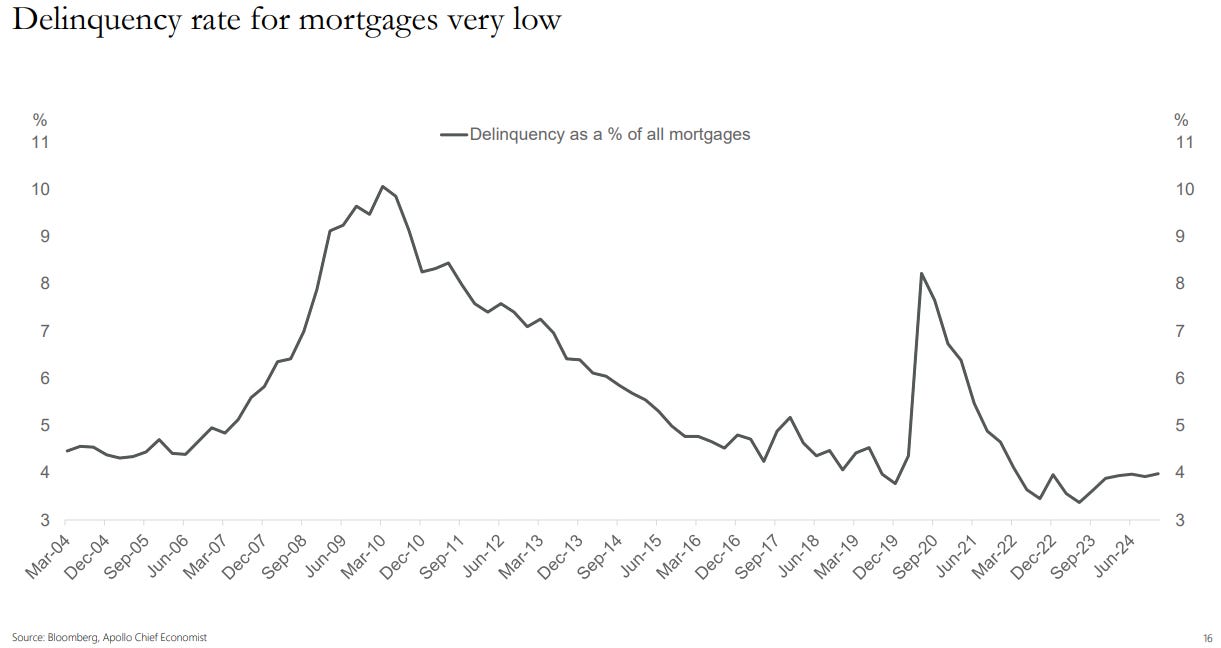

Given low leverage levels and limited job losses, mortgage delinquency rates remain very low.

And 40% of US homeowners don’t even have a mortgage.

With the rise in prices post pandemic, US households are home equity rich.

Despite poor affordability, housing starts remain resilient.

The market survived 2023 fears that the residential construction market was going to roll over. Residential construction tends to lead into a recession.

Almost half of the US’ largest cities are experiencing rent declines.

Even with rents already low compared to housing prices.