Zero-Sum Games 🎮

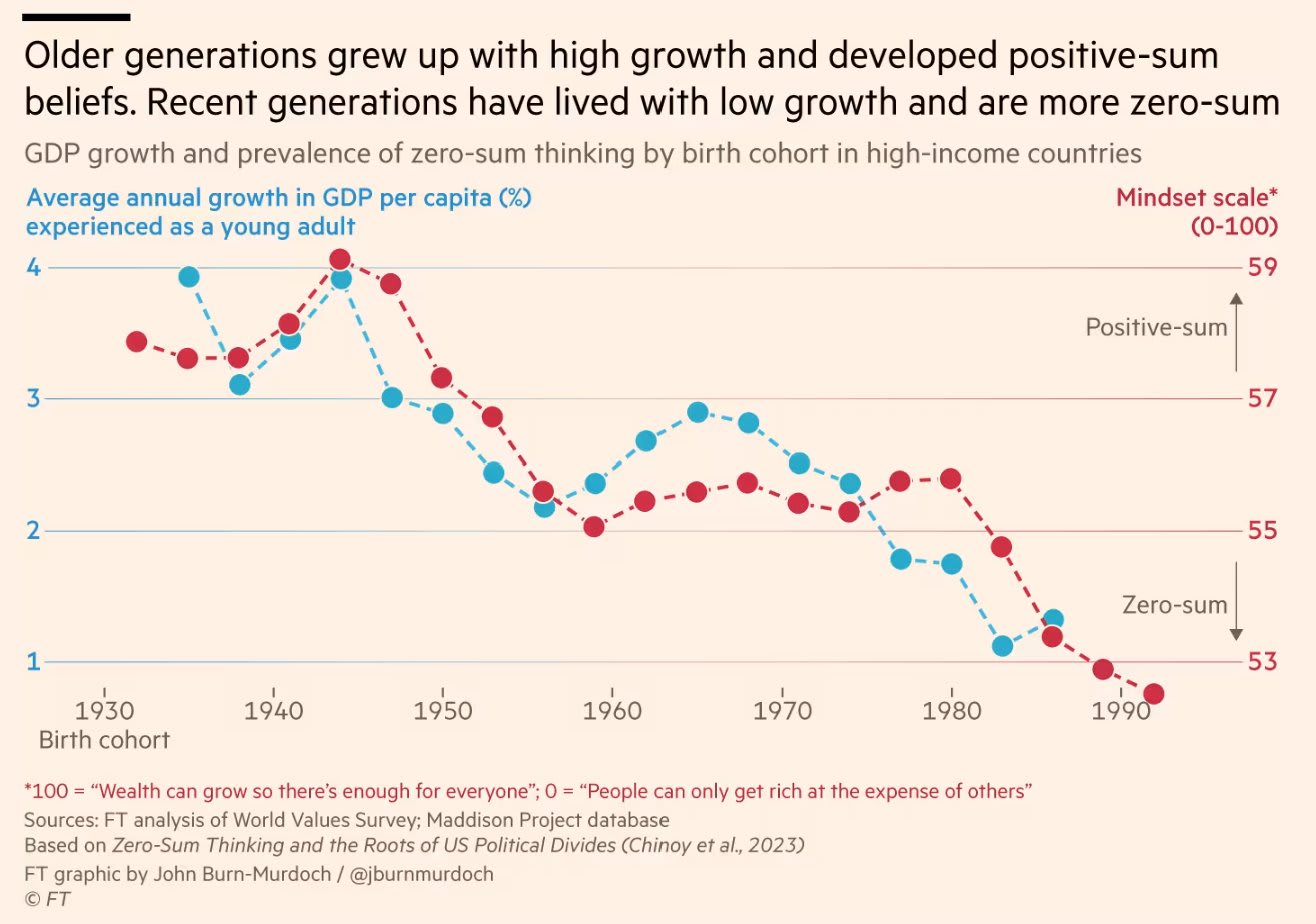

A frequently overlooked benefit of economic growth is that its absence turns the economy into a zero-sum game, where improving one's standard of living comes at the expense of others. Consequently, recent generations experiencing slower growth are increasingly inclined toward zero-sum thinking, likely contributing to the tensions observed in the West.

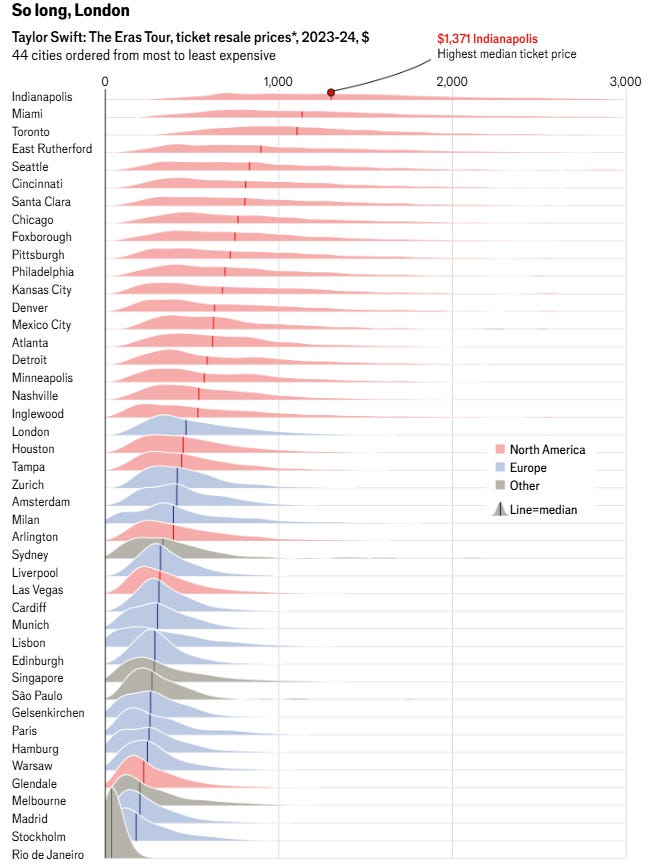

Taylor Swift’s Eras Tour, which began in March 2023, has sold over 10 million tickets for 149 shows across five continents. By the end of last year, it became the first tour to gross over $1 billion, with final earnings expected to double that. Prior to the tour, critics and fans criticized her for high ticket prices, which ranged from $49 to over $899 in the U.S. However, secondary-market prices suggest she could have charged more, with resale tickets averaging $839—exceeding face values for some top seats. She is projected to earn nearly $10 million per concert.

Multistrategy hedge funds enjoyed another successful year, despite high fees. While most underperformed the S&P 500, this index is not always a suitable benchmark. These strategies are designed to offer downside protection during market downturns.

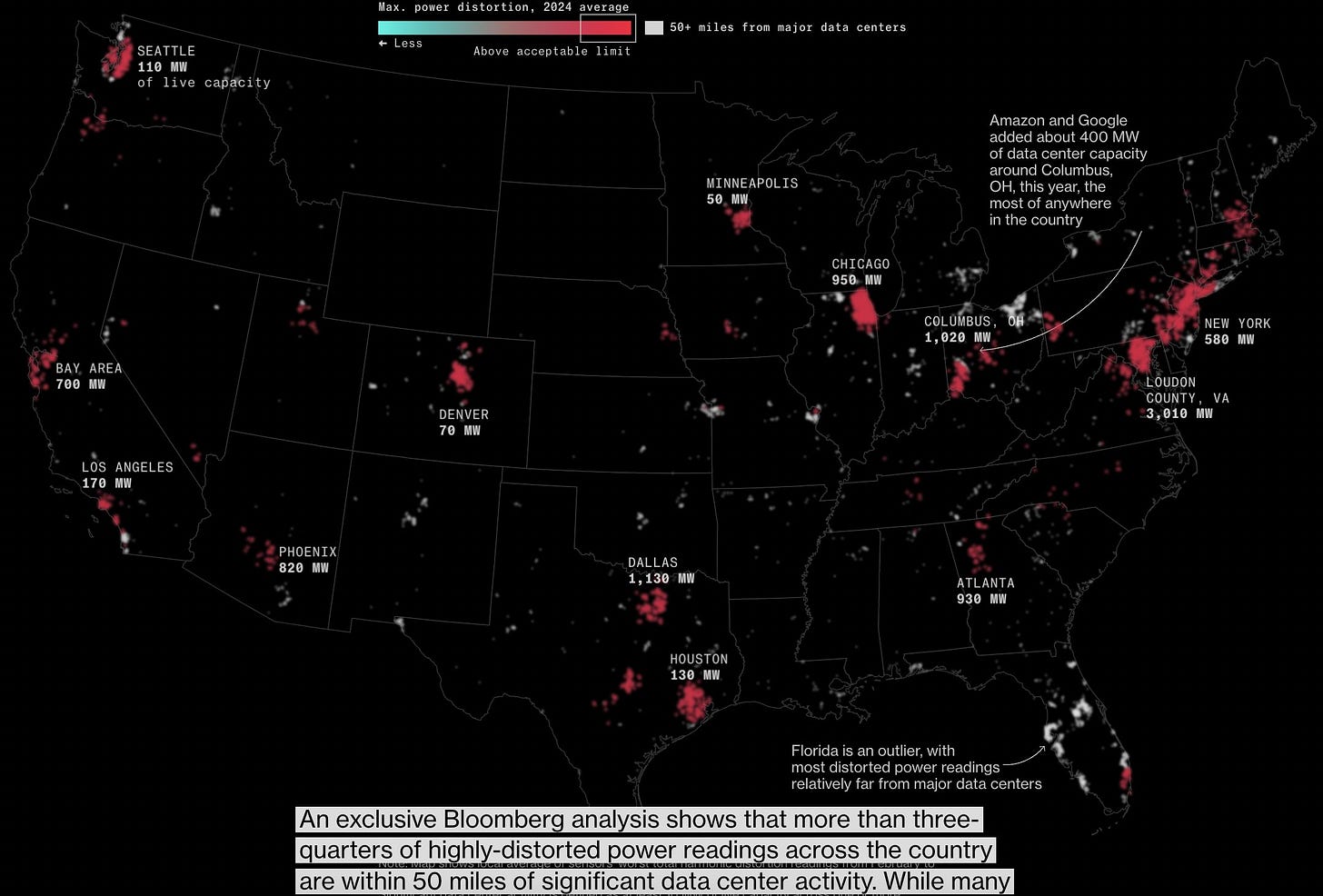

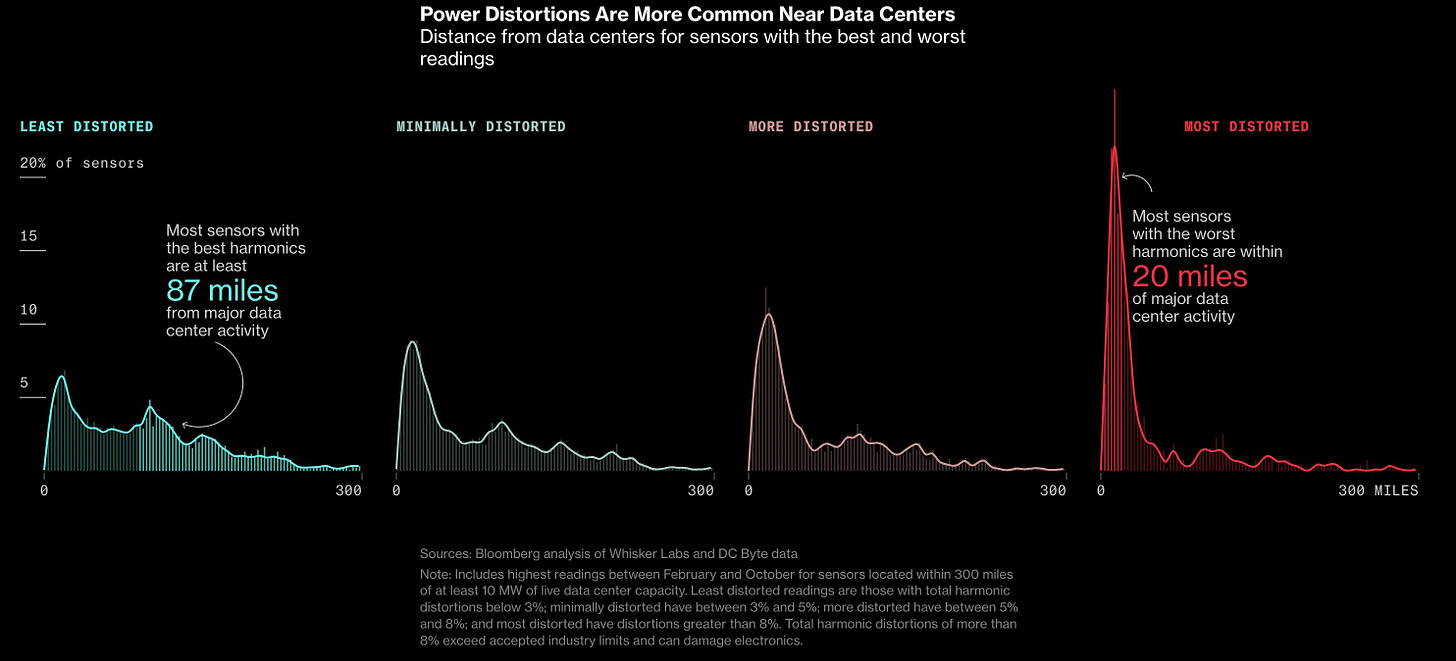

Expect to hear more about this. Over three-quarters of highly distorted power readings nationwide occur within 50 miles of significant data centers. This trend is evident both in major US cities and rural areas, adding stress to already fragile grids..

This becomes an issue if Data Center energy needs start impacting power for regular people. Power capacity is unable to ramp quickly enough.

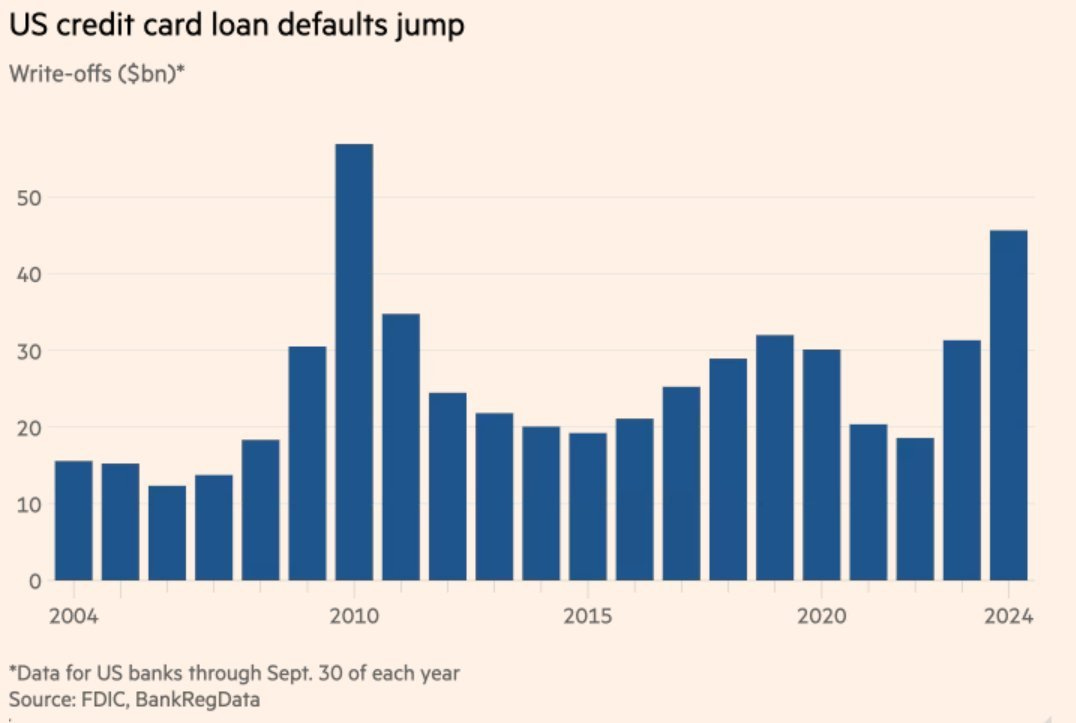

It’s not all sunshine and rainbows out there. US credit card defaults have reached their highest level since 2010, with lenders writing off $46B in seriously delinquent balances in the first nine months of 2024. This figure, up 50% from the same period last year, marks the highest level in 14 years.

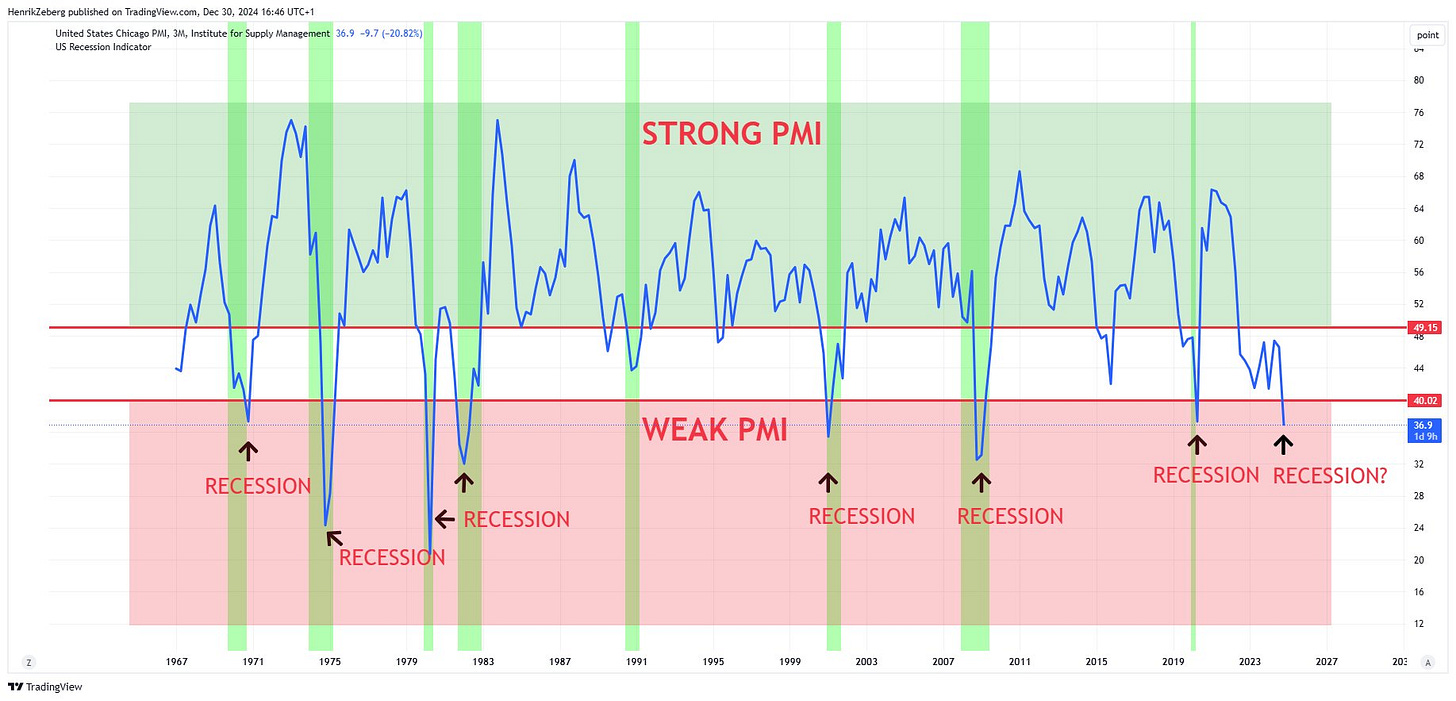

Two weeks ago, Powell mentioned the strength of the US economy; last week, the Chicago PMI recorded 36.9. These levels coincide with previous recessionary levels.

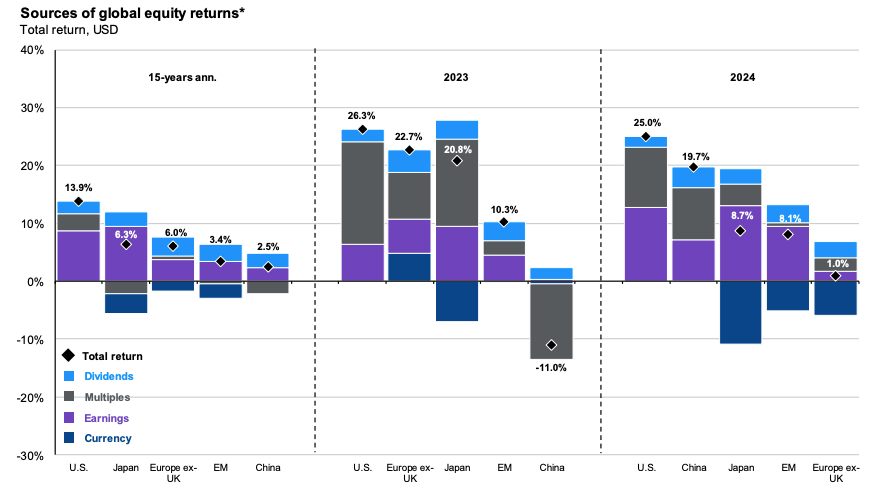

Decomposing return drivers over various time frames. In the short term, multiples can drive returns but in the long run, earnings do the lifting.

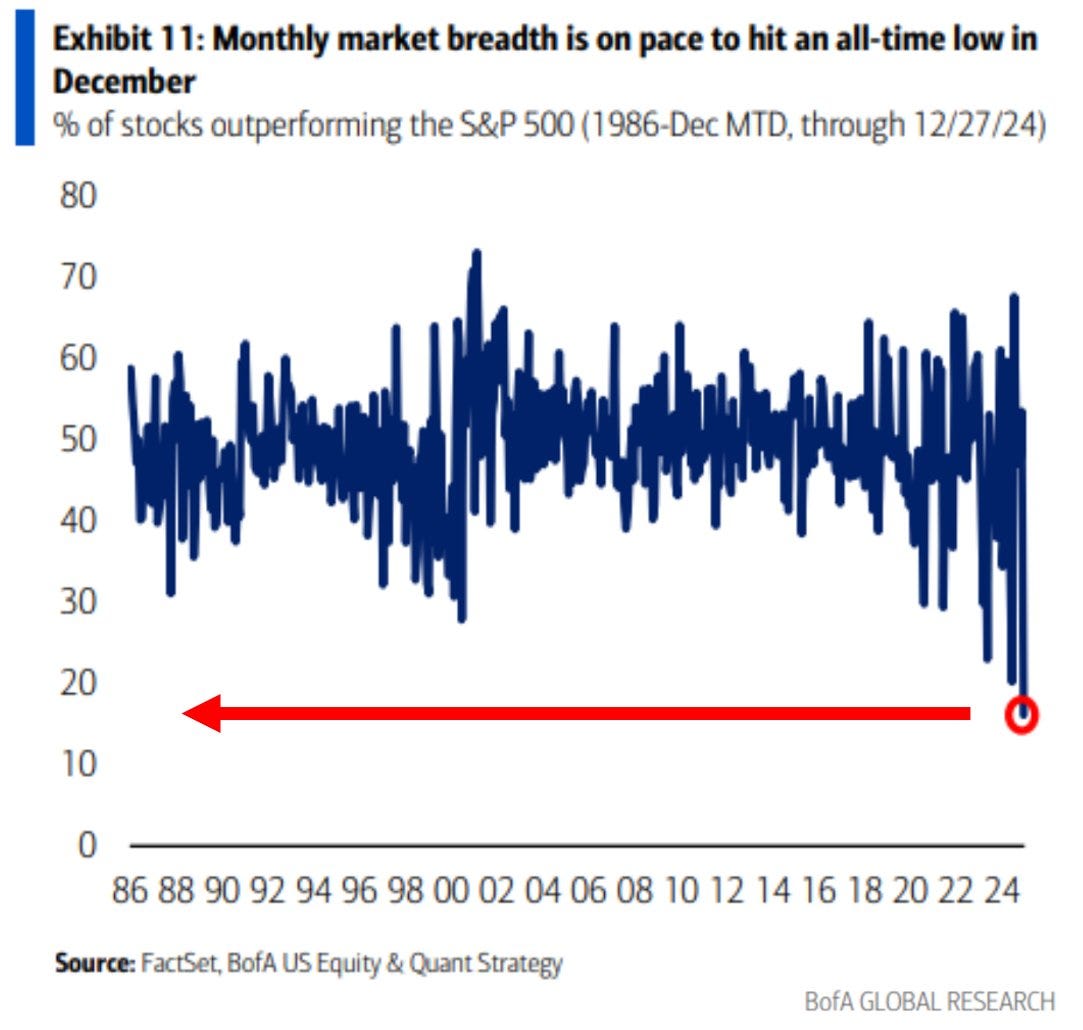

Another year where the majority of stocks in the S&P 500, underperformed the S&P 500. Investing is hard.

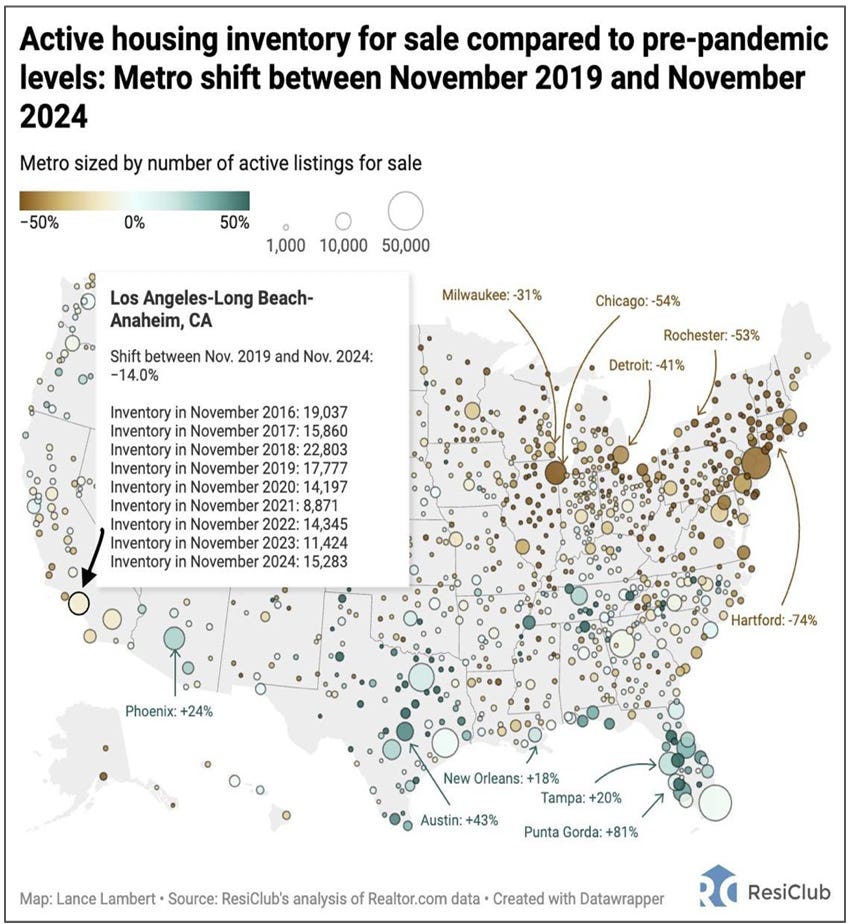

Active listings are increasing in the South, while declining in the Northeast. The South saw the highest price increases and is the primary source of new supply.

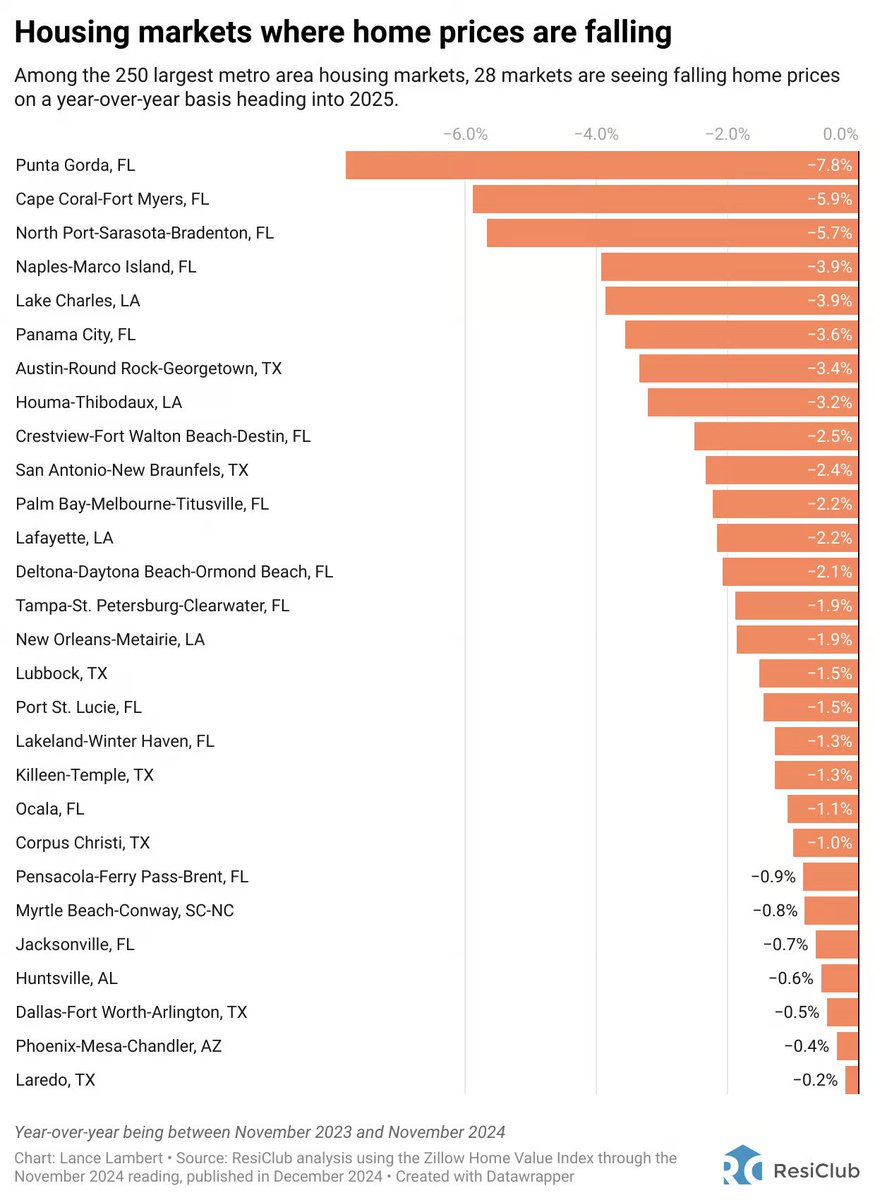

With more supply, prices are declining in certain regions. High mortgage costs continue to pressure affordability.

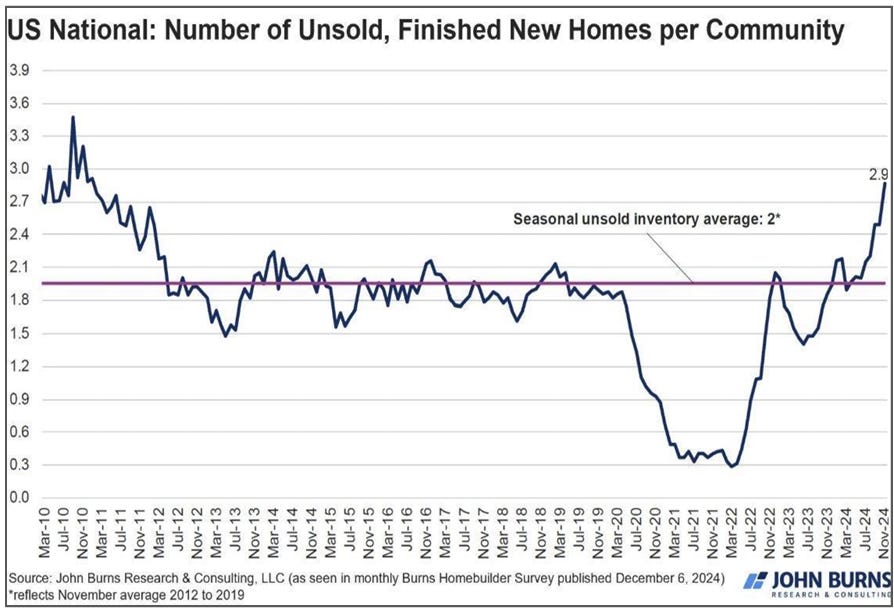

New home inventory is at its highest level since the global financial crisis.

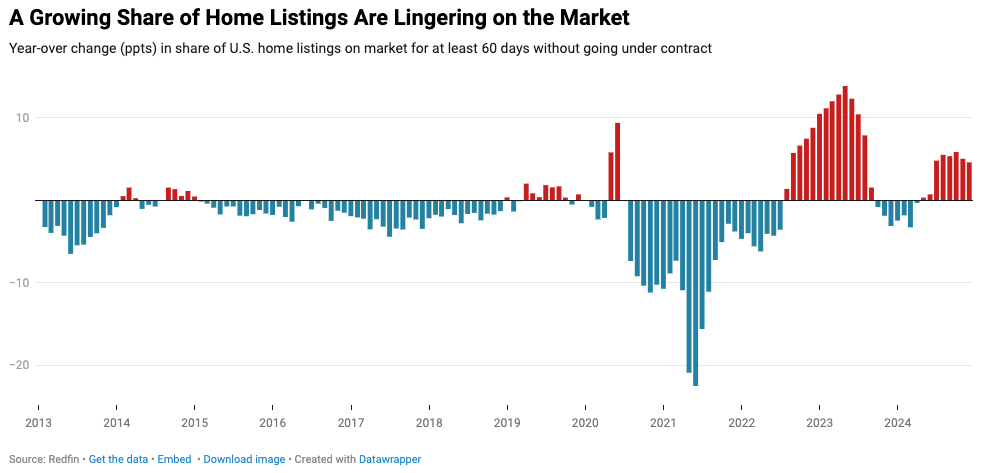

Houses are sitting longer on the market.

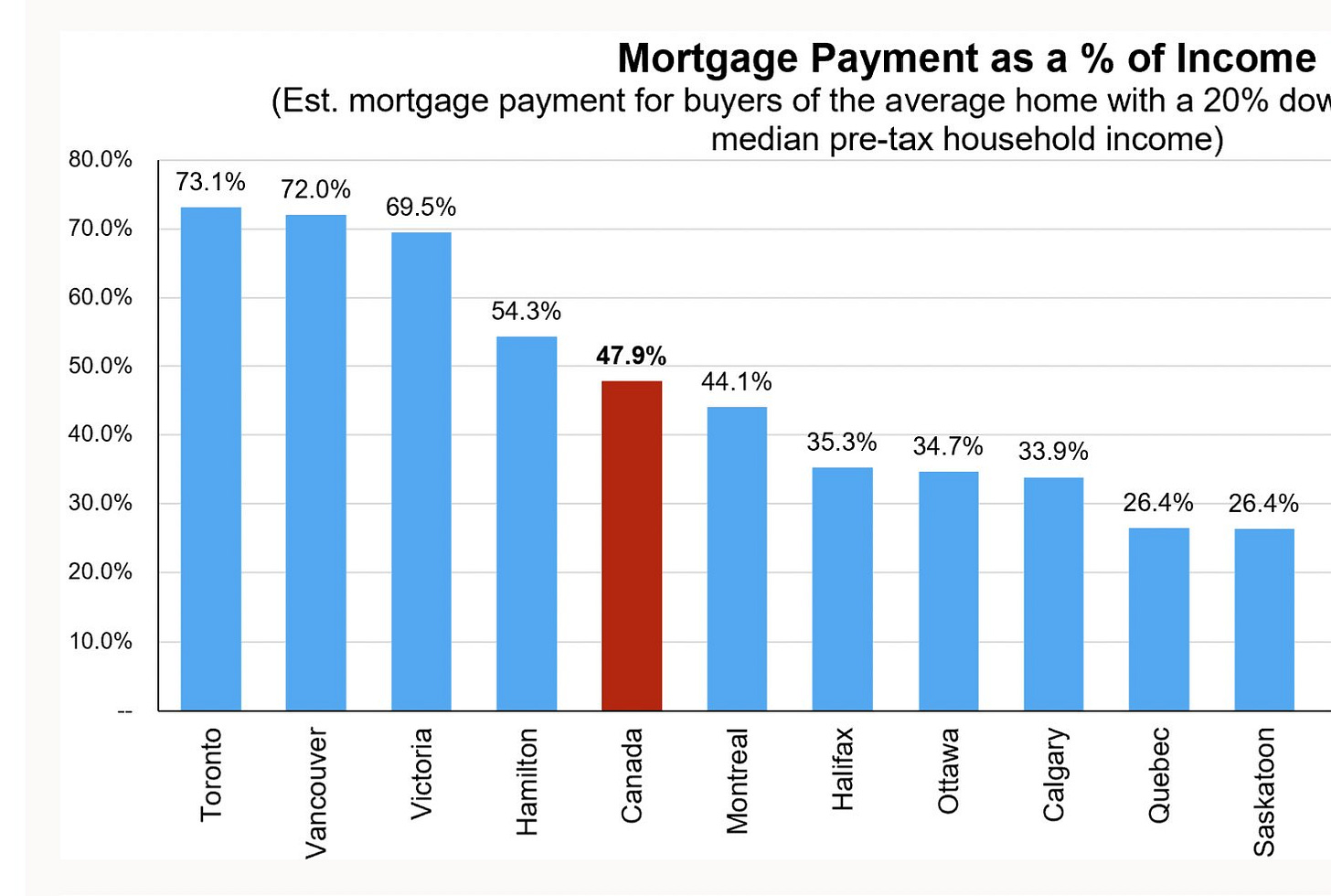

Is the Canadian dream dead in Canada’s major metros? The average person cannot afford a home without help.